AngloAmerican Results Presentation Deck

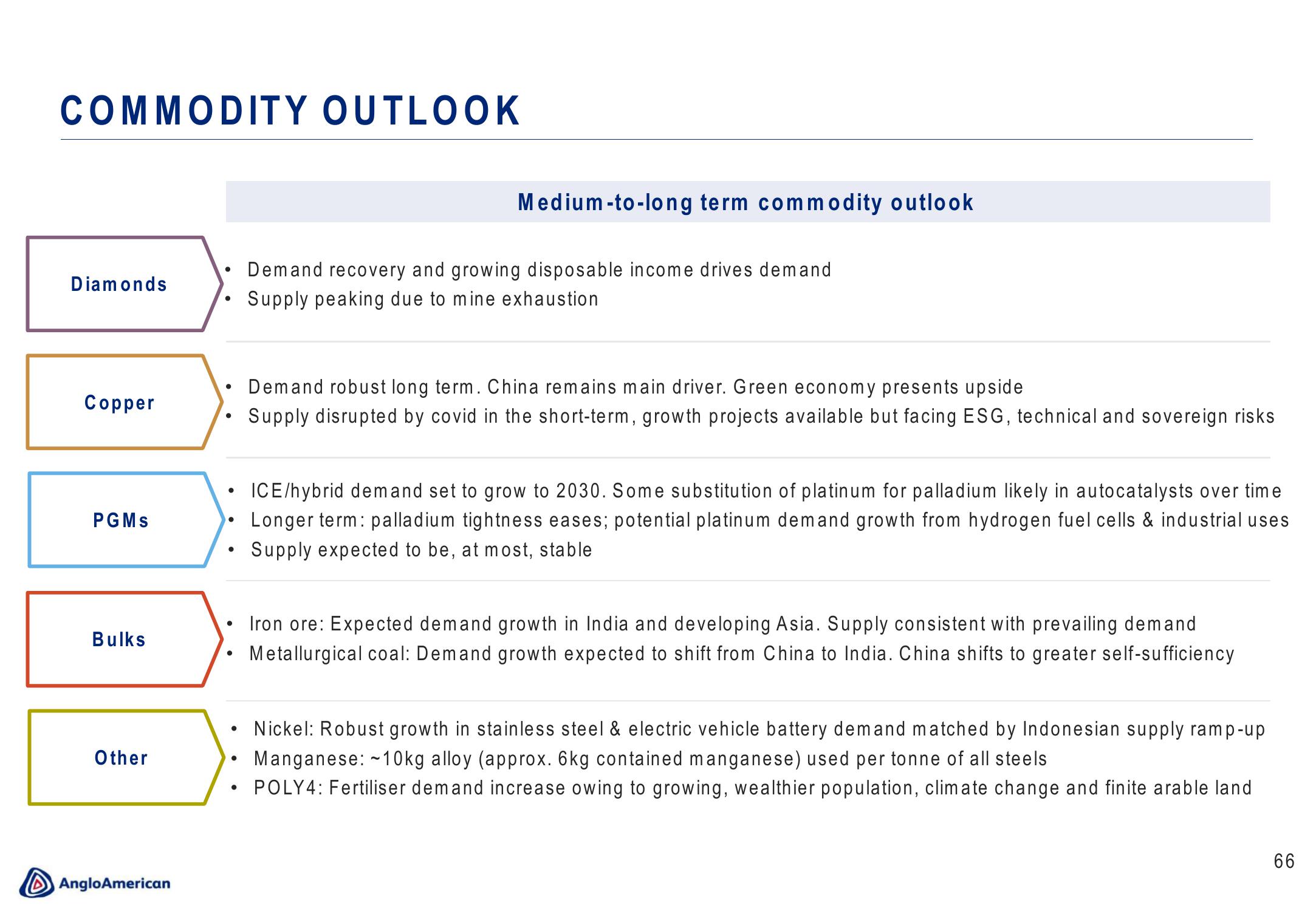

COMMODITY OUTLOOK

Diamonds

Copper

PGMs

Bulks

Other

Anglo American

●

●

●

●

●

●

Medium-to-long term commodity outlook

Demand recovery and growing disposable income drives demand

Supply peaking due to mine exhaustion

Demand robust long term. China remains main driver. Green economy presents upside

Supply disrupted by covid in the short-term, growth projects available but facing ESG, technical and sovereign risks

ICE/hybrid demand set to grow to 2030. Some substitution of platinum for palladium likely in autocatalysts over time

Longer term: palladium tightness eases; potential platinum demand growth from hydrogen fuel cells & industrial uses

Supply expected to be, at most, stable

Iron ore: Expected demand growth in India and developing Asia. Supply consistent with prevailing demand

Metallurgical coal: Demand growth expected to shift from China to India. China shifts to greater self-sufficiency

Nickel: Robust growth in stainless steel & electric vehicle battery demand matched by Indonesian supply ramp-up

Manganese: ~10kg alloy (approx. 6kg contained manganese) used per tonne of all steels

POLY4: Fertiliser demand increase owing to growing, wealthier population, climate change and finite arable land

66View entire presentation