Melrose Results Presentation Deck

Melrose Aerospace: long-term cashflow dynamics

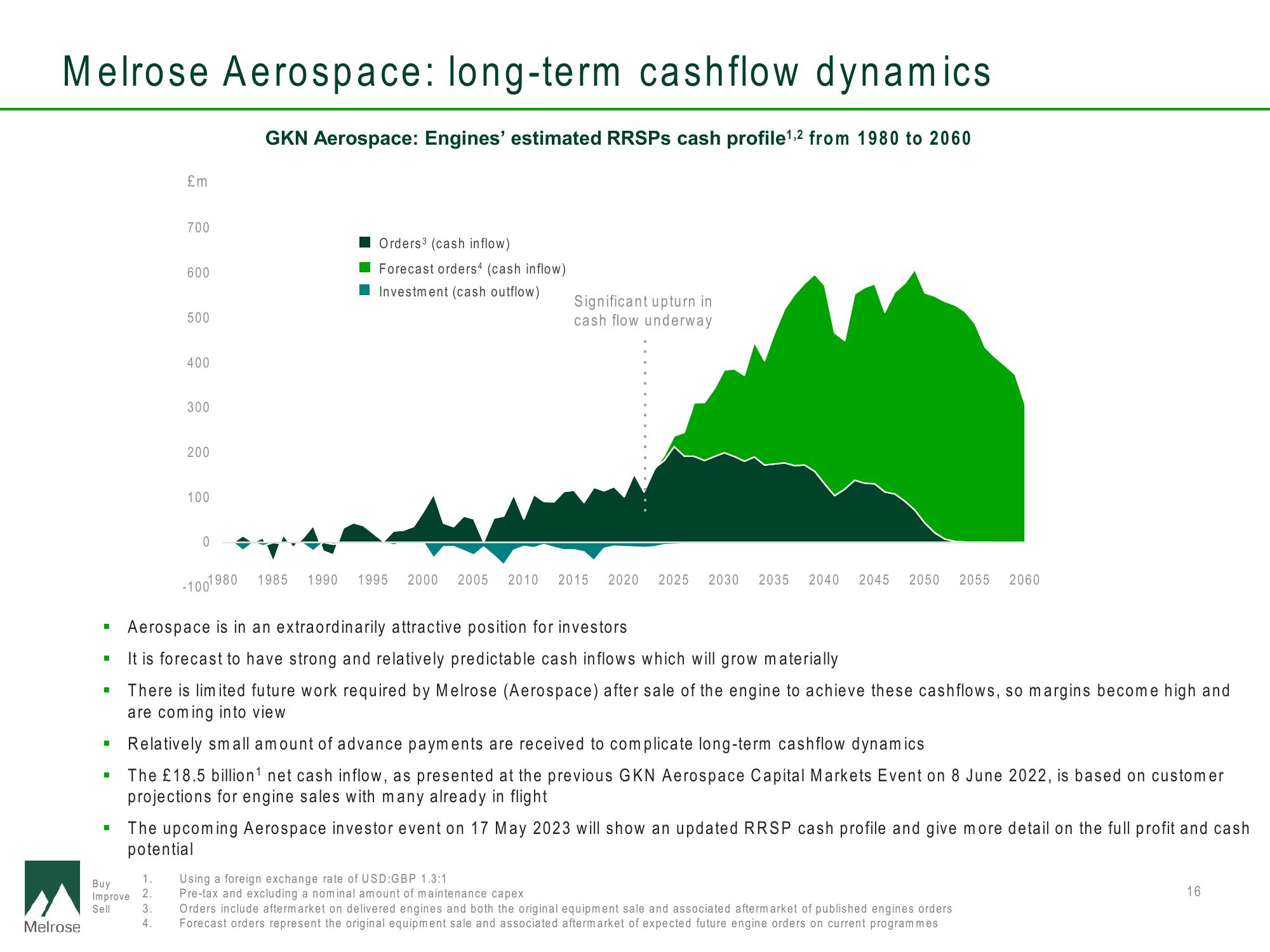

GKN Aerospace: Engines' estimated RRSPS cash profile¹,2 from 1980 to 2060

Melrose

I

■

I

I

£m

Buy

Improve

Sell

700

1.

2.

600

3.

4.

500

400

300

200

100

0

-1001980

Orders 3 (cash inflow)

Forecast orders4 (cash inflow)

Investment (cash outflow)

Significant upturn in

cash flow underway

Aerospace is in an extraordinarily attractive position for investors

It is forecast to have strong and relatively predictable cash inflows which will grow materially

There is limited future work required by Melrose (Aerospace) after sale of the engine to achieve these cashflows, so margins become high and

are coming in to view

1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 2040

Relatively small amount of advance payments are received to complicate long-term cashflow dynamics

The £18.5 billion¹ net cash inflow, as presented at the previous GKN Aerospace Capital Markets Event on 8 June 2022, is based on customer

projections for engine sales with many already in flight

2045 2050 2055 2060

The upcoming Aerospace investor event on 17 May 2023 will show an updated RRSP cash profile and give more detail on the full profit and cash

potential

Using a foreign exchange rate of USD GBP 1.3:1

Pre-tax and excluding a nominal amount of maintenance capex

Orders include aftermarket on delivered engines and both the original equipment sale and associated aftermarket of published engines orders.

Forecast orders represent the original equipment sale and associated aftermarket of expected future engine orders on current programmes

16View entire presentation