Snap Inc Results Presentation Deck

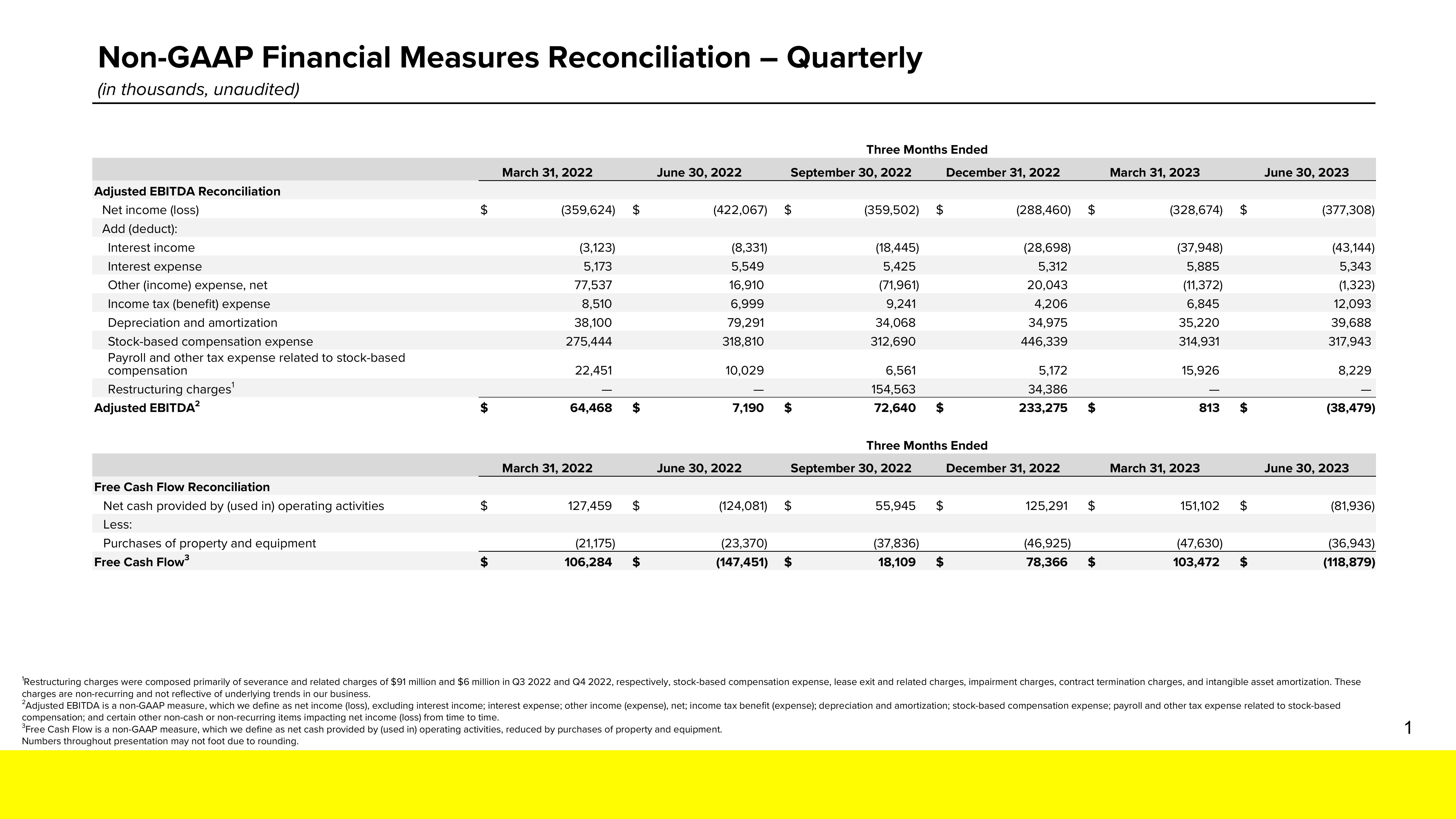

Non-GAAP Financial Measures Reconciliation

(in thousands, unaudited)

Adjusted EBITDA Reconciliation

Net income (loss)

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll and other tax expense related to stock-based

compensation

Restructuring charges¹

Adjusted EBITDA²

Free Cash Flow Reconciliation

Net cash provided by (used in) operating activities

Less:

Purchases of property and equipment

Free Cash Flow³

$

$

$

$

March 31, 2022

(359,624)

(3,123)

5,173

77,537

8,510

38,100

275,444

22,451

64,468

March 31, 2022

$

$

127,459 $

(21,175)

106,284 $

June 30, 2022

(422,067)

(8,331)

5,549

16,910

6,999

79,291

318,810

10,029

7,190

June 30, 2022

- Quarterly

September 30, 2022

$

$

Three Months Ended

December 31, 2022

(124,081) $

(23,370)

(147,451) $

(359,502) $

(18,445)

5,425

(71,961)

9,241

34,068

312,690

6,561

154,563

72,640 $

September 30, 2022

55,945 $

(288,460)

Three Months Ended

December 31, 2022

(37,836)

18,109 $

(28,698)

5,312

20,043

4,206

34,975

446,339

5,172

34,386

233,275

125,291

$

$

$

(46,925)

78,366 $

March 31, 2023

(328,674) $

(37,948)

5,885

(11,372)

6,845

35,220

314,931

15,926

813

March 31, 2023

151,102

$

$

(47,630)

103,472 $

June 30, 2023

(377,308)

(43,144)

5,343

(1,323)

12,093

39,688

317,943

8,229

(38,479)

June 30, 2023

(81,936)

(36,943)

(118,879)

'Restructuring charges were composed primarily of severance and related charges of $91 million and $6 million in Q3 2022 and Q4 2022, respectively, stock-based compensation expense, lease exit and related charges, impairment charges, contract termination charges, and intangible asset amortization. These

charges are non-recurring and not reflective of underlying trends in our business.

2Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based

compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time.

³Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

Numbers throughout presentation may not foot due to rounding.

1View entire presentation