Netstreit Investor Presentation Deck

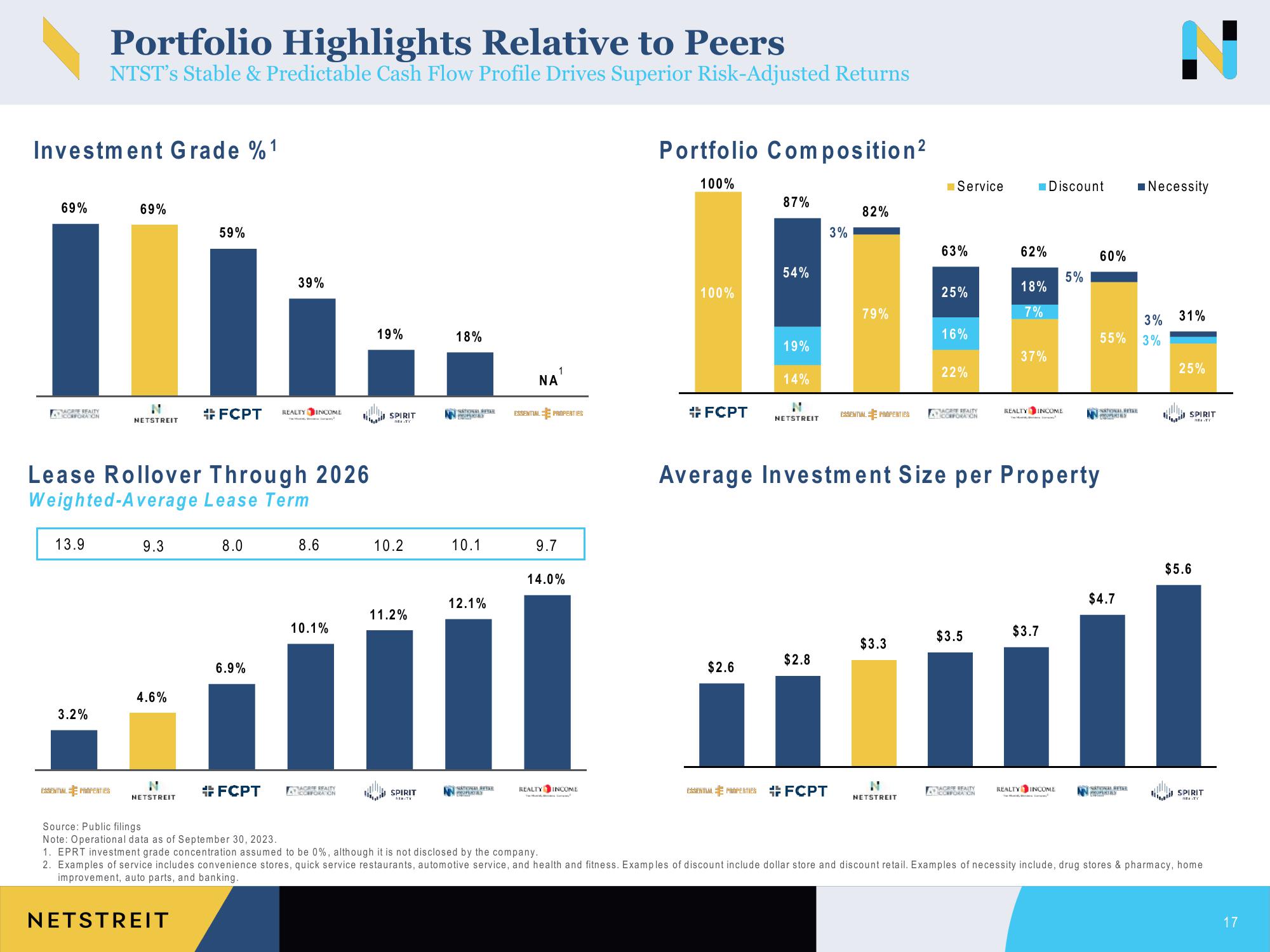

Investment Grade %¹ 1

69%

SAGRIE REALTY

•CCEFORA ON

Portfolio Highlights Relative to Peers

NTST's Stable & Predictable Cash Flow Profile Drives Superior Risk-Adjusted Returns

11

13.9

3.2%

69%

ESSENTIAL PROPERTIES

N

NETSTREIT

Lease Rollover Through 2026

Weighted-Average Lease Term

9.3

4.6%

59%

N

NETSTREIT

#FCPT

8.0

6.9%

39%

#FCPT

REALTY INCOME

8.6

10.1%

ROTAGREE REALTY

ASTICCEFORA ON

19%

SPIRIT

10.2

11.2%

SPIRIT

SERITY

18%

10.1

NATIONAL RETAR ESSENTIAL PROPERTIES

PROPEIES

12.1%

ΝΑ

NATIONAL RETAR

PROPERTIES

1

9.7

14.0%

REALTY INCOME

Portfolio Composition²

100%

100%

#FCPT

87%

$2.6

54%

19%

14%

NETSTREIT

$2.8

3%

ESSENTIAL MIMPERTIES #FCPT

82%

79%

ESSENTIAL PROPERTIES

$3.3

Service

N

NETSTREIT

63%

25%

16%

22%

AGREE REALITY

CORPORA ON

$3.5

62%

AGREE REALTY

CORPORATION

18%

7%

37%

Average Investment Size per Property

Discount ■Necessity

REALTY INCOME

$3.7

5%

REALTY INCOME

60%

55% 3%

NATIONAL RETAR

PROPERSEY

$4.7

3% 31%

NATIONAL RETAR

PROPRIAS

25%

SPIRIT

MEATY

$5.6

SPIRIT

Source: Public filings

Note: Operational data as of September 30, 2023.

1. EPRT investment grade concentration assumed to be 0%, although it is not disclosed by the company.

2. Examples of service includes convenience stores, quick service restaurants, automotive service, and health and fitness. Examples of discount include dollar store and discount retail. Examples of necessity include, drug stores & pharmacy, home.

improvement, auto parts, and banking.

NETSTREIT

17View entire presentation