Better SPAC Presentation Deck

Building the leading integrated

homeownership platform

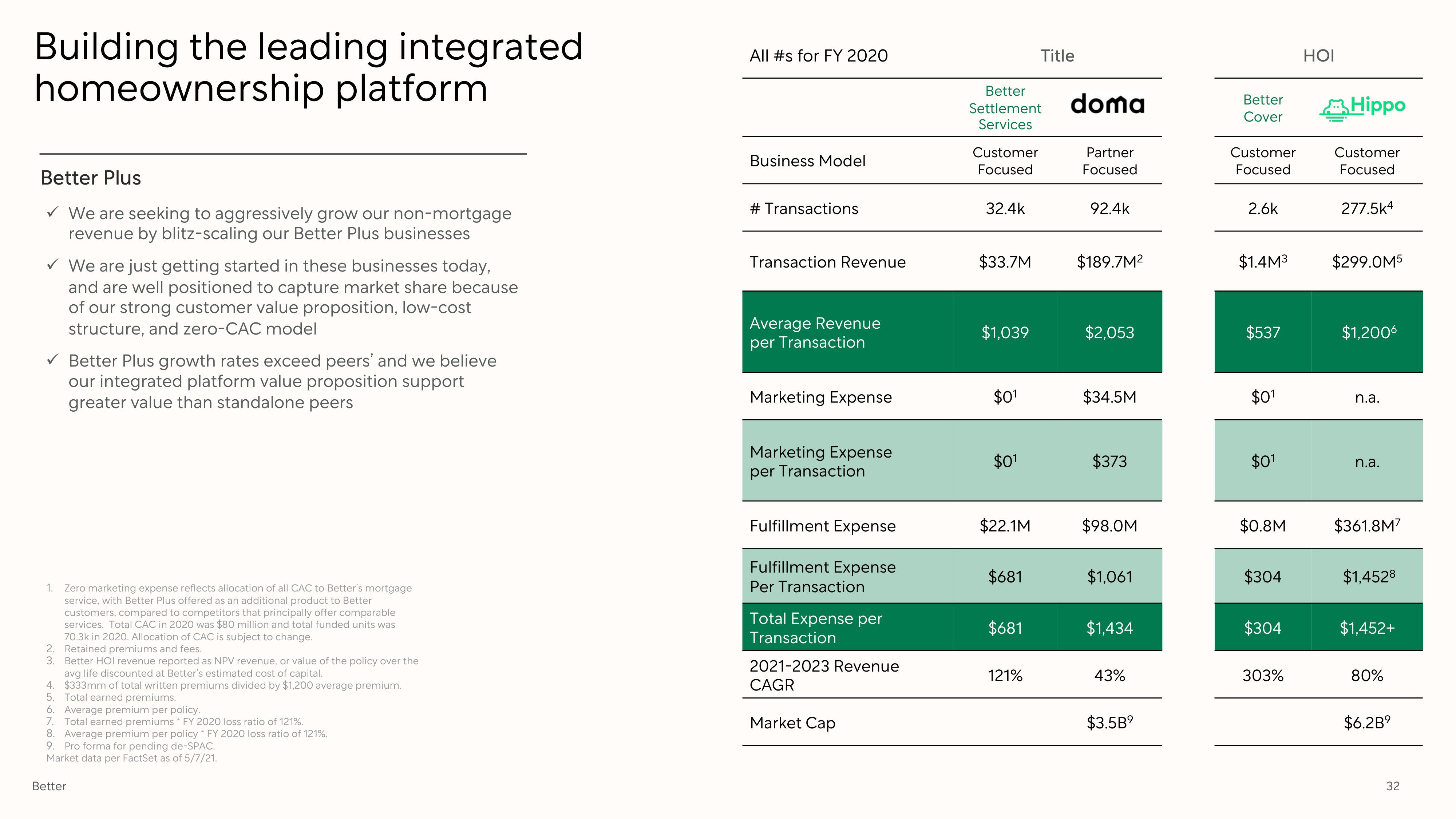

Better Plus

✓ We are seeking to aggressively grow our non-mortgage

revenue by blitz-scaling our Better Plus businesses

✓ We are just getting started in these businesses today,

and are well positioned to capture market share because

of our strong customer value proposition, low-cost

structure, and zero-CAC model

Better Plus growth rates exceed peers' and we believe

our integrated platform value proposition support

greater value than standalone peers

1. Zero marketing expense reflects allocation of all CAC to Better's mortgage

service, with Better Plus offered as an additional product to Better

customers, compared to competitors that principally offer comparable

services. Total CAC in 2020 was $80 million and total funded units was

70.3k in 2020. Allocation of CAC is subject to change.

2. Retained premiums and fees.

3. Better HOI revenue reported as NPV revenue, or value of the policy over the

avg life discounted at Better's estimated cost of capital.

4. $333mm of total written premiums divided by $1,200 average premium.

5. Total earned premiums.

6. Average premium per policy.

7. Total earned premiums * FY 2020 loss ratio of 121%.

8. Average premium per policy * FY 2020 loss ratio of 121%.

9. Pro forma for pending de-SPAC.

Market data per FactSet as of 5/7/21.

Better

All #s for FY 2020

Business Model

# Transactions

Transaction Revenue

Average Revenue

per Transaction

Marketing Expense

Marketing Expense

per Transaction

Fulfillment Expense

Fulfillment Expense

Per Transaction

Total Expense per

Transaction

2021-2023 Revenue

CAGR

Market Cap

Better

Settlement doma

Services

Customer

Focused

32.4k

$33.7M

$1,039

$01

$0¹

$22.1M

$681

$681

Title

121%

Partner

Focused

92.4k

$189.7M²

$2,053

$34.5M

$373

$98.0M

$1,061

$1,434

43%

$3.5B⁹

Better

Cover

Customer

Focused

2.6k

$1.4M³

$537

$01

$0¹

$0.8M

$304

$304

303%

HOI

Hippo

Customer

Focused

277.5k4

$299.0M5

$1,2006

n.a.

n.a.

$361.8M7

$1,4528

$1,452+

80%

$6.2B⁹

32View entire presentation