UBS Results Presentation Deck

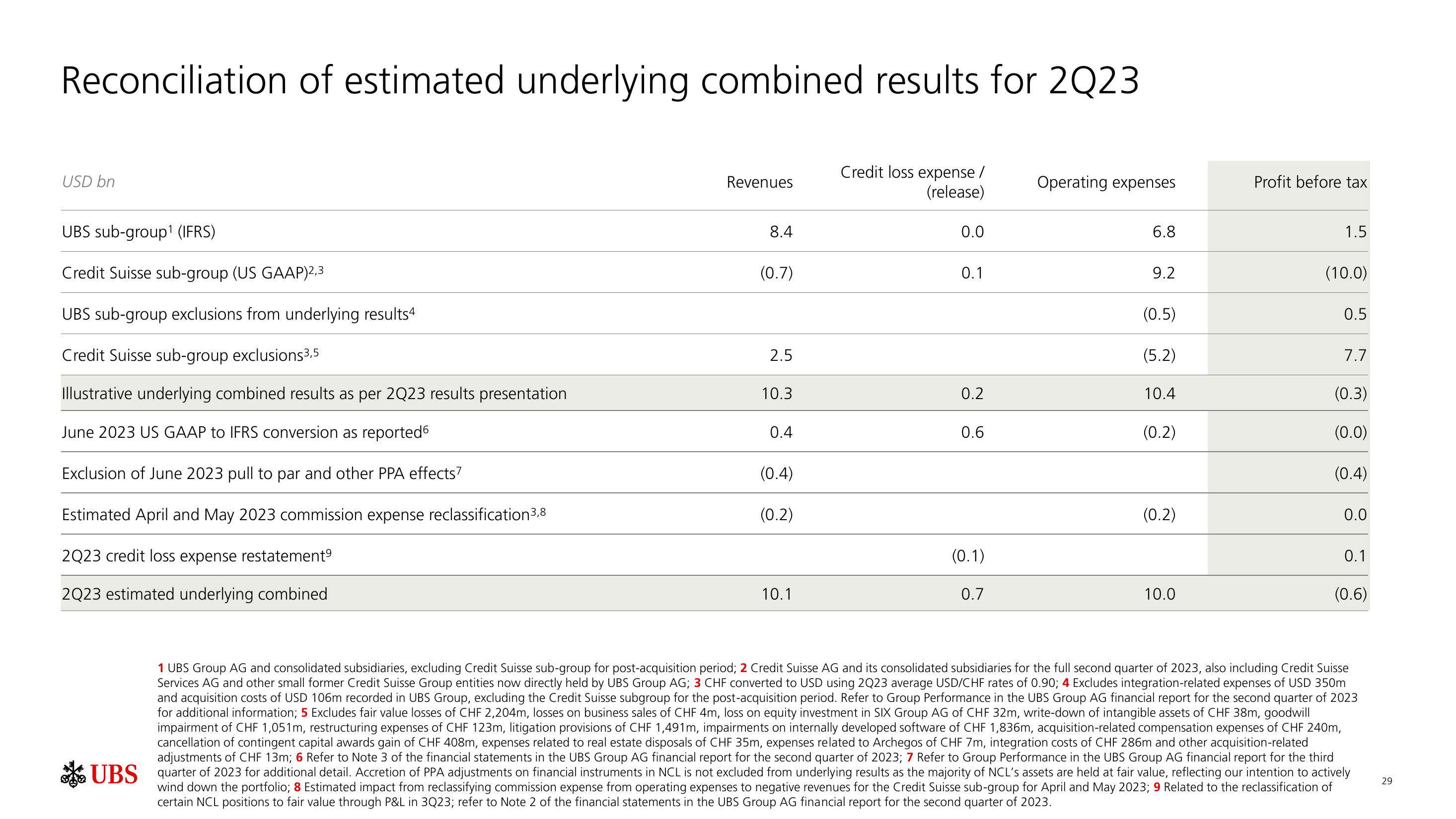

Reconciliation of estimated underlying combined results for 2Q23

Credit loss expense /

(release)

USD bn

UBS sub-group¹ (IFRS)

Credit Suisse sub-group (US GAAP)2,3

UBS sub-group exclusions from underlying results4

Credit Suisse sub-group exclusions3,5

Illustrative underlying combined results as per 2Q23 results presentation

June 2023 US GAAP to IFRS conversion as reported

Exclusion of June 2023 pull to par and other PPA effects7

Estimated April and May 2023 commission expense reclassification ³,8

2Q23 credit loss expense restatement⁹

2Q23 estimated underlying combined

Revenues

8.4

(0.7)

2.5

10.3

0.4

(0.4)

(0.2)

10.1

0.0

0.1

0.2

0.6

(0.1)

0.7

Operating expenses

6.8

9.2

(0.5)

(5.2)

10.4

(0.2)

(0.2)

10.0

Profit before tax

1.5

(10.0)

0.5

7.7

(0.3)

(0.0)

(0.4)

0.0

0.1

(0.6)

1 UBS Group AG and consolidated subsidiaries, excluding Credit Suisse sub-group for post-acquisition period; 2 Credit Suisse AG and its consolidated subsidiaries for the full second quarter of 2023, also including Credit Suisse

Services AG and other small former Credit Suisse Group entities now directly held by UBS Group AG; 3 CHF converted to USD using 2Q23 average USD/CHF rates of 0.90; 4 Excludes integration-related expenses of USD 350m

and acquisition costs of USD 106m recorded in UBS Group, excluding the Credit Suisse subgroup for the post-acquisition period. Refer to Group Performance in the UBS Group AG financial report for the second quarter of 2023

for additional information; 5 Excludes fair value losses of CHF 2,204m, losses on business sales of CHF 4m, loss on equity investment in SIX Group AG of CHF 32m, write-down of intangible assets of CHF 38m, goodwill

impairment of CHF 1,051m, restructuring expenses of CHF 123m, litigation provisions of CHF 1,491m, impairments on internally developed software of CHF 1,836m, acquisition-related compensation expenses of CHF 240m,

cancellation of contingent capital awards gain of CHF 408m, expenses related to real estate disposals of CHF 35m, expenses related to Archegos of CHF 7m, integration costs of CHF 286m and other acquisition-related

adjustments of CHF 13m; 6 Refer to Note 3 of the financial statements in the UBS Group AG financial report for the second quarter of 2023; 7 Refer to Group Performance in the UBS Group AG financial report for the third

UBS quarter of 2023 for additional detail. Accretion of PPA adjustments on financial instruments in NCL is not excluded from underlying results as the majority of NCL's assets are held at fair value, reflecting our intention to actively

wind down the portfolio; 8 Estimated impact from reclassifying commission expense from operating expenses to negative revenues for the Credit Suisse sub-group for April and May 2023; 9 Related to the reclassification of

certain NCL positions to fair value through P&L in 3Q23; refer to Note 2 of the financial statements in the UBS Group AG financial report for the second quarter of 2023.

29View entire presentation