Hanmi Financial Results Presentation Deck

USKC (1) Loans & Deposits

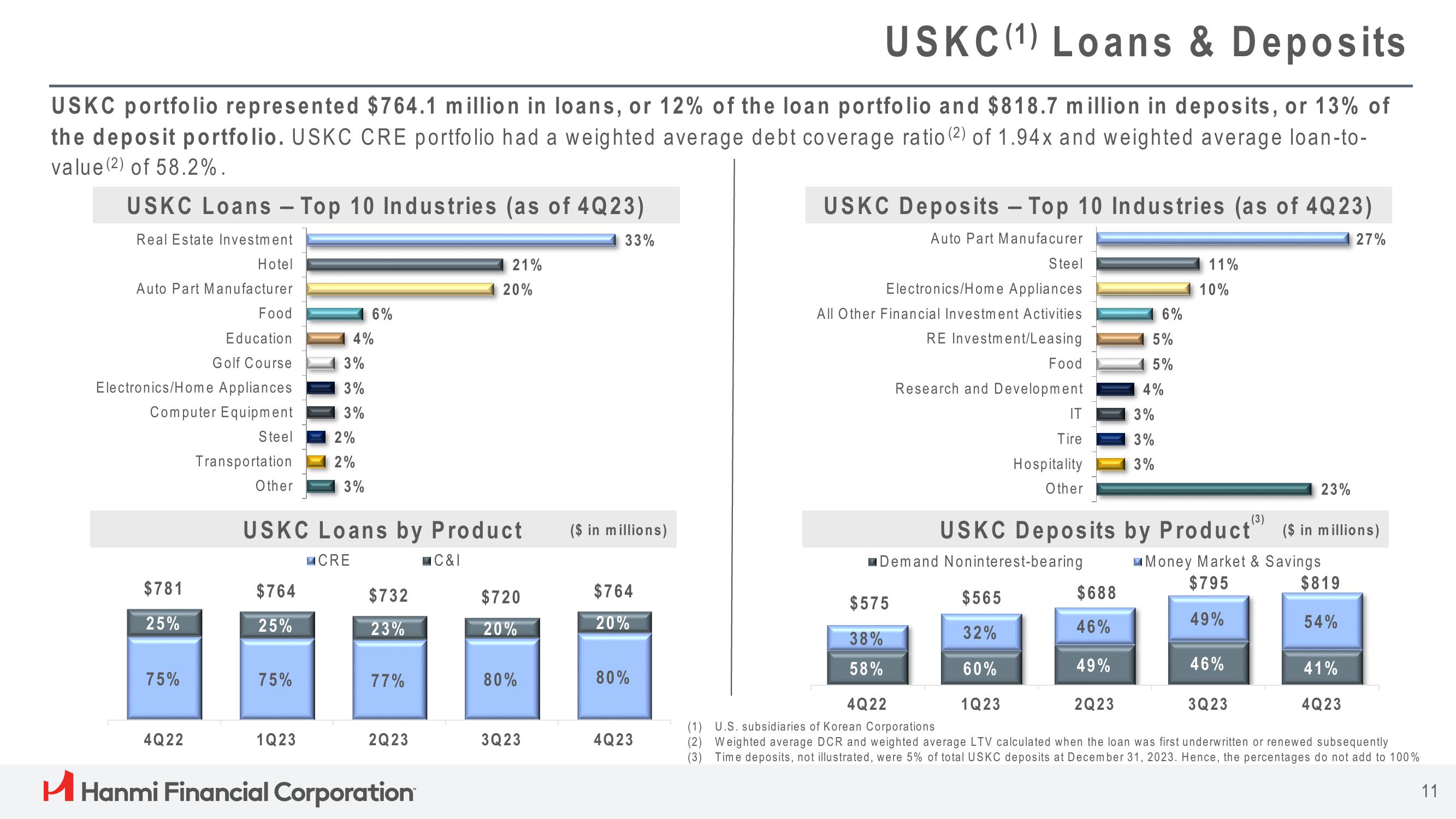

USKC portfolio represented $764.1 million in loans, or 12% of the loan portfolio and $818.7 million in deposits, or 13% of

the deposit portfolio. USKC CRE portfolio had a weighted average debt coverage ratio (2) of 1.94x and weighted average loan-to-

value (2) of 58.2%.

USKC Loans - Top 10 Industries (as of 4Q23)

Real Estate Investment

Hotel

Auto Part Manufacturer

Electronics/Home Appliances

Computer Equipment

Steel

$781

25%

75%

Food

Education

Golf Course

4Q22

Transportation

Other

$764

25%

75%

1Q23

4%

3%

3%

3%

2%

2%

6%

3%

USKC Loans by Product

CRE

$732

23%

77%

2Q23

H Hanmi Financial Corporation

21%

C&I

20%

$720

20%

80%

3Q23

33%

($ in millions)

$764

20%

80%

4Q23

USKC Deposits - Top 10 Industries (as of 4Q23)

Auto Part Manufacurer

Steel

Electronics/Home Appliances

All Other Financial Investment Activities

RE Investment/Leasing

Food

Research and Development

IT

Tire

Hospitality

Other

$565

32%

60%

1Q23

Demand Noninterest-bearing

$688

46%

49%

6%

5%

5%

2Q23

4%

3%

3%

3%

USKC Deposits by Product

11%

10%

(3)

46%

23%

Money Market & Savings

$795

49%

3Q23

($ in millions)

$575

38%

58%

4Q22

(1) U.S. subsidiaries of Korean Corporations

(2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently

(3) Time deposits, not illustrated, were 5% of total USKC deposits at December 31, 2023. Hence, the percentages do not add to 100%

$819

54%

27%

41%

4Q23

11View entire presentation