KKR Real Estate Finance Trust Investor Presentation Deck

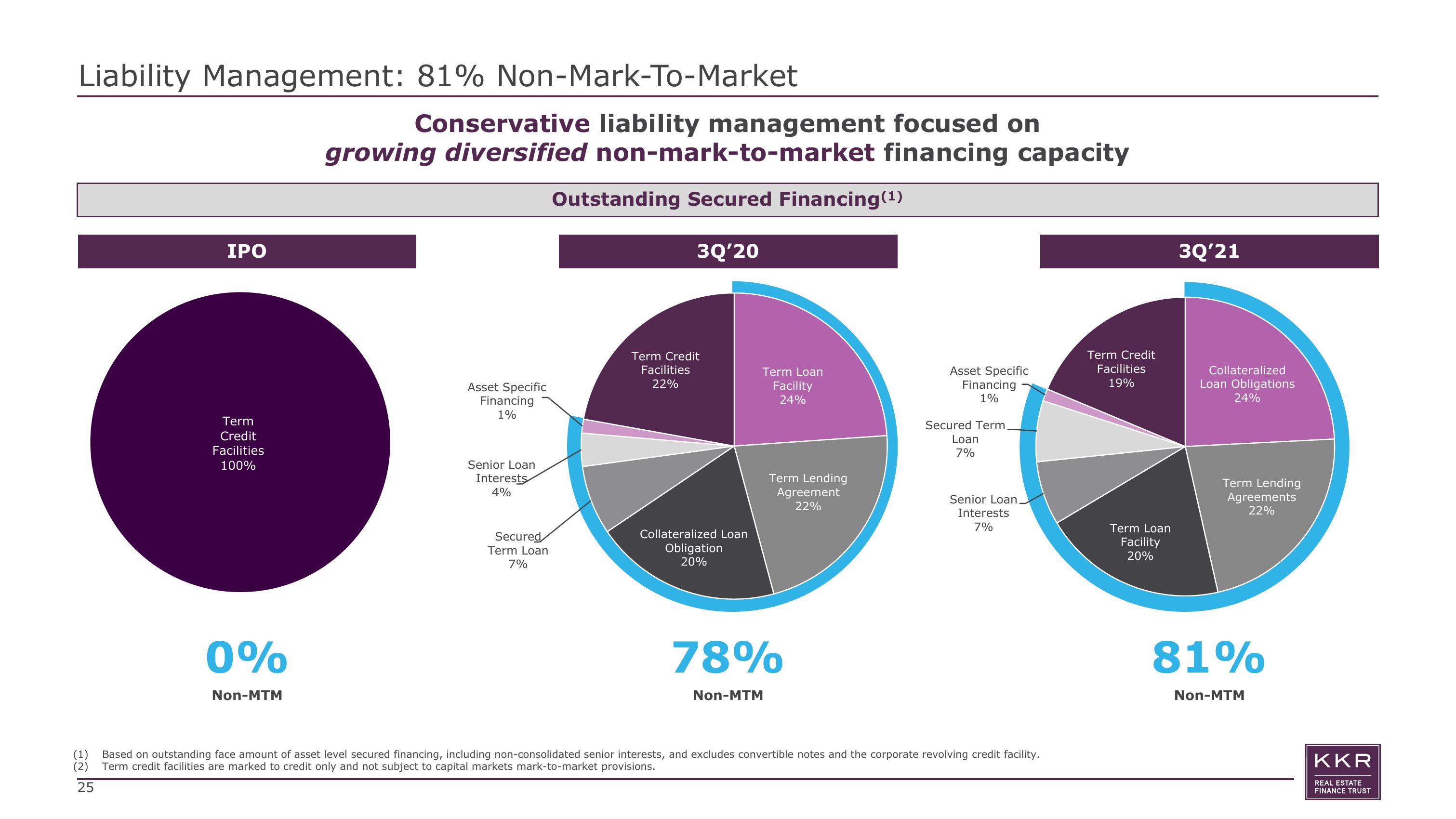

Liability Management: 81% Non-Mark-To-Market

IPO

Term

Credit

Facilities

100%

0%

Non-MTM

Conservative liability management focused on

growing diversified non-mark-to-market financing capacity

Outstanding Secured Financing(¹)

3Q'20

Asset Specific

Financing

1%

Senior Loan

Interests

4%

Secured

Term Loan

7%

Term Credit

Facilities

22%

Collateralized Loan

Obligation

20%

Term Loan

Facility

24%

Term Lending

Agreement

22%

78%

Non-MTM

Asset Specific

Financing

1%

Secured Term

Loan

7%

Senior Loan.

Interests

7%

(1) Based on outstanding face amount of asset level secured financing, including non-consolidated senior interests, and excludes convertible notes and the corporate revolving credit facility.

(2) Term credit facilities are marked to credit only and not subject to capital markets mark-to-market provisions.

25

Term Credit

Facilities

19%

Term Loan

Facility

20%

3Q'21

Collateralized

Loan Obligations

24%

Term Lending

Agreements

22%

81%

Non-MTM

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation