3M Results Presentation Deck

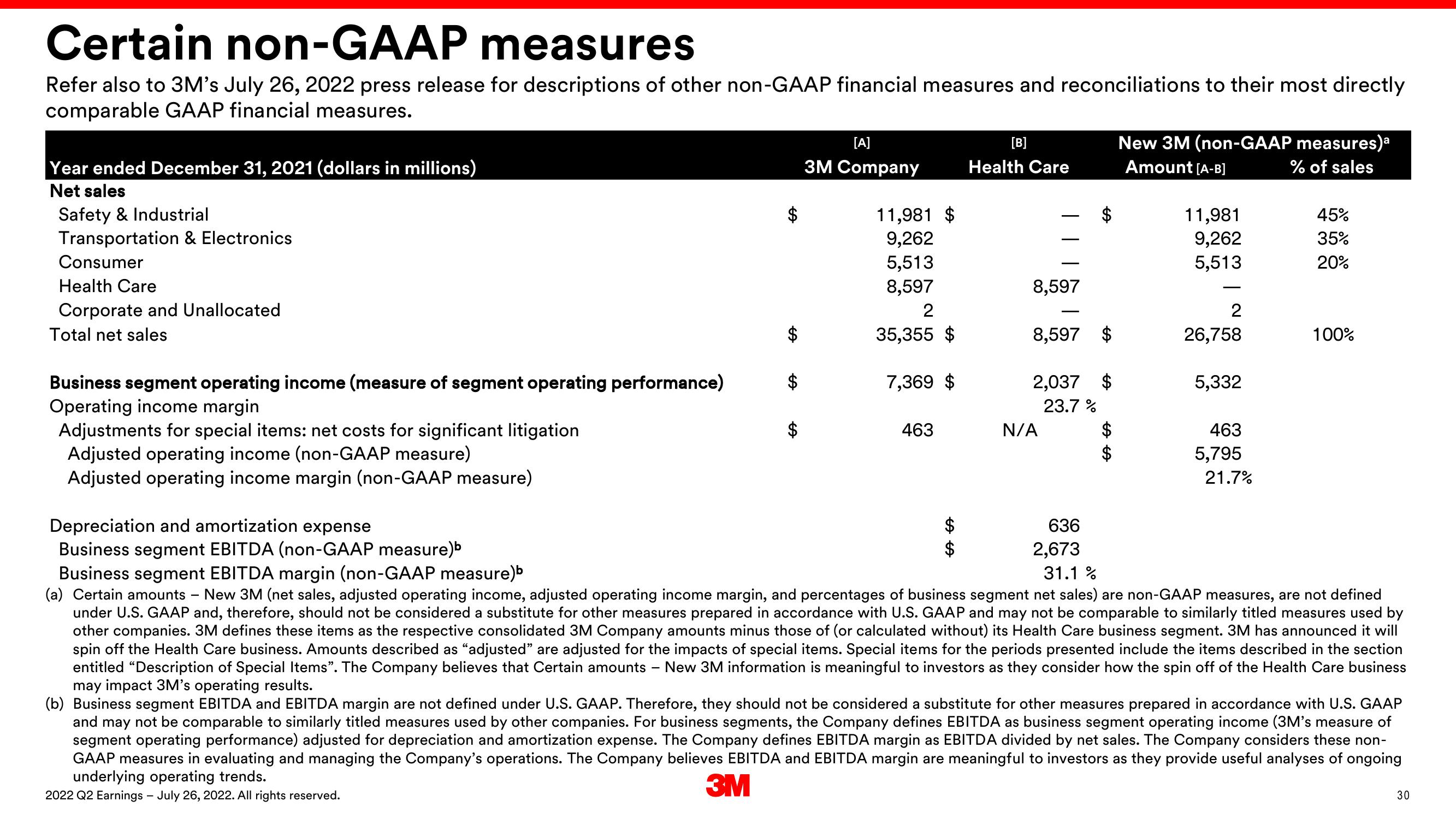

Certain non-GAAP measures

Refer also to 3M's July 26, 2022 press release for descriptions of other non-GAAP financial measures and reconciliations to their most directly

comparable GAAP financial measures.

Year ended December 31, 2021 (dollars in millions)

Net sales

Safety & Industrial

Transportation & Electronics

Consumer

Health Care

Corporate and Unallocated

Total net sales

Business segment operating income (measure of segment operating performance)

Operating income margin

Adjustments for special items: net costs for significant litigation

Adjusted operating income (non-GAAP measure)

Adjusted operating income margin (non-GAAP measure)

Depreciation and amortization expense

Business segment EBITDA (non-GAAP measure)b

6A

-

[A]

3M Company

11,981 $

9,262

5,513

8,597

2

35,355 $

7,369 $

463

[B]

Health Care

8,597

8,597

2,037 $

23.7%

N/A

636

2,673

31.1 %

A A

New 3M (non-GAAP measures)a

Amount [A-B]

% of sales

11,981

9,262

5,513

2

26,758

5,332

463

5,795

21.7%

45%

35%

20%

100%

Business segment EBITDA margin (non-GAAP measure)b

(a) Certain amounts New 3M (net sales, adjusted operating income, adjusted operating income margin, and percentages of business segment net sales) are non-GAAP measures, are not defined

under U.S. GAAP and, therefore, should not be considered a substitute for other measures prepared in accordance with U.S. GAAP and may not be comparable to similarly titled measures used by

other companies. 3M defines these items as the respective consolidated 3M Company amounts minus those of (or calculated without) its Health Care business segment. 3M has announced it will

spin off the Health Care business. Amounts described as "adjusted" are adjusted for the impacts of special items. Special items for the periods presented include the items described in the section

entitled "Description of Special Items". The Company believes that Certain amounts New 3M information is meaningful to investors as they consider how the spin off of the Health Care business

may impact 3M's operating results.

(b) Business segment EBITDA and EBITDA margin are not defined under U.S. GAAP. Therefore, they should not be considered a substitute for other measures prepared in accordance with U.S. GAAP

and may not be comparable to similarly titled measures used by other companies. For business segments, the Company defines EBITDA as business segment operating income (3M's measure of

segment operating performance) adjusted for depreciation and amortization expense. The Company defines EBITDA margin as EBITDA divided by net sales. The Company considers these non-

GAAP measures in evaluating and managing the Company's operations. The Company believes EBITDA and EBITDA margin are meaningful to investors as they provide useful analyses of ongoing

underlying operating trends.

3M

2022 Q2 Earnings - July 26, 2022. All rights reserved.

30View entire presentation