Moelis & Company Investment Banking Pitch Book

Situation Overview (cont'd)

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

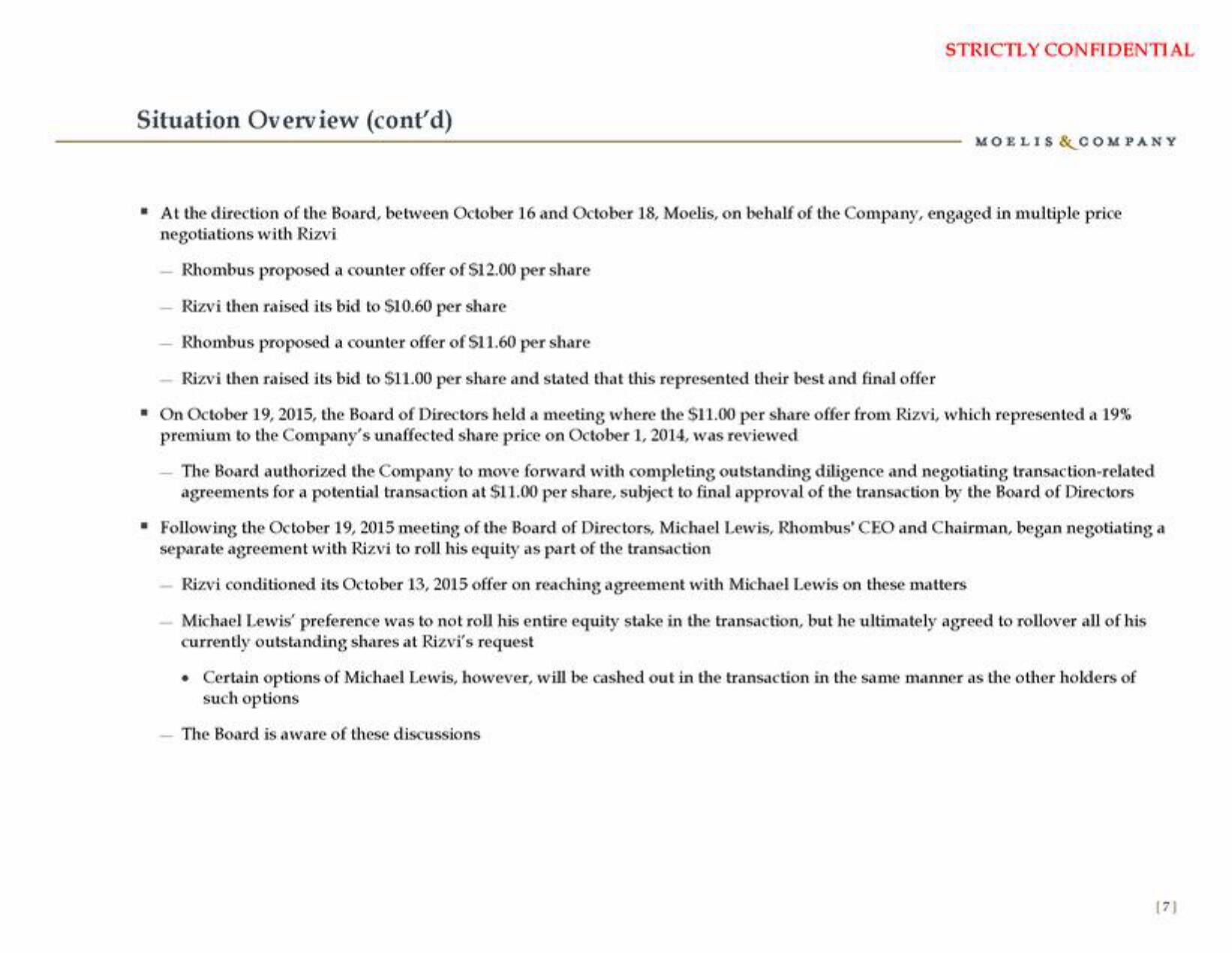

* At the direction of the Board, between October 16 and October 18, Moelis, on behalf of the Company, engaged in multiple price

negotiations with Rizvi

Rhombus proposed a counter offer of $12.00 per share

Rizvi then raised its bid to $10.60 per share

Rhombus proposed a counter offer of $11.60 per share

Rizvi then raised its bid to $11.00 per share and stated that this represented their best and final offer

▪ On October 19, 2015, the Board of Directors held a meeting where the $11.00 per share offer from Rizvi, which represented a 19%

premium to the Company's unaffected share price on October 1, 2014, was reviewed

The Board authorized the Company to move forward with completing outstanding diligence and negotiating transaction-related

agreements for a potential transaction at $11.00 per share, subject to final approval of the transaction by the Board of Directors

▪ Following the October 19, 2015 meeting of the Board of Directors, Michael Lewis, Rhombus' CEO and Chairman, began negotiating a

separate agreement with Rizvi to roll his equity as part of the transaction

Rizvi conditioned its October 13, 2015 offer on reaching agreement with Michael Lewis on these matters

Michael Lewis' preference was to not roll his entire equity stake in the transaction, but he ultimately agreed to rollover all of his

currently outstanding shares at Rizvi's request

• Certain options of Michael Lewis, however, will be cashed out in the transaction in the same manner as the other holders of

such options

The Board is aware of these discussionsView entire presentation