Science 37 SPAC

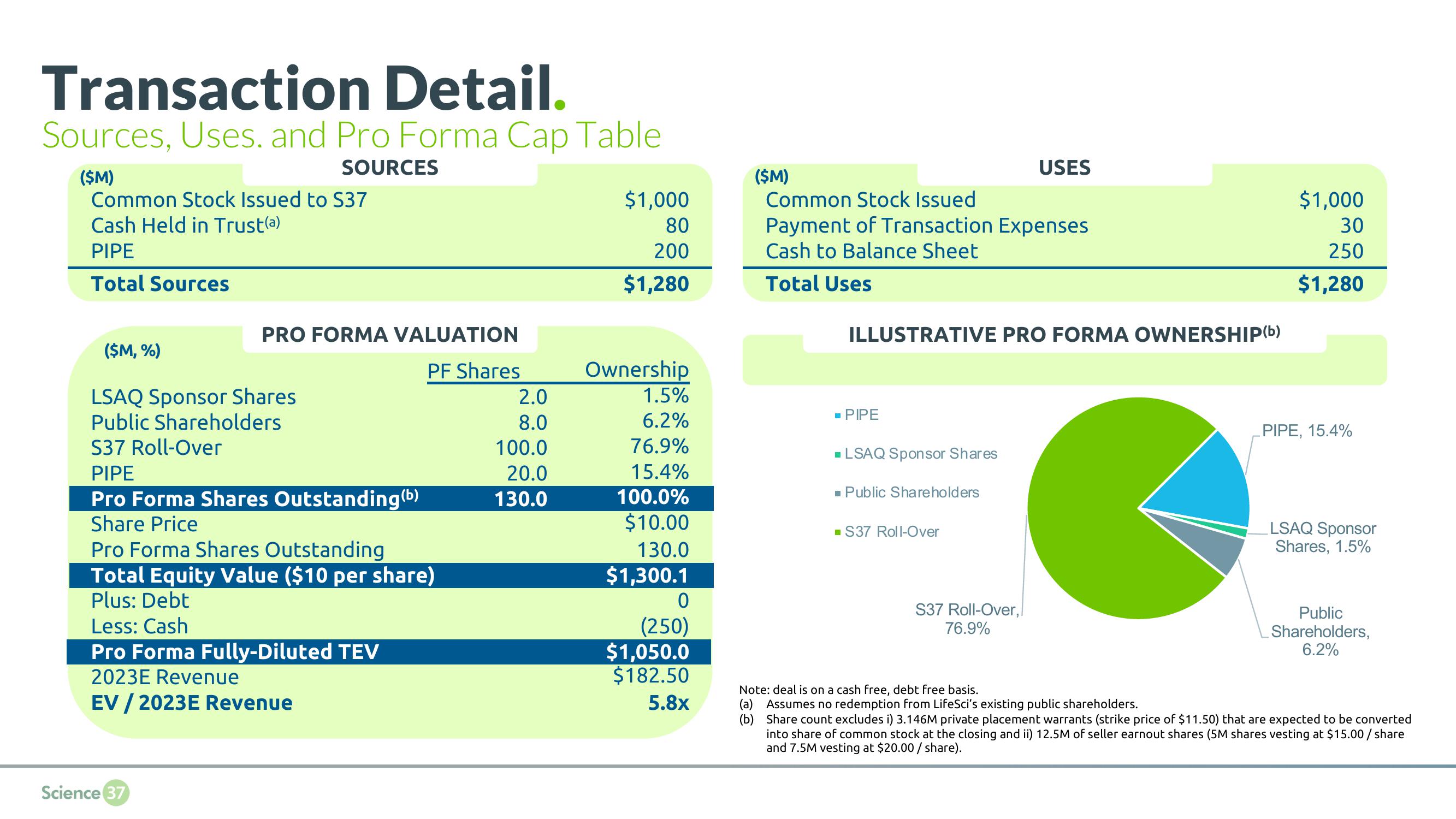

Transaction Detail.

Sources, Uses. and Pro Forma Cap Table

SOURCES

($M)

Common Stock Issued to S37

Cash Held in Trust(a)

PIPE

Total Sources

($M, %)

PRO FORMA VALUATION

PF Shares

LSAQ Sponsor Shares

Public Shareholders

S37 Roll-Over

PIPE

Pro Forma Shares Outstanding (b)

Share Price

Pro Forma Shares Outstanding

Total Equity Value ($10 per share)

Plus: Debt

Less: Cash

Pro Forma Fully-Diluted TEV

2023E Revenue

EV / 2023E Revenue

Science 37

2.0

8.0

100.0

20.0

130.0

$1,000

80

200

$1,280

Ownership

1.5%

6.2%

76.9%

15.4%

100.0%

$10.00

130.0

$1,300.1

0

(250)

$1,050.0

$182.50

5.8x

($M)

Common Stock Issued

Payment of Transaction Expenses

Cash to Balance Sheet

Total Uses

ILLUSTRATIVE PRO FORMA OWNERSHIP(b)

■ PIPE

■LSAQ Sponsor Shares

■ Public Shareholders

USES

■ S37 Roll-Over

S37 Roll-Over,

76.9%

$1,000

30

250

$1,280

PIPE, 15.4%

LSAQ Sponsor

Shares, 1.5%

Public

Shareholders,

6.2%

Note: deal is on a cash free, debt free basis.

(a) Assumes no redemption from LifeSci's existing public shareholders.

(b) Share count excludes i) 3.146M private placement warrants (strike price of $11.50) that are expected to be converted

into share of common stock at the closing and ii) 12.5M of seller earnout shares (5M shares vesting at $15.00/share

and 7.5M vesting at $20.00/share).View entire presentation