AngloAmerican Results Presentation Deck

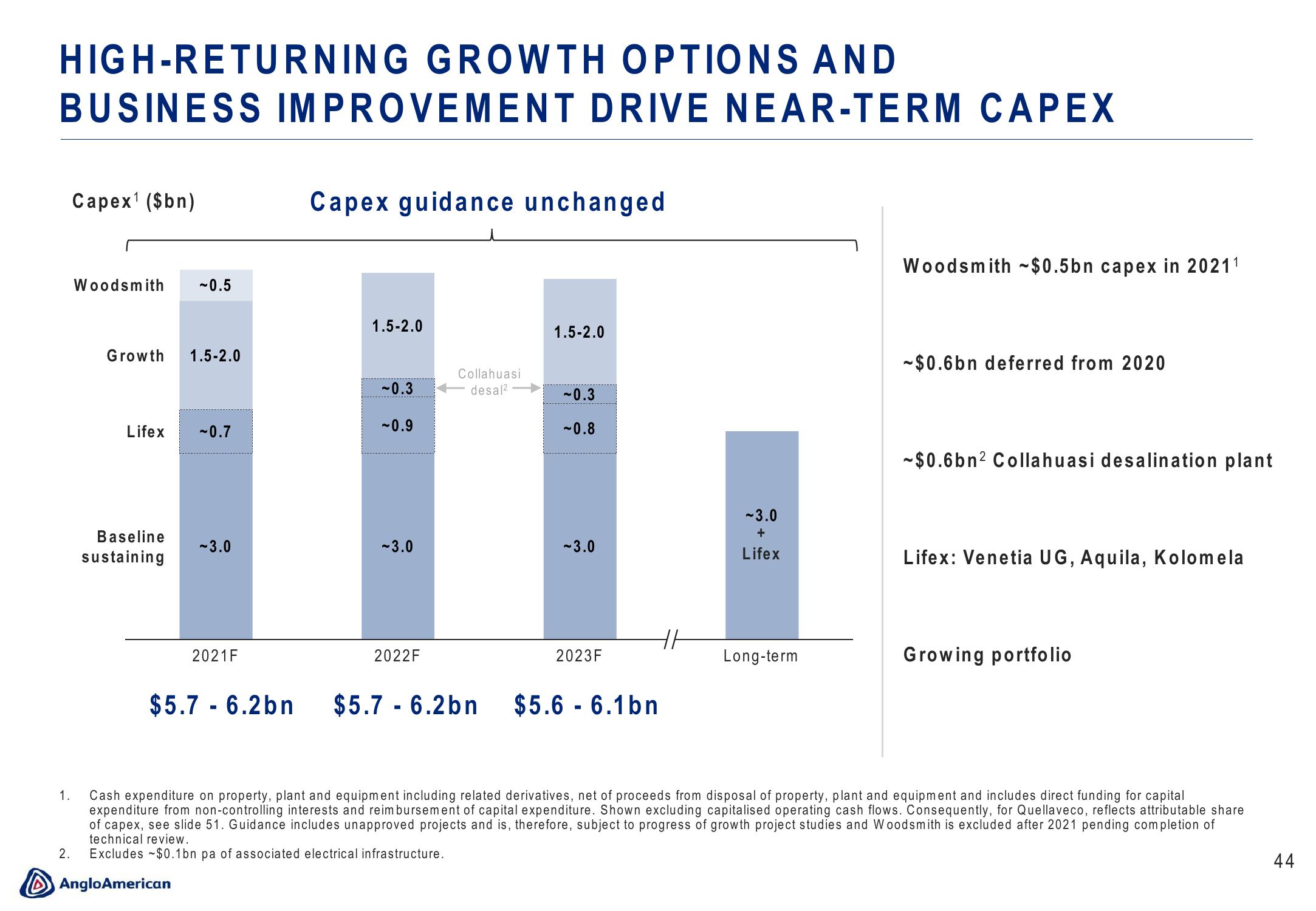

HIGH-RETURNING GROWTH OPTIONS AND

BUSINESS IMPROVEMENT DRIVE NEAR-TERM CAPEX

1.

Capex¹ ($bn)

2.

Woodsmith -0.5

Growth 1.5-2.0

Lifex

Baseline

sustaining

~0.7

-3.0

2021F

$5.7-6.2bn

Capex guidance unchanged.

1.5-2.0

~0.3

-0.9

-3.0

2022F

Collahuasi

desal²

$5.7 - 6.2bn

1.5-2.0

~0.3

~0.8

-3.0

2023F

$5.6 - 6.1bn

11

-3.0

+

Lifex

Long-term

Woodsmith $0.5bn capex in 20211

~$0.6bn deferred from 2020

~$0.6bn² Collahuasi desalination plant

Lifex: Venetia UG, Aquila, Kolomela

Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital

expenditure from non-controlling interests and reimbursement of capital expenditure. Shown excluding capitalised operating cash flows. Consequently, for Quellaveco, reflects attributable share

of capex, see slide 51. Guidance includes unapproved projects and is, therefore, subject to progress of growth project studies and Woodsmith is excluded after 2021 pending completion of

technical review.

Excludes $0.1bn pa of associated electrical infrastructure.

Anglo American

Growing portfolio

44View entire presentation