Meta Shareholder Engagement Presentation Deck

Shareholder Proposals

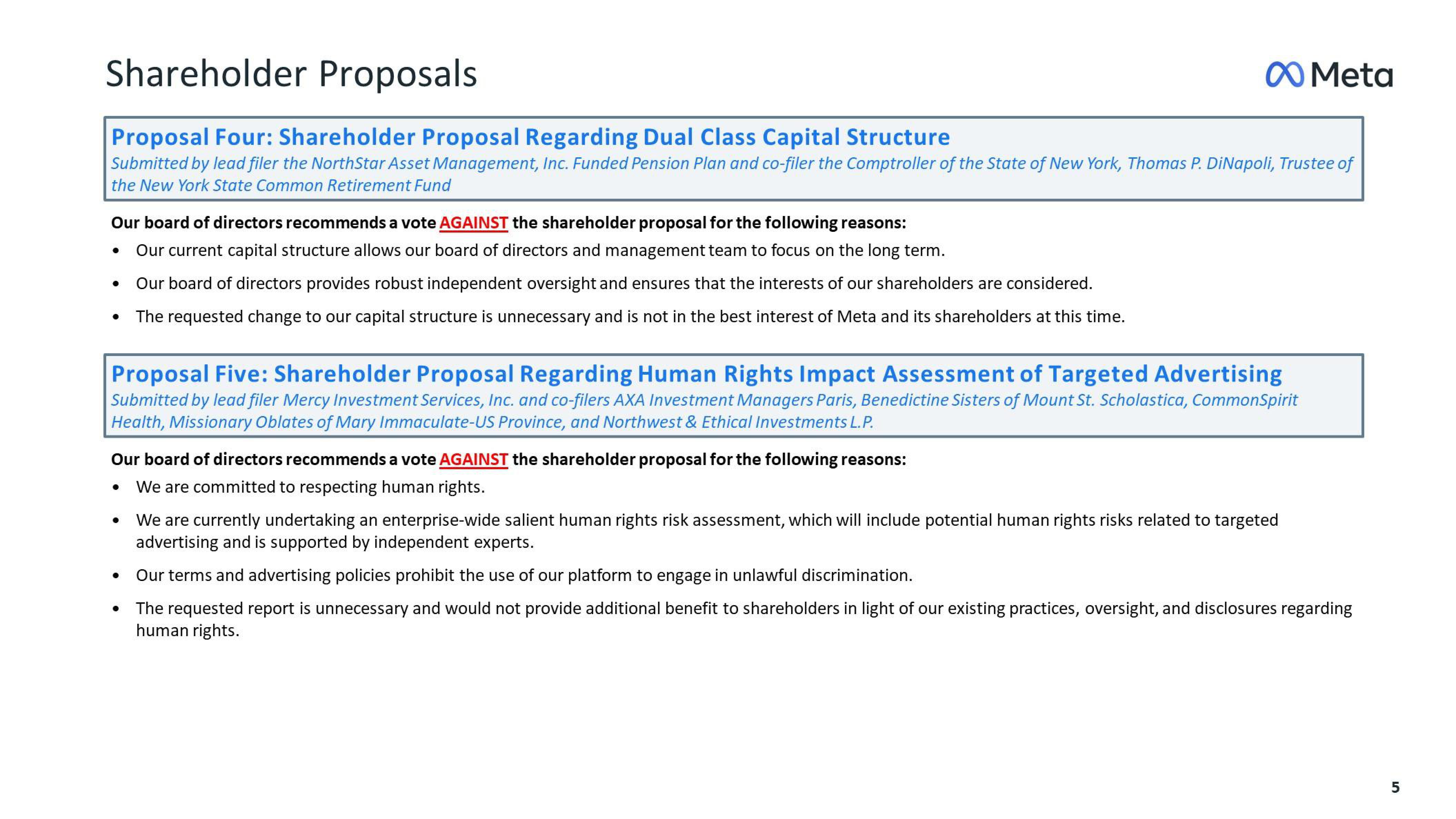

Proposal Four: Shareholder Proposal Regarding Dual Class Capital Structure

Submitted by lead filer the NorthStar Asset Management, Inc. Funded Pension Plan and co-filer the Comptroller of the State of New York, Thomas P. DiNapoli, Trustee of

the New York State Common Retirement Fund

Our board of directors recommends a vote AGAINST the shareholder proposal for the following reasons:

Our current capital structure allows our board of directors and management team to focus on the long term.

Our board of directors provides robust independent oversight and ensures that the interests of our shareholders are considered.

The requested change to our capital structure is unnecessary and is not in the best interest of Meta and its shareholders at this time.

●

●

Proposal Five: Shareholder Proposal Regarding Human Rights Impact Assessment of Targeted Advertising

Submitted by lead filer Mercy Investment Services, Inc. and co-filers AXA Investment Managers Paris, Benedictine Sisters of Mount St. Scholastica, CommonSpirit

Health, Missionary Oblates of Mary Immaculate-US Province, and Northwest & Ethical Investments L.P.

Our board of directors recommends a vote AGAINST the shareholder proposal for the following reasons:

We are committed to respecting human rights.

●

●

●

Meta

●

We are currently undertaking an enterprise-wide salient human rights risk assessment, which will include potential human rights risks related to targeted

advertising and is supported by independent experts.

Our terms and advertising policies prohibit the use of our platform to engage in unlawful discrimination.

The requested report is unnecessary and would not provide additional benefit to shareholders in light of our existing practices, oversight, and disclosures regarding

human rights.

5View entire presentation