Pathward Financial Results Presentation Deck

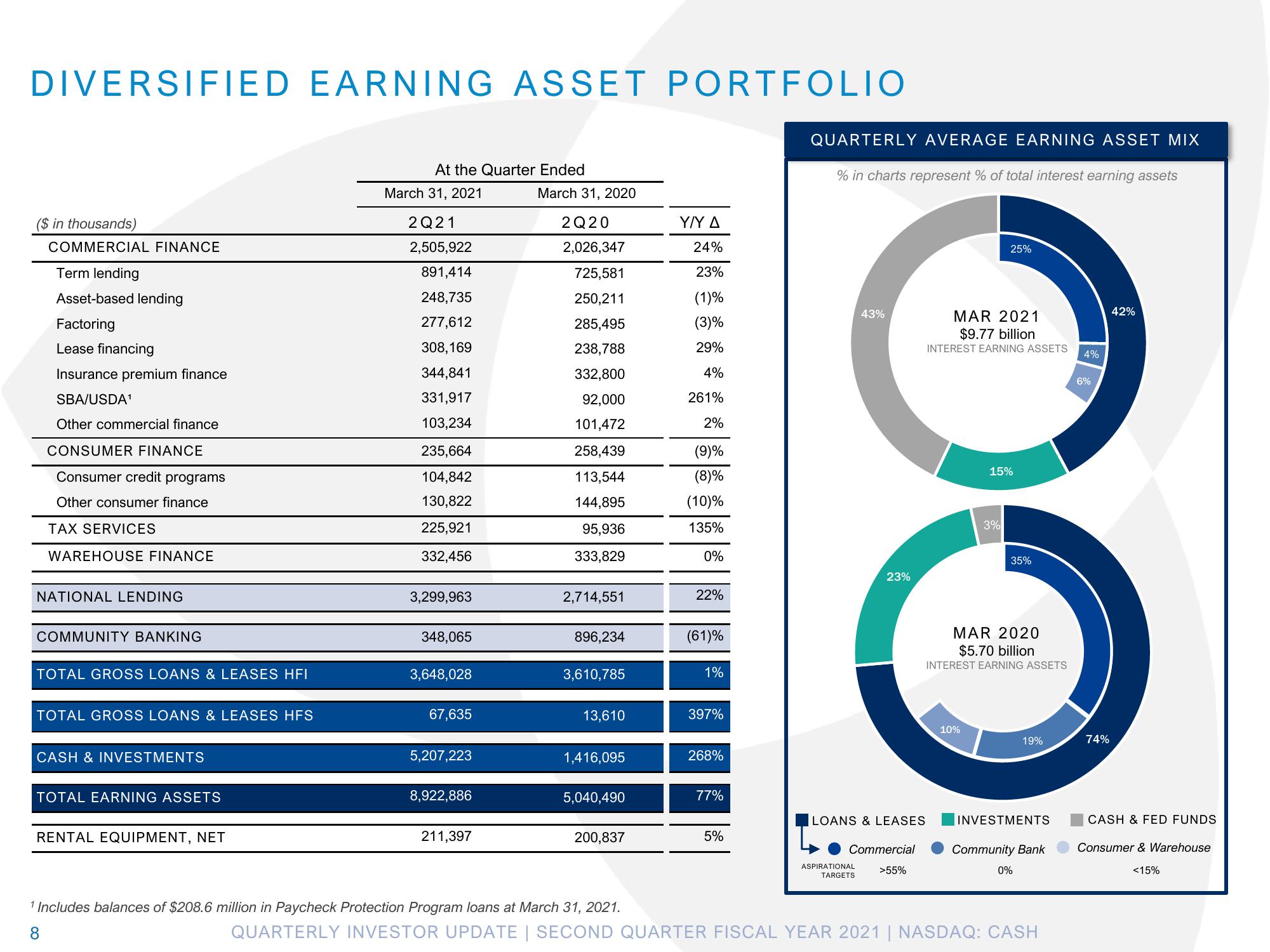

DIVERSIFIED EARNING ASSET PORTFOLIO

($ in thousands)

COMMERCIAL FINANCE

Term lending

Asset-based lending

Factoring

Lease financing

Insurance premium finance

SBA/USDA¹

Other commercial finance

CONSUMER FINANCE

Consumer credit programs

Other consumer finance

TAX SERVICES

WAREHOUSE FINANCE

NATIONAL LENDING

COMMUNITY BANKING

TOTAL GROSS LOANS & LEASES HFI

TOTAL GROSS LOANS & LEASES HFS

CASH & INVESTMENTS

TOTAL EARNING ASSETS

RENTAL EQUIPMENT, NET

At the Quarter Ended

March 31, 2021

2Q21

2,505,922

891,414

248,735

277,612

308,169

344,841

331,917

103,234

235,664

104,842

130,822

225,921

332,456

3,299,963

348,065

3,648,028

67,635

5,207,223

8,922,886

211,397

March 31, 2020

2Q20

2,026,347

725,581

250,211

285,495

238,788

332,800

92,000

101,472

258,439

113,544

144,895

95,936

333,829

2,714,551

896,234

3,610,785

13,610

1,416,095

5,040,490

200,837

Y/Y A

24%

23%

(1)%

(3)%

29%

4%

261%

2%

(9)%

(8)%

(10)%

135%

0%

22%

(61)%

1%

397%

268%

77%

5%

QUARTERLY AVERAGE EARNING ASSET MIX

% in charts represent % of total interest earning assets

43%

23%

ASPIRATIONAL

TARGETS

LOANS & LEASES

Commercial

>55%

MAR 2021

$9.77 billion

INTEREST EARNING ASSETS

25%

10%

15%

3%

MAR 2020

$5.70 billion

INTEREST EARNING ASSETS

35%

19%

INVESTMENTS

Community Bank

0%

¹ Includes balances of $208.6 million in Paycheck Protection Program loans at March 31, 2021.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

8

4%

6%

74%

42%

CASH & FED FUNDS

Consumer & Warehouse

<15%View entire presentation