Kin SPAC Presentation Deck

1

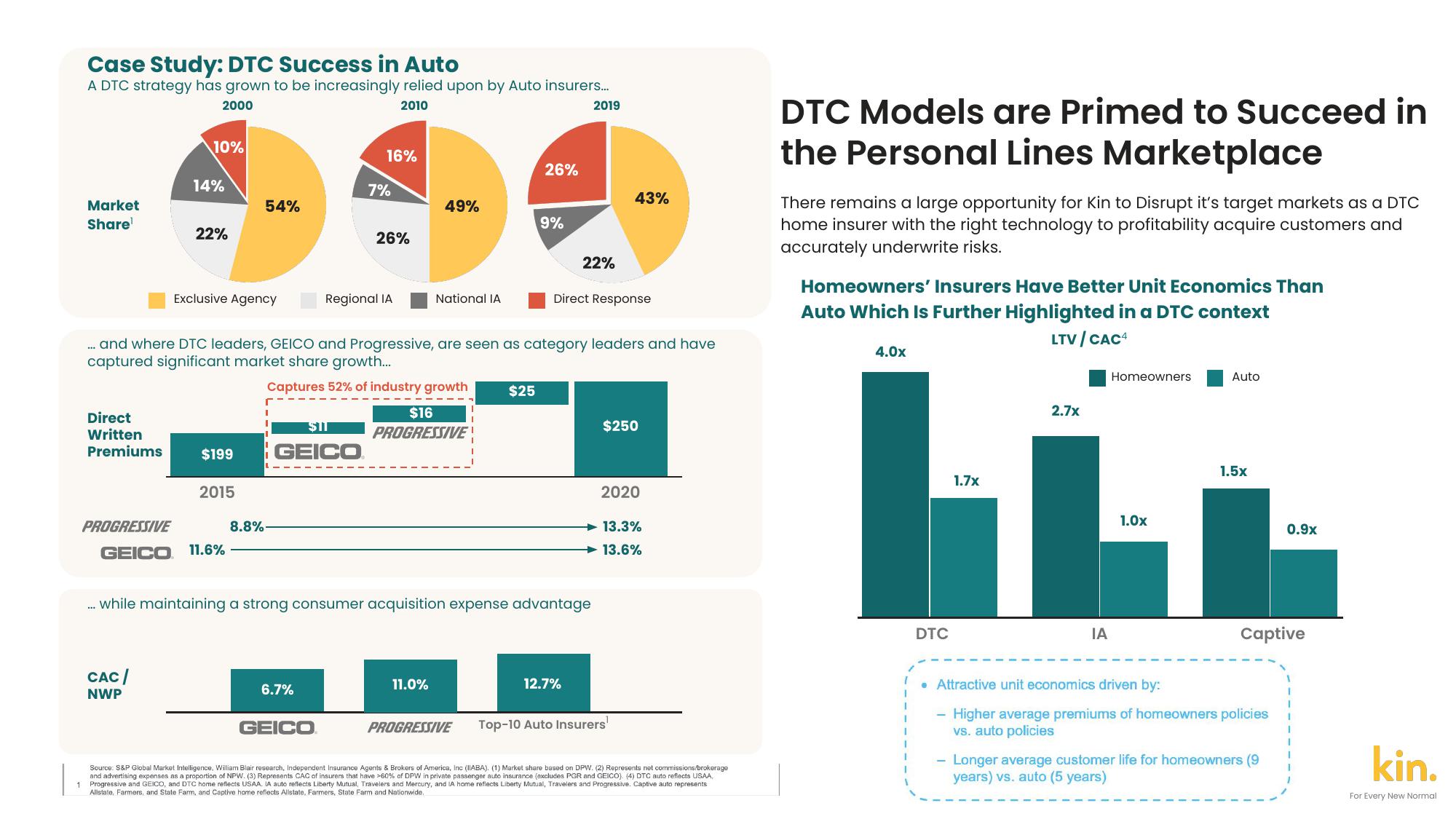

Case Study: DTC Success in Auto

A DTC strategy has grown to be increasingly relied upon by Auto insurers...

2000

2010

Market

Share¹

Direct

Written

Premiums

PROGRESSIVE

GEICO

10%

14%

CAC /

NWP

22%

Exclusive Agency

$199

2015

54%

11.6%

8.8%

$11

GEICO

16%

6.7%

7%

GEICO

26%

Regional IA

... and where DTC leaders, GEICO and Progressive, are seen as category leaders and have

captured significant market share growth...

Captures 52% of industry growth

49%

National IA

$16

PROGRESSIVE

11.0%

26%

$25

PROGRESSIVE

9%

... while maintaining a strong consumer acquisition expense advantage

2019

22%

Direct Response

12.7%

43%

$250

2020

13.3%

→ 13.6%

Top-10 Auto Insurers

Source: S&P Global Market Intelligence, William Blair research, Independent Insurance Agents & Brokers of America, Inc (IIABA). (1) Market share based on DPW. (2) Represents net commissions/brokerage

and advertising expenses as a proportion of NPW. (3) Represents CAC of insurers that have >60% of DPW in private passenger auto insurance (excludes PGR and GEICO). (4) DTC auto reflects USAA,

Progressive and GEICO, and DTC home reflects USAA. IA auto reflects Liberty Mutual, Travelers and Mercury, and IA home reflects Liberty Mutual, Travelers and Progressive. Captive auto represents

Allstate, Farmers, and State Farm, and Captive home reflects Allstate, Farmers, State Farm and Nationwide.

DTC Models are Primed to Succeed in

the Personal Lines Marketplace

There remains a large opportunity for Kin to Disrupt it's target markets as a DTC

home insurer with the right technology to profitability acquire customers and

accurately underwrite risks.

Homeowners' Insurers Have Better Unit Economics Than

Auto Which Is Further Highlighted in a DTC context

LTV / CAC4

4.0x

Homeowners

2.7x

bit

1.7x

1.0x

DTC

IA

1

• Attractive unit economics driven by:

Auto

1.5x

Captive

- Higher average premiums of homeowners policies

vs. auto policies

0.9x

- Longer average customer life for homeowners (9

years) vs. auto (5 years)

kin.

For Every New NormalView entire presentation