Endeavour Mining Investor Presentation Deck

SHORT TERM REVENUE PROTECTION PROGRAM

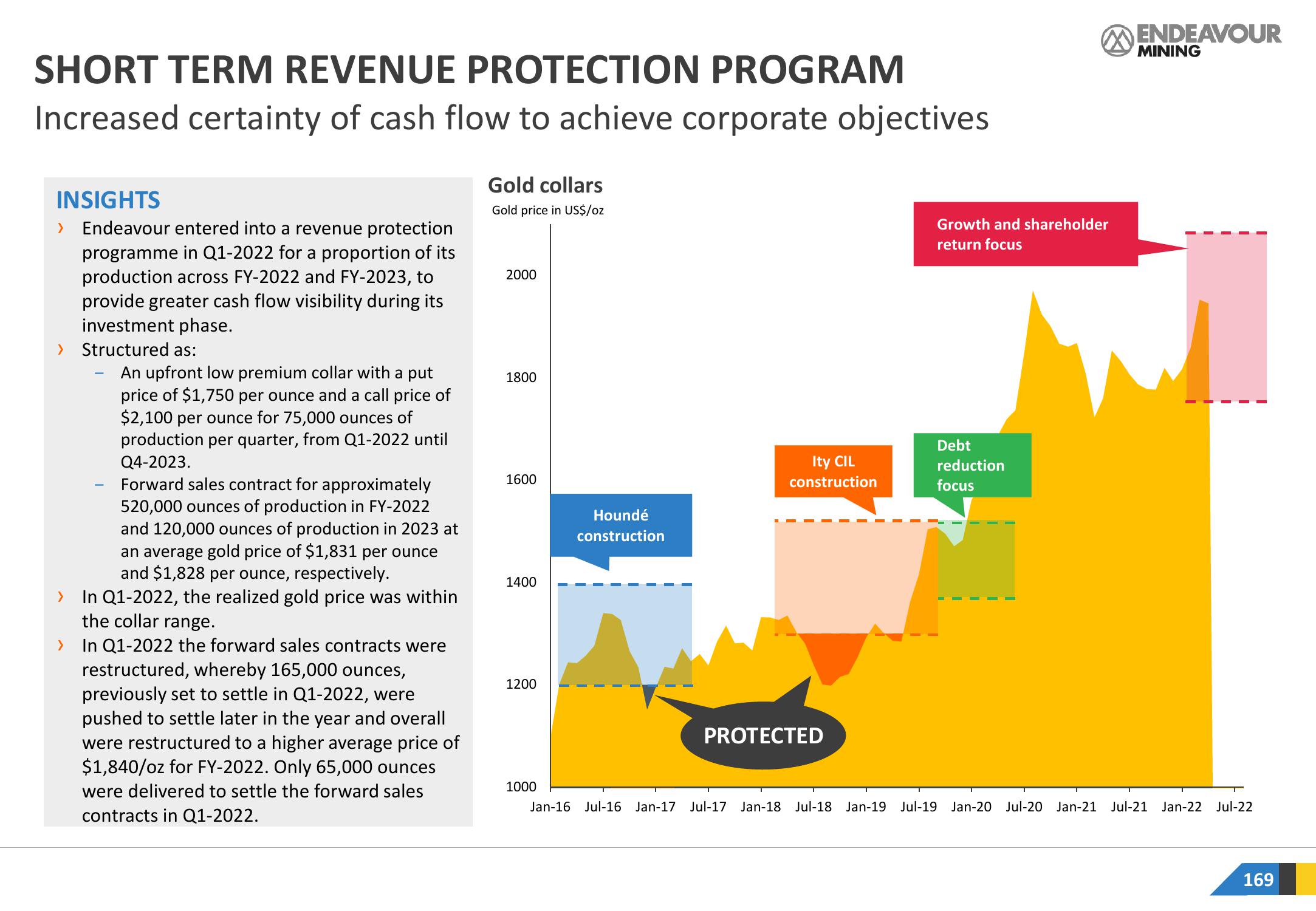

Increased certainty of cash flow to achieve corporate objectives

INSIGHTS

> Endeavour entered into a revenue protection

programme in Q1-2022 for a proportion of its

production across FY-2022 and FY-2023, to

provide greater cash flow visibility during its

investment phase.

> Structured as:

-

An upfront low premium collar with a put

price of $1,750 per ounce and a call price of

$2,100 per ounce for 75,000 ounces of

production per quarter, from Q1-2022 until

Q4-2023.

Forward sales contract for approximately

520,000 ounces of production in FY-2022

and 120,000 ounces of production in 2023 at

an average gold price of $1,831 per ounce

and $1,828 per ounce, respectively.

>

In Q1-2022, the realized gold price was within

the collar range.

>

In Q1-2022 the forward sales contracts were

restructured, whereby 165,000 ounces,

previously set to settle in Q1-2022, were

pushed to settle later in the year and overall

were restructured to a higher average price of

$1,840/oz for FY-2022. Only 65,000 ounces

were delivered to settle the forward sales

contracts in Q1-2022.

Gold collars

Gold price in US$/oz

2000

1800

1600

1400

1200

1000

Houndé

construction

Ity CIL

construction

PROTECTED

Growth and shareholder

return focus

Debt

reduction

focus

ENDEAVOUR

MINING

Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

169View entire presentation