Main Street Capital Fixed Income Presentation Deck

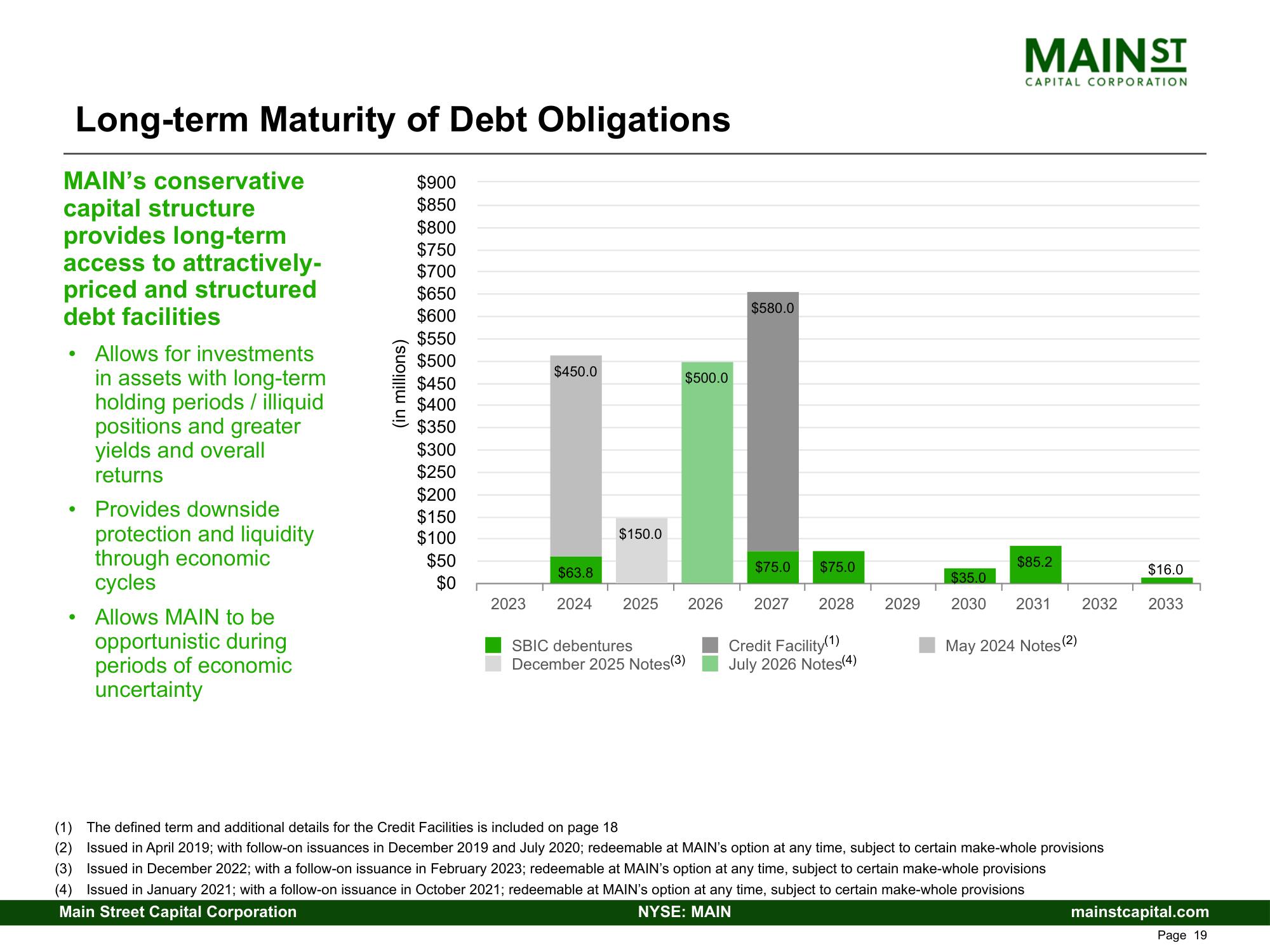

Long-term Maturity of Debt Obligations

MAIN's conservative

capital structure

provides long-term

access to attractively-

priced and structured

debt facilities

●

Allows for investments

in assets with long-term

holding periods / illiquid

positions and greater

yields and overall

returns

Provides downside

protection and liquidity

through economic

cycles

Allows MAIN to be

opportunistic during

periods of economic

uncertainty

(in millions)

$900

$850

$800

$750

$700

$650

$600

$550

$500

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

$450.0

$150.0

$63.8

2023 2024 2025

$500.0

SBIC debentures

December 2025 Notes(3)

2026

$580.0

$75.0

$75.0

2027 2028

Credit Facility (1)

July 2026 Notes(4)

MAIN ST

CAPITAL CORPORATION

$85.2

$35.0

2029 2030 2031 2032

May 2024 Notes (2)

(1) The defined term and additional details for the Credit Facilities is included on page 18

(2) Issued in April 2019; with follow-on issuances in December 2019 and July 2020; redeemable at MAIN's option at any time, subject to certain make-whole provisions

(3) Issued in December 2022; with a follow-on issuance in February 2023; redeemable at MAIN's option at any time, subject to certain make-whole provisions

(4) Issued in January 2021; with a follow-on issuance in October 2021; redeemable at MAIN's option at any time, subject to certain make-whole provisions

Main Street Capital Corporation

NYSE: MAIN

$16.0

2033

mainstcapital.com

Page 19View entire presentation