Credit Suisse Investment Banking Pitch Book

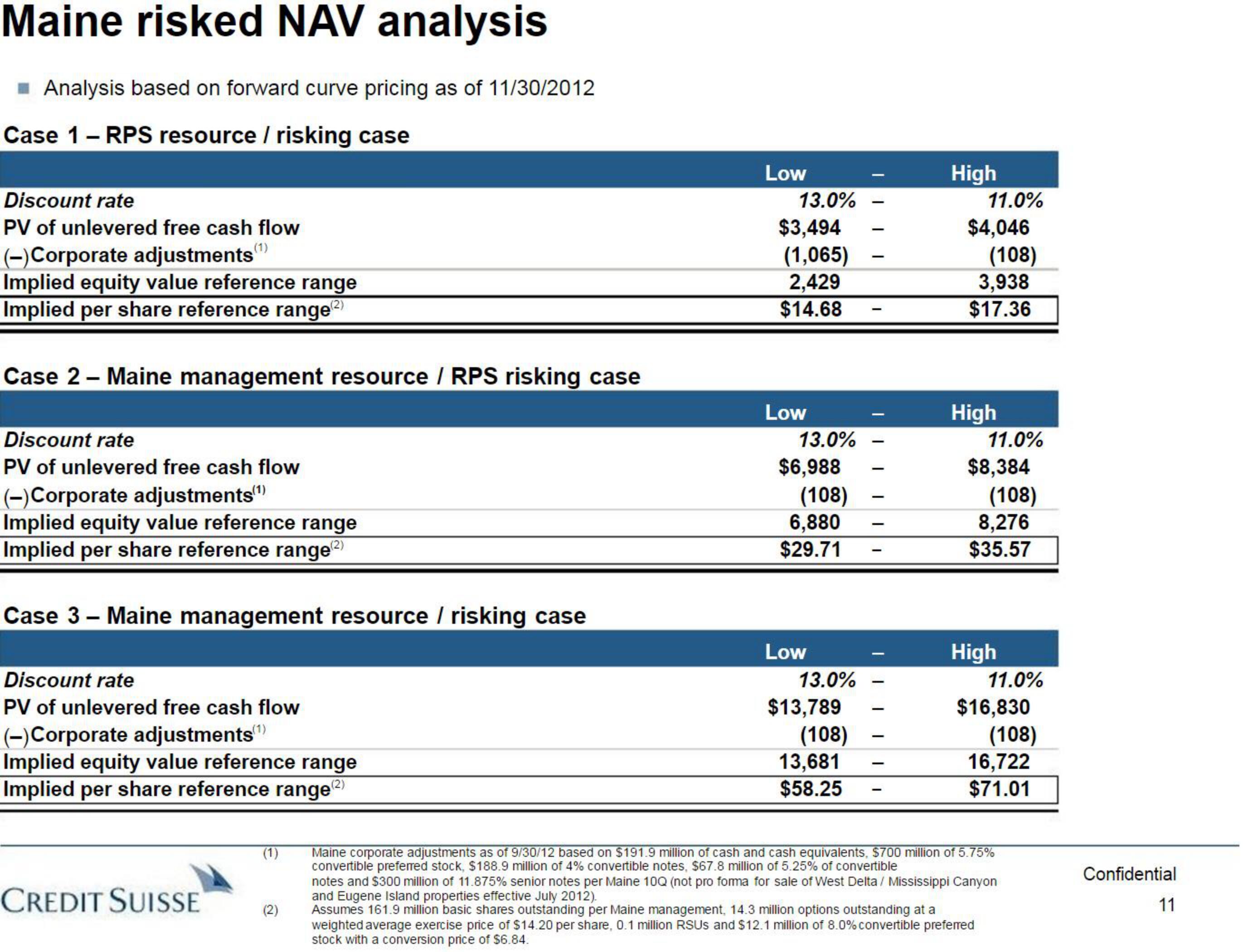

Maine risked NAV analysis

Analysis based on forward curve pricing as of 11/30/2012

Case 1 - RPS resource / risking case

Discount rate

PV of unlevered free cash flow

(-)Corporate adjustments (¹)

Implied equity value reference range

Implied per share reference range(2)

Case 2 - Maine management resource / RPS risking case

Discount rate

PV of unlevered free cash flow

(-)Corporate adjustments(¹)

Implied equity value reference range

Implied per share reference range(2)

Case 3 - Maine management resource / risking case

Discount rate

PV of unlevered free cash flow

(-)Corporate adjustments(¹)

Implied equity value reference range

Implied per share reference range(2)

CREDIT SUISSE

(1)

(2)

Low

13.0%

$3,494

(1,065)

2,429

$14.68

Low

13.0%

$6,988

(108)

6,880

$29.71

Low

13.0%

$13,789

(108)

13,681

$58.25

-

-

-

-

-

-

-

-

High

11.0%

$4,046

(108)

3,938

$17.36

High

11.0%

$8,384

(108)

8,276

$35.57

High

11.0%

$16,830

(108)

16,722

$71.01

Maine corporate adjustments as of 9/30/12 based on $191.9 million of cash and cash equivalents, $700 million of 5.75%

convertible preferred stock, $188.9 million of 4% convertible notes, $67.8 million of 5.25% of convertible

notes and $300 million of 11.875% senior notes per Maine 10Q (not pro forma for sale of West Delta / Mississippi Canyon

and Eugene Island properties effective July 2012).

Assumes 161.9 million basic shares outstanding per Maine management, 14.3 million options outstanding at a

weighted average exercise price of $14.20 per share, 0.1 million RSUS and $12.1 million of 8.0% convertible preferred

stock with a conversion price of $6.84.

Confidential

11View entire presentation