Barclays Investment Banking Pitch Book

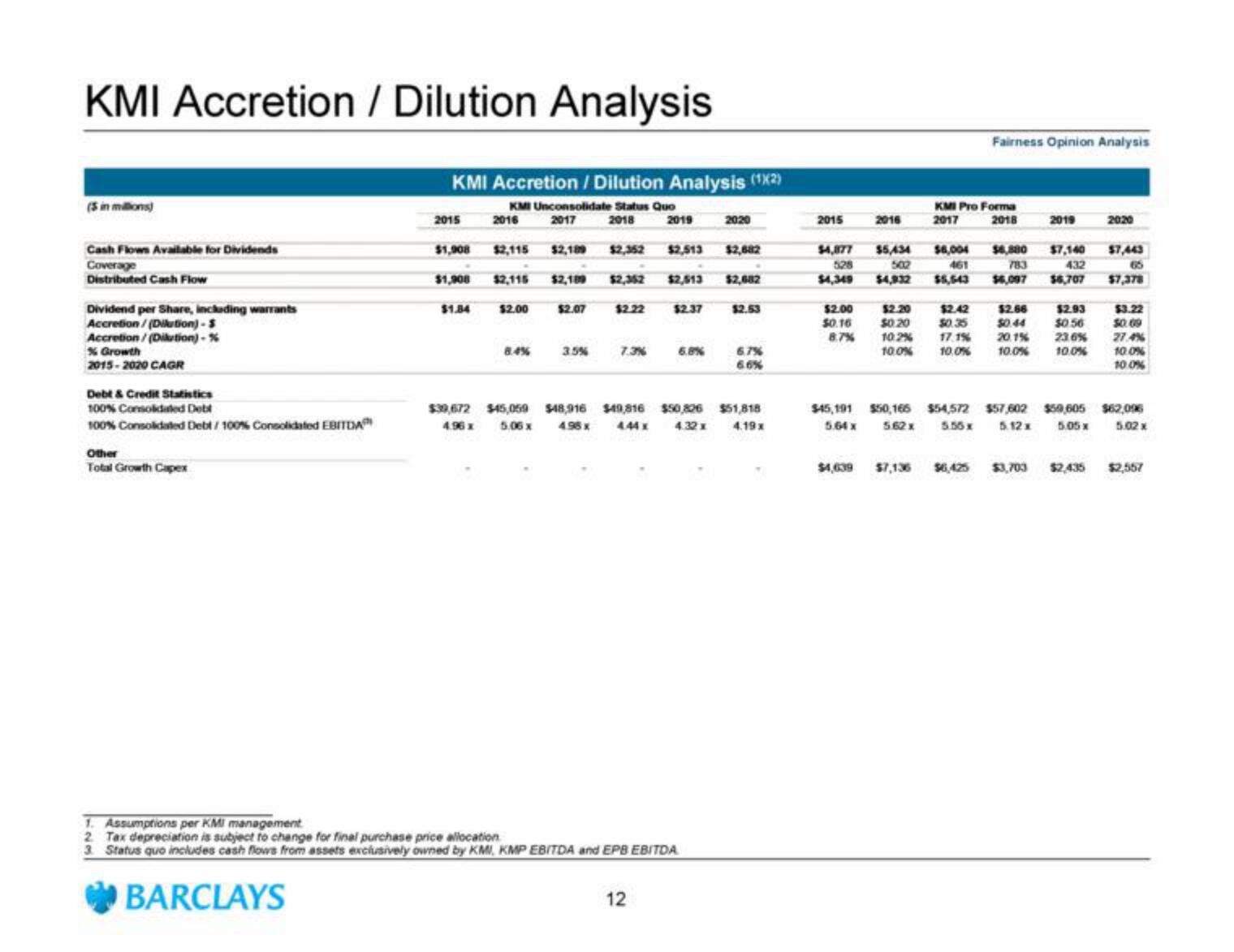

KMI Accretion / Dilution Analysis

(5 in millions)

Cash Flows Available for Dividends

Coverage

Distributed Cash Flow

Dividend per Share, including warrants

Accretion/(Dilution)-$

Accretion/(Dilution) -%

% Growth

2015-2020 CAGR

Debt & Credit Statistics

100% Consolidated Debt

100% Consolidated Debt / 100% Consolidated EBITDA

Other

Total Growth Capex

KMI Accretion/Dilution Analysis (12)

KMI Unconsolidate Status Quo

2017

2018

BARCLAYS

2015

$1,908

$1,908

$1.84

2016

$2,115

$2,115 $2,109

$2.00

8.4%

$39,672 $45,059

4.96 x

5.06 x

$2,189 $2,352 $2,513 $2,682

$2,352 $2,513 $2,682

$2.07

3.5%

$48,916

4.98 x

$2.22

7.3%

2019

$2.37

12

6.8%

1. Assumptions per KMI management

2 Tax depreciation is subject to change for final purchase price allocation

3. Status quo includes cash flows from assets exclusively owned by KMI, KMP EBITDA and EPB EBITDA

2020

$2.53

$49,816 $50,826 $51,818

4.44 x 4.32 x 4.19x

6.7%

6.6%

2015

2016

$2.00

$0.16

8.7%

$2.20

$0.20

$4,877 $5,434 $6,004 $6,880 $7,140

528

502

461

783

432

$4,349 $4,932 $5,543 $6,097 $6,707

10.2%

10.0%

KMI Pro Forma

2017

2018

$4,639 $7,136

$2.42

$0.35

Fairness Opinion Analysis

17.1%

10.0%

$6,425

2019

$2.66

$2.93

$0.56

23.6%

20.1%

10.0% 10.0%

2020

$45,191 $50,166 $54,572 $57,602 $59,605 $62,096

5.64 x 562x 5.55x 5.12x 5.05x

5.02 x

$3,703 $2,435

$7,443

65

$7,378

$3.22

$0.09

27.4%

10.0%

10.0%

$2,557View entire presentation