Cartrack IPO

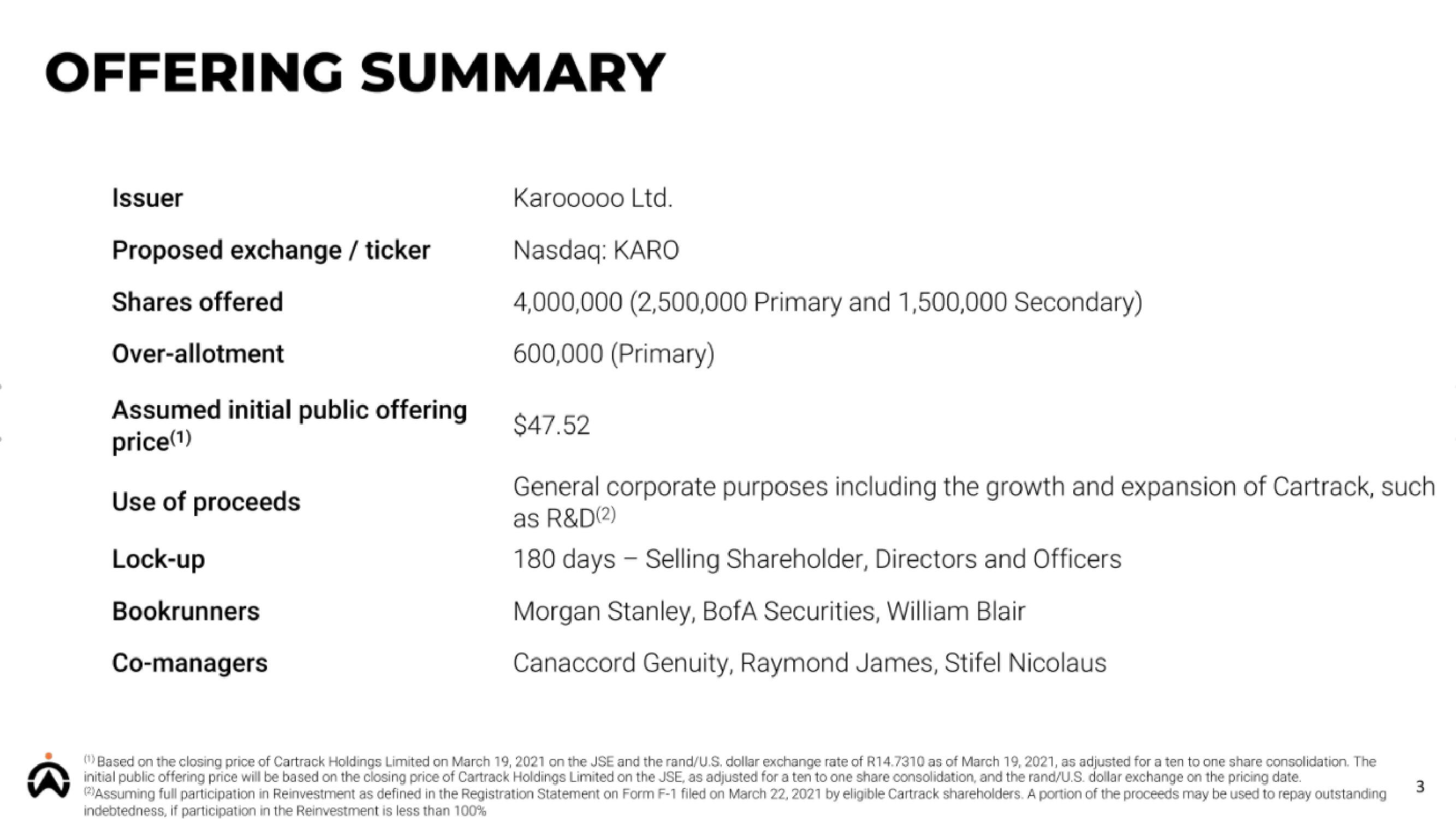

OFFERING SUMMARY

(

Issuer

Proposed exchange/ticker

Shares offered

Over-allotment

Assumed initial public offering

price(¹)

Use of proceeds

Lock-up

Bookrunners

Co-managers

Karooooo Ltd.

Nasdaq: KARO

4,000,000 (2,500,000 Primary and 1,500,000 Secondary)

600,000 (Primary)

$47.52

General corporate purposes including the growth and expansion of Cartrack, such

as R&D(2)

180 days - Selling Shareholder, Directors and Officers

Morgan Stanley, BofA Securities, William Blair

Canaccord Genuity, Raymond James, Stifel Nicolaus

(1)Based on the closing price of Cartrack Holdings Limited on March 19, 2021 on the JSE and the rand/U.S. dollar exchange rate of R14.7310 as of March 19, 2021, as adjusted for a ten to one share consolidation. The

initial public offering price will be based on the closing price of Cartrack Holdings Limited on the JSE, as adjusted for a ten to one share consolidation, and the rand/U.S. dollar exchange on the pricing date.

(2) Assuming full participation in Reinvestment as defined in the Registration Statement on Form F-1 filed on March 22, 2021 by eligible Cartrack shareholders. A portion of the proceeds may be used to repay outstanding

indebtedness, if participation in the Reinvestment is less than 100%

3View entire presentation