Hilltop Holdings Results Presentation Deck

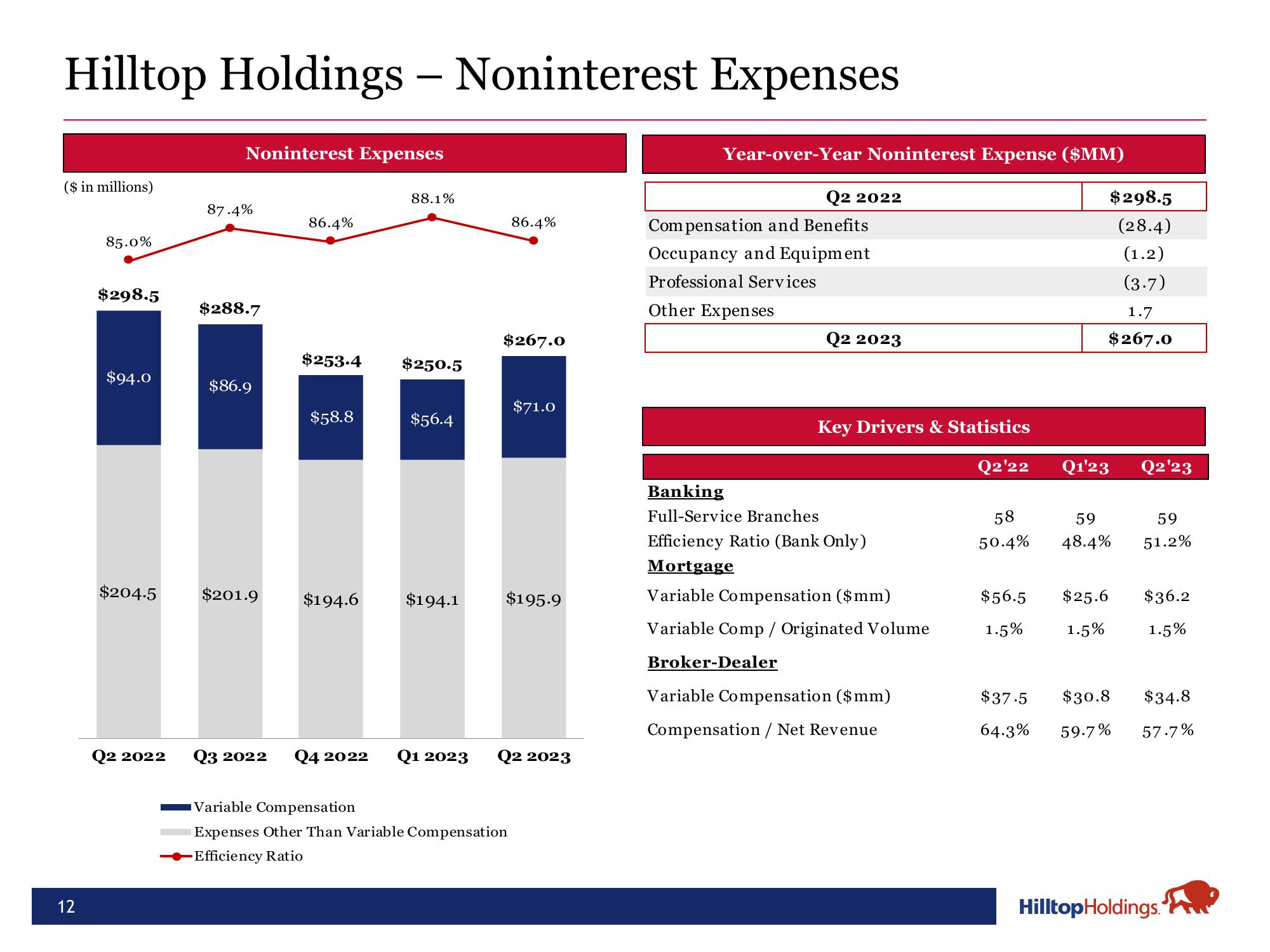

Hilltop Holdings - Noninterest Expenses

($ in millions)

12

85.0%

$298.5

$94.0

$204.5

Noninterest Expenses

87.4%

$288.7

$86.9

$201.9

86.4%

$253.4

$58.8

$194.6

88.1%

$250.5

$56.4

$194.1

Q2 2022 Q3 2022 Q4 2022 Q1 2023

86.4%

$267.0

$71.0

$195.9

Variable Compensation

Expenses Other Than Variable Compensation

Efficiency Ratio

Q2 2023

Year-over-Year Noninterest Expense ($MM)

Compensation and Benefits

Occupancy and Equipment

Professional Services

Other Expenses

Q2 2022

Banking

Full-Service Branches

Broker-Dealer

Q2 2023

Key Drivers & Statistics

Q2'22

Efficiency Ratio (Bank Only)

Mortgage

Variable Compensation ($mm)

Variable Comp / Originated Volume

Variable Compensation ($mm)

Compensation / Net Revenue

58

50.4%

$56.5

1.5%

Q1'23

$298.5

(28.4)

(1.2)

(3.7)

$25.6

1.5%

1.7

$267.0

59

48.4%

Q2'23

59

51.2%

$36.2

1.5%

$37.5 $30.8 $34.8

64.3%

59.7% 57.7%

Hilltop Holdings.View entire presentation