Ready Capital Investor Presentation Deck

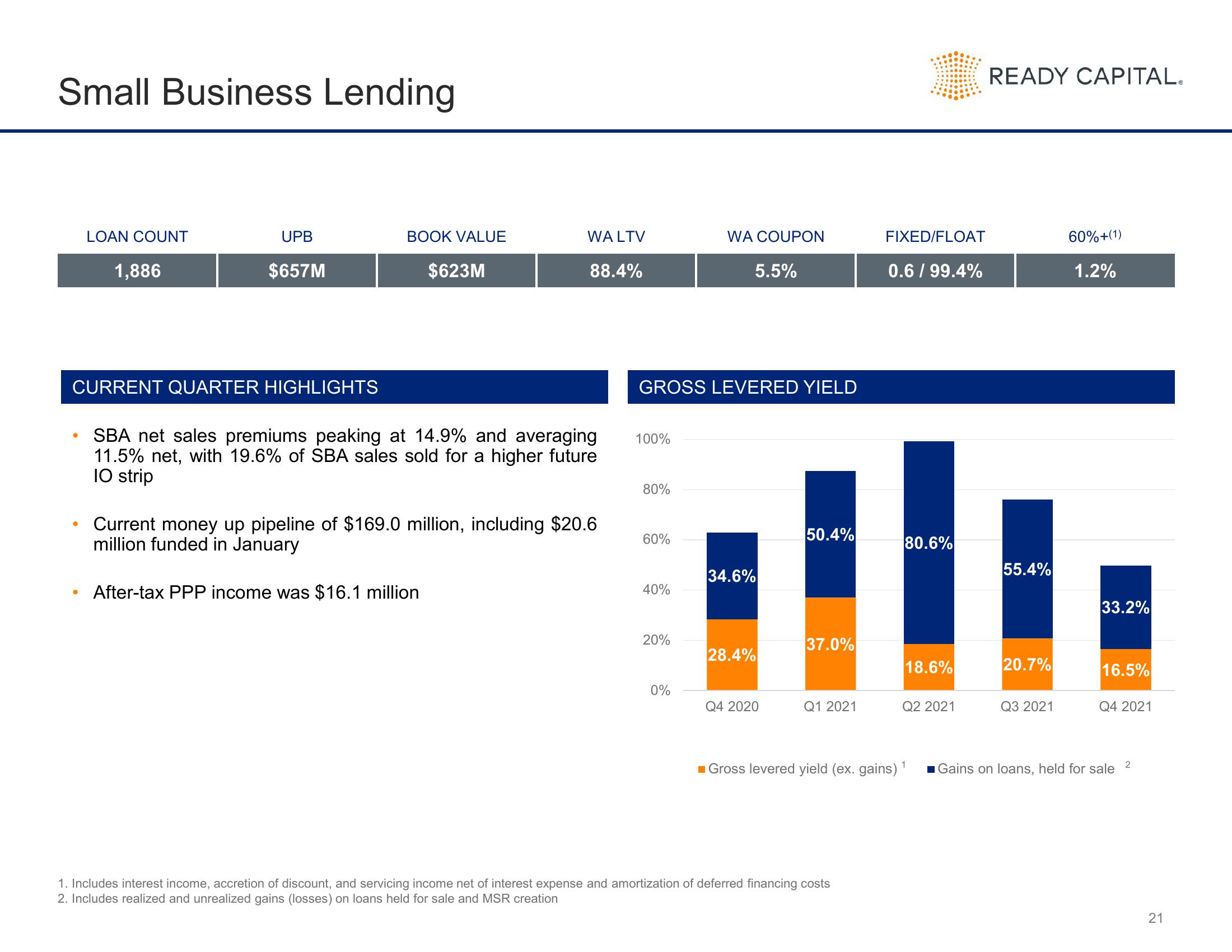

Small Business Lending

●

LOAN COUNT

●

1,886

CURRENT QUARTER HIGHLIGHTS

UPB

$657M

BOOK VALUE

$623M

WA LTV

After-tax PPP income was $16.1 million

88.4%

SBA net sales premiums peaking at 14.9% and averaging

11.5% net, with 19.6% of SBA sales sold for a higher future

10 strip

Current money up pipeline of $169.0 million, including $20.6

million funded in January

100%

GROSS LEVERED YIELD

80%

60%

40%

20%

WA COUPON

0%

5.5%

34.6%

28.4%

Q4 2020

50.4%

37.0%

Q1 2021

FIXED/FLOAT

0.6 / 99.4%

1. Includes interest income, accretion of discount, and servicing income net of interest expense and amortization of deferred financing costs

2. Includes realized and unrealized gains (losses) on loans held for sale and MSR creation

80.6%

18.6%

Q2 2021

■Gross levered yield (ex. gains) ¹

READY CAPITAL.

55.4%

20.7%

Q3 2021

60%+(1)

1.2%

33.2%

16.5%

Q4 2021

Gains on loans, held for sale

2

21View entire presentation