Capacity, Applications, and Outlook

Summary

TRENDFORCE

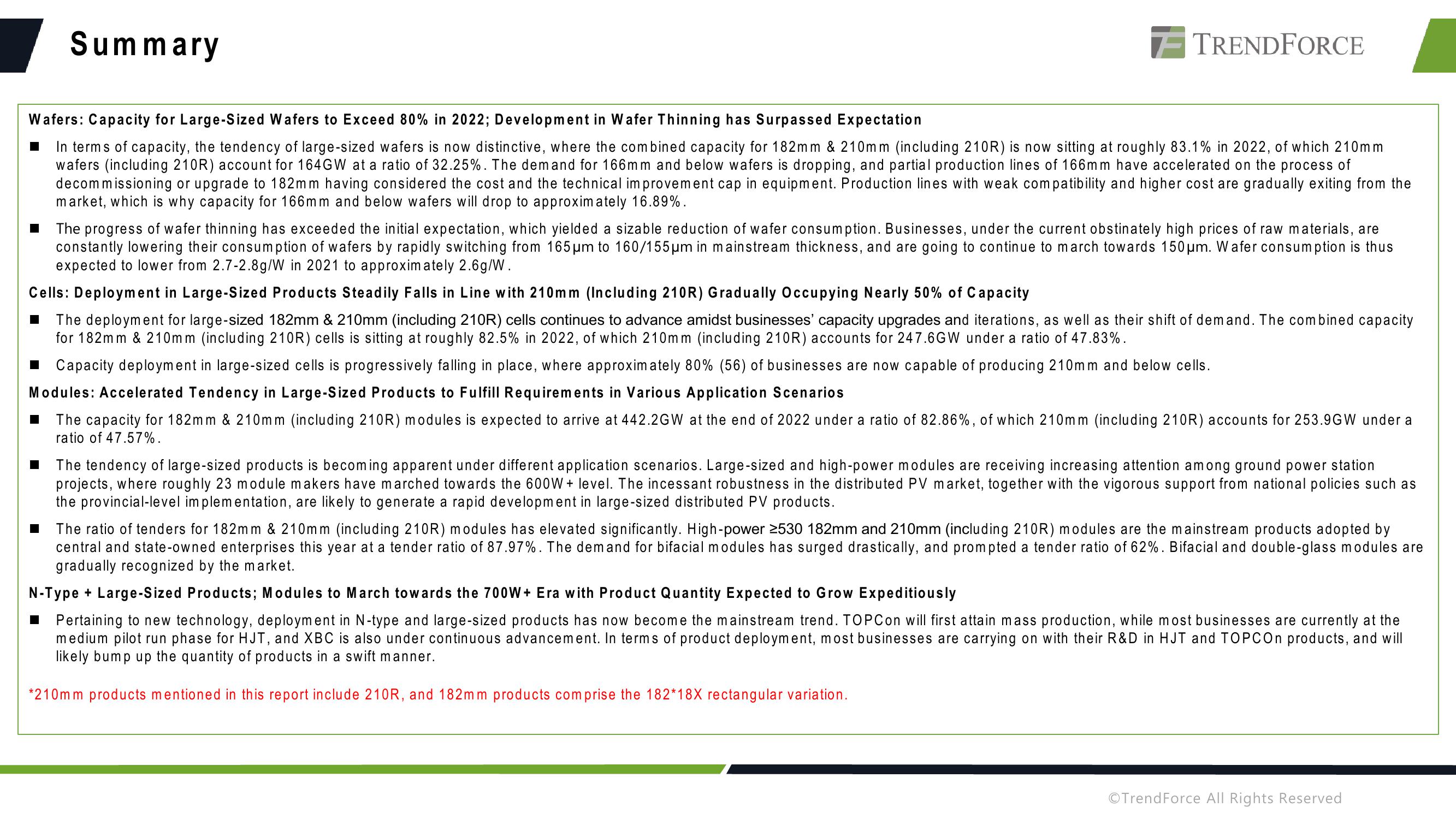

Wafers: Capacity for Large-Sized Wafers to Exceed 80% in 2022; Development in Wafer Thinning has Surpassed Expectation

In terms of capacity, the tendency of large-sized wafers is now distinctive, where the combined capacity for 182mm & 210mm (including 210R) is now sitting at roughly 83.1% in 2022, of which 210mm

wafers (including 210R) account for 164GW at a ratio of 32.25%. The demand for 166mm and below wafers is dropping, and partial production lines of 166mm have accelerated on the process of

decommissioning or upgrade to 182mm having considered the cost and the technical improvement cap in equipment. Production lines with weak compatibility and higher cost are gradually exiting from the

market, which is why capacity for 166mm and below wafers will drop to approximately 16.89%.

The progress of wafer thinning has exceeded the initial expectation, which yielded a sizable reduction of wafer consumption. Businesses, under the current obstinately high prices of raw materials, are

constantly lowering their consumption of wafers by rapidly switching from 165 μm to 160/155 μm in mainstream thickness, and are going to continue to march towards 150 μm. Wafer consumption is thus

expected to lower from 2.7-2.8g/W in 2021 to approximately 2.6g/W.

Cells: Deployment in Large-Sized Products Steadily Falls in Line with 210mm (Including 210R) Gradually Occupying Nearly 50% of Capacity

The deployment for large-sized 182mm & 210mm (including 210R) cells continues to advance amidst businesses' capacity upgrades and iterations, as well as their shift of demand. The combined capacity

for 182mm & 210mm (including 210R) cells is sitting at roughly 82.5% in 2022, of which 210mm (including 210R) accounts for 247.6GW under a ratio of 47.83%.

■ Capacity deployment in large-sized cells is progressively falling in place, where approximately 80% (56) of businesses are now capable of producing 210mm and below cells.

Modules: Accelerated Tendency in Large-Sized Products to Fulfill Requirements in Various Application Scenarios

The capacity for 182mm & 210mm (including 210R) modules is expected to arrive at 442.2GW at the end of 2022 under a ratio of 82.86%, of which 210mm (including 210R) accounts for 253.9GW under a

ratio of 47.57%.

The tendency of large-sized products is becoming apparent under different application scenarios. Large-sized and high-power modules are receiving increasing attention among ground power station

projects, where roughly 23 module makers have marched towards the 600W + level. The incessant robustness in the distributed PV market, together with the vigorous support from national policies such as

the provincial-level implementation, are likely to generate a rapid development in large-sized distributed PV products.

The ratio of tenders for 182mm & 210mm (including 210R) modules has elevated significantly. High-power ≥530 182mm and 210mm (including 210R) modules are the mainstream products adopted by

central and state-owned enterprises this year at a tender ratio of 87.97%. The demand for bifacial modules has surged drastically, and prompted a tender ratio of 62%. Bifacial and double-glass modules are

gradually recognized by the market.

N-Type

Large-Sized Products; Modules to March towards the 700W+ Era with Product Quantity Expected to Grow Expeditiously

■ Pertaining to new technology, deployment in N-type and large-sized products has now become the mainstream trend. TOP Con will first attain mass production, while most businesses are currently at the

medium pilot run phase for HJT, and XBC is also under continuous advancement. In terms of product deployment, most businesses are carrying on with their R&D in HJT and TOPCOn products, and will

likely bump up the quantity of products in a swift manner.

*210mm products mentioned in this report include 210R, and 182mm products comprise the 182*18X rectangular variation.

OTrend Force All Rights ReservedView entire presentation