Proterra Investor Presentation Deck

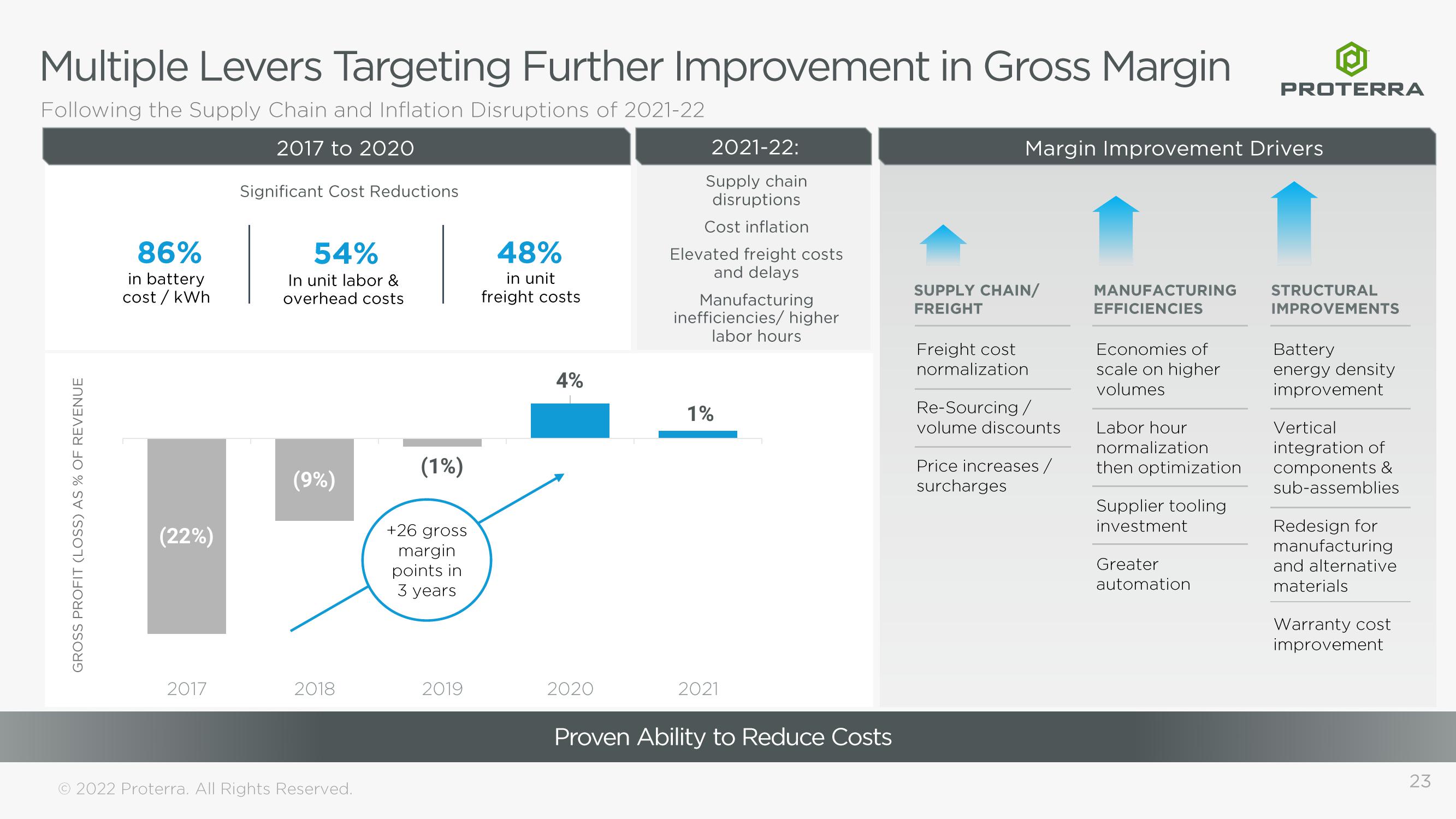

Multiple Levers Targeting Further Improvement in Gross Margin

Following the Supply Chain and Inflation Disruptions of 2021-22

2017 to 2020

Significant Cost Reductions

GROSS PROFIT (LOSS) AS % OF REVENUE

86%

in battery

cost / kWh

(22%)

2017

54%

In unit labor &

overhead costs

(9%)

2018

© 2022 Proterra. All Rights Reserved.

(1%)

+26 gross

margin

points in

3 years

2019

48%

in unit

freight costs

4%

2020

2021-22:

Supply chain

disruptions

Cost inflation

Elevated freight costs

and delays

Manufacturing

inefficiencies/ higher

labor hours

1%

2021

Proven Ability to Reduce Costs

Margin Improvement Drivers

SUPPLY CHAIN/

FREIGHT

Freight cost

normalization

Re-Sourcing /

volume discounts

Price increases/

surcharges

MANUFACTURING

EFFICIENCIES

Economies of

scale on higher

volumes

Labor hour

normalization

then optimization

Supplier tooling

investment

PROTERRA

Greater

automation

STRUCTURAL

IMPROVEMENTS

Battery

energy density

improvement

Vertical

integration of

components &

sub-assemblies

Redesign for

manufacturing

and alternative

materials

Warranty cost

improvement

23View entire presentation