First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

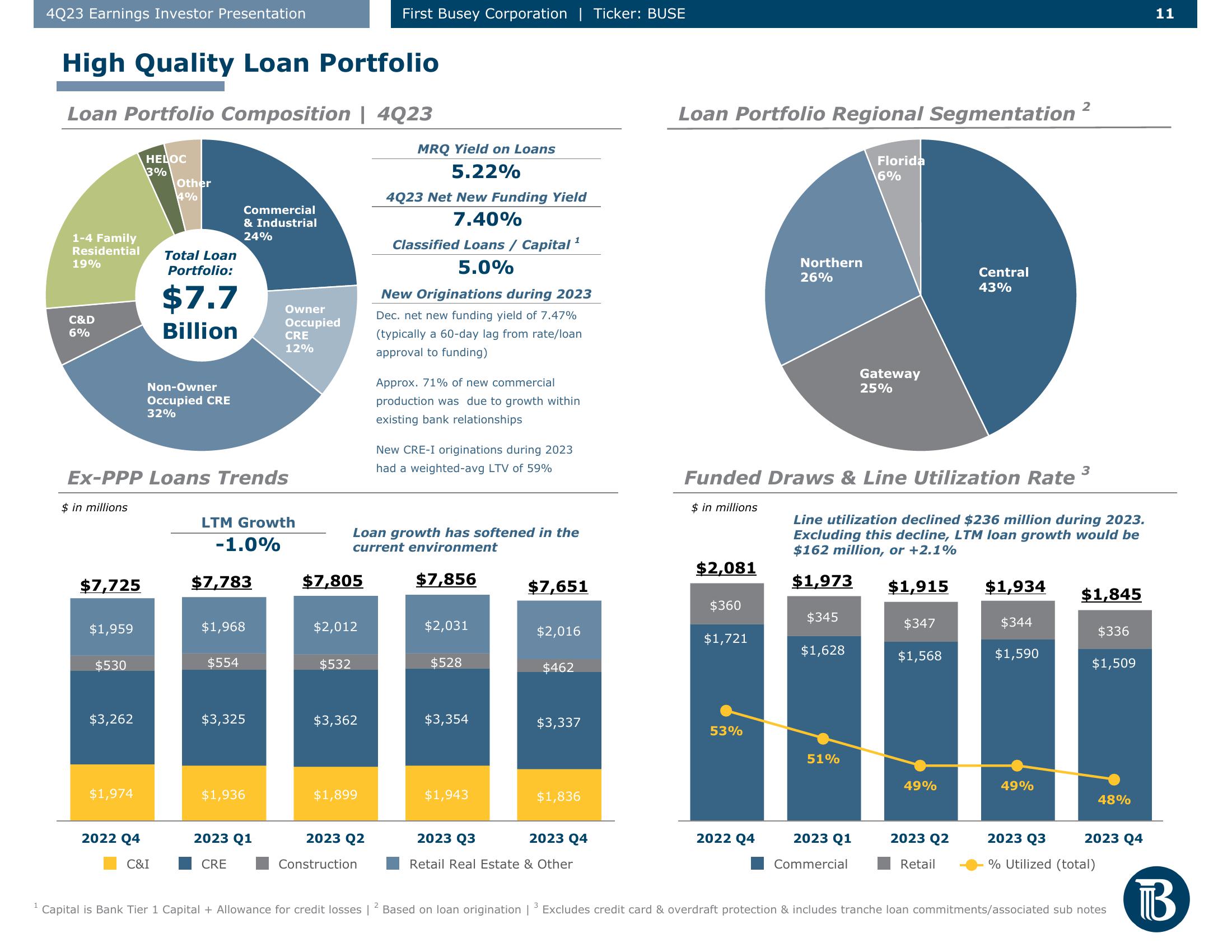

High Quality Loan Portfolio

Loan Portfolio Composition | 4Q23

1-4 Family

Residential

19%

C&D

6%

$7,725

$1,959

$530

$3,262

HELOC

3%

$1,974

Ex-PPP Loans Trends

$ in millions

Other

4%

Total Loan

Portfolio:

$7.7

Billion

Non-Owner

Occupied CRE

32%

2022 Q4

C&I

Commercial

& Industrial

24%

LTM Growth

-1.0%

$7,783

$1,968

$554

$3,325

Owner

Occupied

CRE

12%

$1,936

2023 Q1

CRE

$7,805

$2,012

$532

$3,362

First Busey Corporation | Ticker: BUSE

$1,899

Loan growth has softened in the

current environment

$7,856

2023 Q2

Construction

MRQ Yield on Loans

5.22%

4Q23 Net New Funding Yield

7.40%

Classified Loans / Capital ¹

5.0%

New Originations during 2023

Dec. net new funding yield of 7.47%

(typically a 60-day lag from rate/loan

approval to funding)

Approx. 71% of new commercial

production was due to growth within

existing bank relationships

New CRE-I originations during 2023

had a weighted-avg LTV of 59%

$2,031

$528

$3,354

$1,943

$7,651

$2,016

$462

$3,337

$1,836

2023 Q3

2023 Q4

Retail Real Estate & Other

Loan Portfolio Regional Segmentation

$ in millions

$2,081

$360

Funded Draws & Line Utilization Rate

$1,721

53%

Northern

26%

2022 Q4

$345

$1,628

Florida

6%

51%

Gateway

25%

2023 Q1

Commercial

Line utilization declined $236 million during 2023.

Excluding this decline, LTM loan growth would be

$162 million, or +2.1%

$1,973

$1,915

$347

$1,568

49%

Central

43%

2023 Q2

Retail

$1,934

$344

$1,590

2

49%

3

$1,845

$336

$1,509

48%

2023 Q3

% Utilized (total)

2023 Q4

1 Capital is Bank Tier 1 Capital + Allowance for credit losses | ² Based on loan origination | 3 Excludes credit card & overdraft protection & includes tranche loan commitments/associated sub notes

11

BView entire presentation