Blackwells Capital Activist Presentation Deck

■

■

A

DUAL-CLASS STRUCTURE LIMITS ACCOUNTABILITY TO SHAREHOLDERS

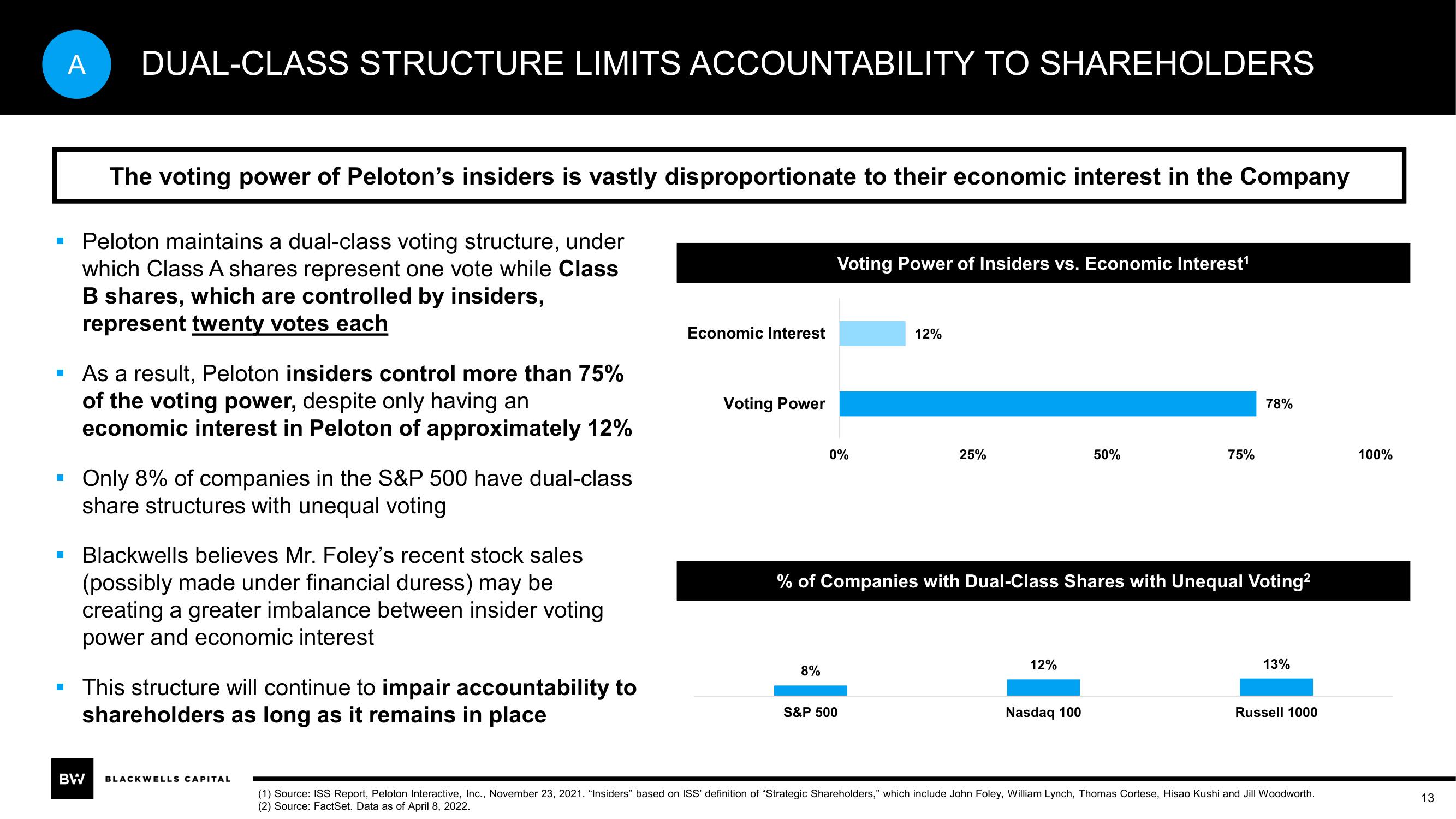

The voting power of Peloton's insiders is vastly disproportionate to their economic interest in the Company

Peloton maintains a dual-class voting structure, under

which Class A shares represent one vote while Class

B shares, which are controlled by insiders,

represent twenty votes each

As a result, Peloton insiders control more than 75%

of the voting power, despite only having an

economic interest in Peloton of approximately 12%

Only 8% of companies in the S&P 500 have dual-class

share structures with unequal voting

Blackwells believes Mr. Foley's recent stock sales

(possibly made under financial duress) may be

creating a greater imbalance between insider voting

power and economic interest

▪ This structure will continue to impair accountability to

shareholders as long as it remains in place

BW

BLACKWELLS CAPITAL

Economic Interest

Voting Power

Voting Power of Insiders vs. Economic Interest¹

8%

0%

12%

S&P 500

25%

% of Companies with Dual-Class Shares with Unequal Voting²

12%

50%

Nasdaq 100

75%

78%

13%

Russell 1000

(1) Source: ISS Report, Peloton Interactive, Inc., November 23, 2021. "Insiders" based on ISS' definition of "Strategic Shareholders," which include John Foley, William Lynch, Thomas Cortese, Hisao Kushi and Jill Woodworth.

(2) Source: FactSet. Data as of April 8, 2022.

100%

13View entire presentation