Bed Bath & Beyond Results Presentation Deck

APPENDIX

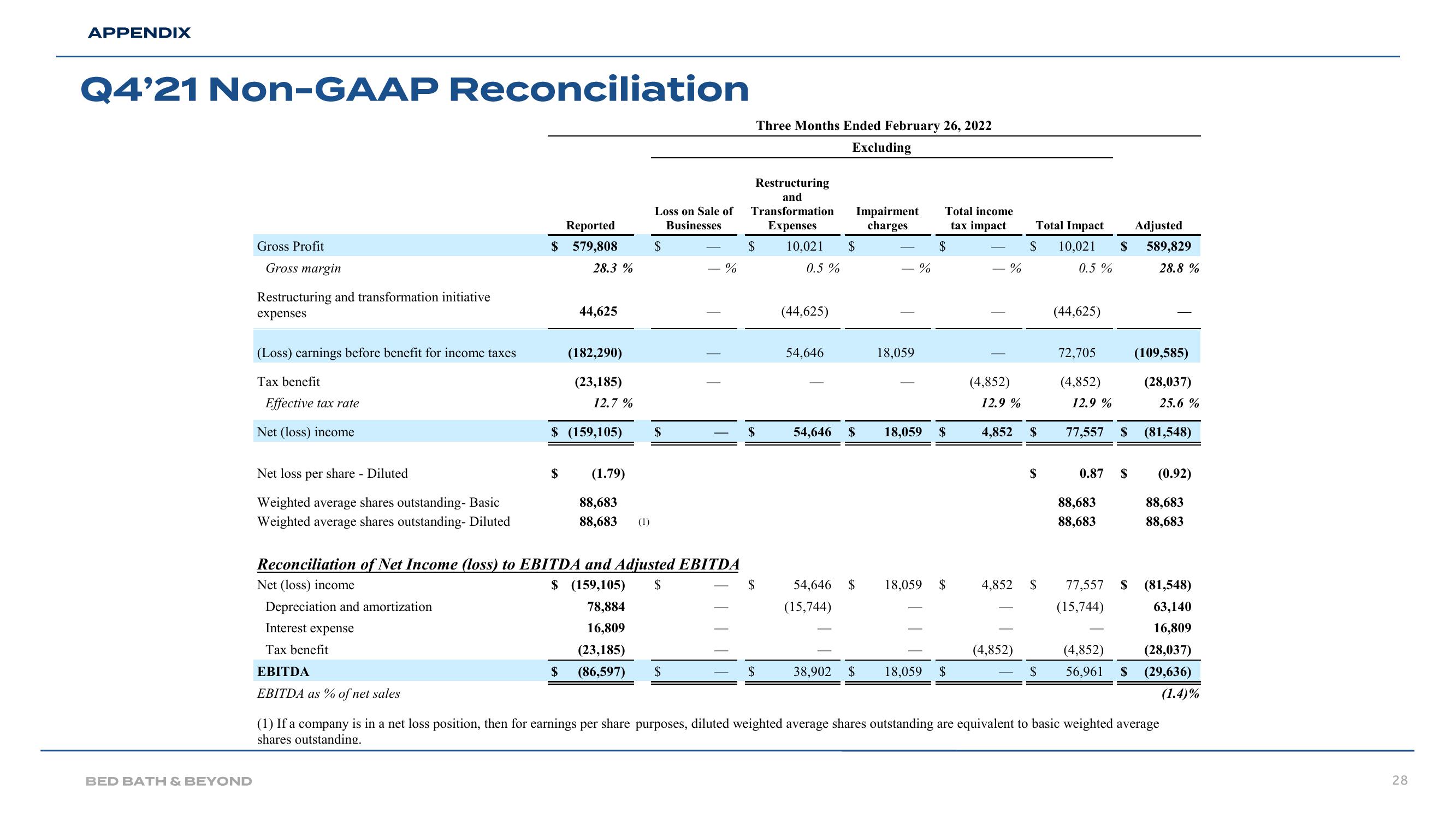

Q4'21 Non-GAAP Reconciliation

BED BATH & BEYOND

Gross Profit

Gross margin

Restructuring and transformation initiative

expenses

(Loss) earnings before benefit for income taxes

Tax benefit

Effective tax rate

Net (loss) income

Net loss per share - Diluted

Weighted average shares outstanding- Basic

Weighted average shares outstanding- Diluted

Reported

$ 579,808

EBITDA

EBITDA as % of net sales

$

28.3 %

44,625

$

(182,290)

(23,185)

$ (159,105)

12.7 %

(1.79)

88,683

88,683 (1)

Loss on Sale of

Businesses

$

$

Reconciliation of Net Income (loss) to EBITDA and Adjusted EBITDA

Net (loss) income

$ (159,105) $

Depreciation and amortization

78,884

Interest expense

16,809

Tax benefit

(23,185)

(86,597)

%

$

Restructuring

and

Transformation

Expenses

10,021 $

0.5%

$

Three Months Ended February 26, 2022

Excluding

$

$

$

(44,625)

54,646

Impairment

charges

54,646 $

54,646 $

(15,744)

- %

18,059

Total income

tax impact

$

18,059 $

18,059 $

38,902 $ 18,059 $

%

(4,852)

12.9%

Total Impact

$

4,852 $

(4,852)

$

4,852 $

Adjusted

10,021 $ 589,829

0.5%

28.8%

(44,625)

72,705

(4,852)

12.9 %

77,557 $

0.87 $

88,683

88,683

(109,585)

(28,037)

(4,852)

$ 56,961 $

25.6%

(81,548)

(0.92)

88,683

88,683

77,557 $ (81,548)

(15,744)

63,140

16,809

(28,037)

(29,636)

(1) If a company is in a net loss position, then for earnings per share purposes, diluted weighted average shares outstanding are equivalent to basic weighted average

shares outstanding.

(1.4)%

28View entire presentation