Invest in The Experience

VICI'S EVOLUTION SINCE FORMATION

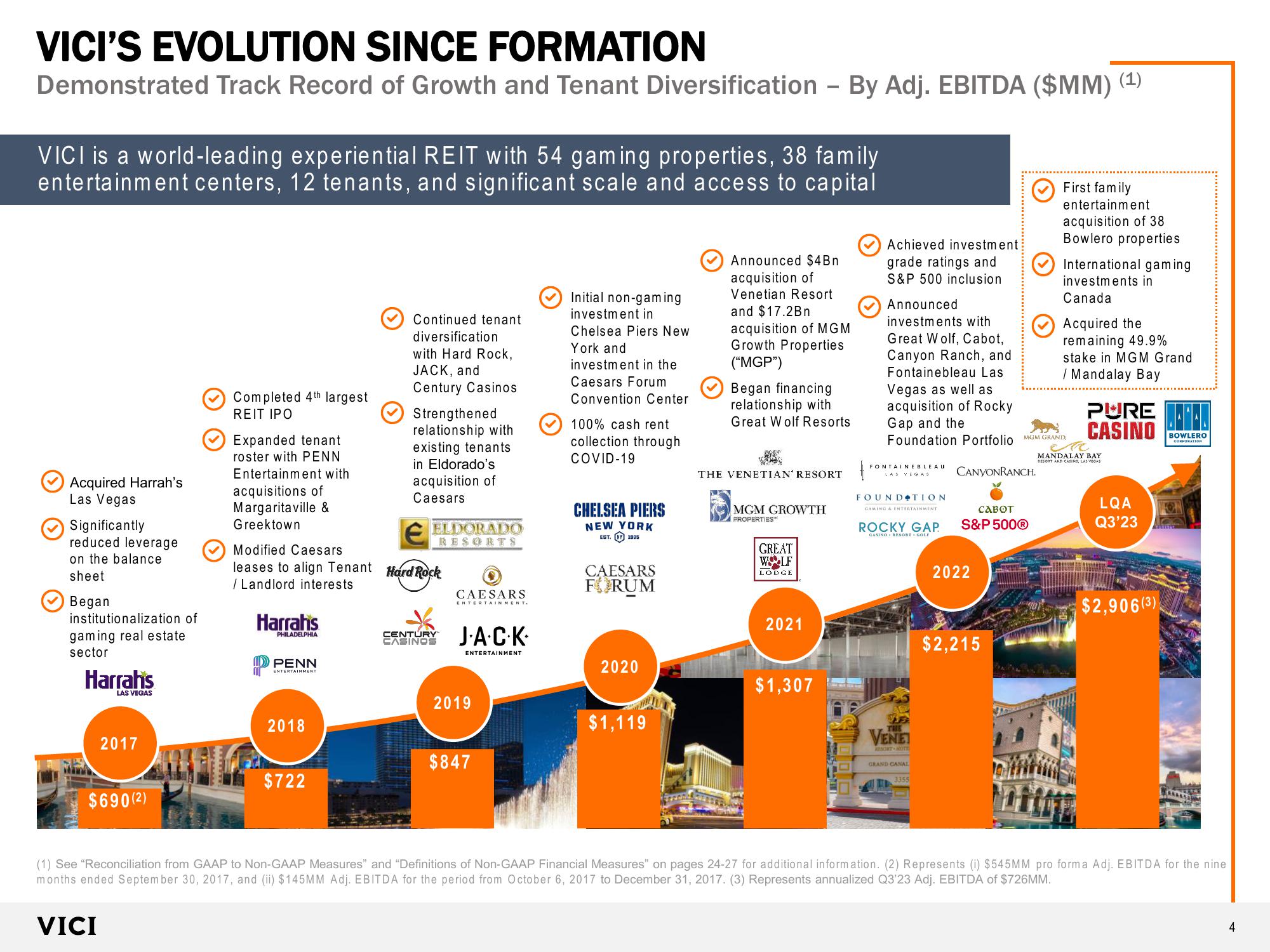

Demonstrated Track Record of Growth and Tenant Diversification - By Adj. EBITDA ($MM) (1)

VICI is a world-leading experiential REIT with 54 gaming properties, 38 family

entertainment centers, 12 tenants, and significant scale and access to capital

Acquired Harrah's

Las Vegas

Significantly

reduced leverage

on the balance

sheet

Began

institutionalization of

gaming real estate

sector

Harrahs

LAS VEGAS

2017

$690(2)

Completed 4th largest

REIT IPO

Expanded tenant

roster with PENN

Entertainment with

acquisitions of

Margaritaville &

Greektown

Modified Caesars

leases to align Tenant

/ Landlord interests.

Harrahs

PHILADELPHIA

PENN

ENTERTAINMENT

2018

$722

Continued tenant

diversification

with Hard Rock,

JACK, and

Century Casinos

Strengthened

relationship with

existing tenants

in Eldorado's

acquisition of

Caesars

EELDORADO

Hard Rock

CAESARS

ENTERTAINMENT.

CASINOS

CENTURY J.A.C.K.

ENTERTAINMENT

2019

$847

Initial non-gaming

investment in

Chelsea Piers New

York and

investment in the

Caesars Forum

Convention Center

100% cash rent

collection through

COVID-19

CHELSEA PIERS

NEW YORK

EST. NY 1905

CAESARS

FORUM

2020

$1,119

Announced $4Bn

acquisition of

Venetian Resort

and $17.2Bn

acquisition of MGM

Growth Properties

("MGP")

Began financing

relationship with

Great Wolf Resorts

A

THE VENETIAN RESORT

MGM GROWTH

PROPERTIES™

GREAT

WOLF

LODGE

2021

$1,307

Achieved investment

grade ratings and

S&P 500 inclusion

Announced

investments with

Great Wolf, Cabot,

Canyon Ranch, and

Fontainebleau Las

Vegas as well as

acquisition of Rocky

Gap and the

Foundation Portfolio MGM GRANDE

FONTAINEBLEAU

LAS VEGAS

FOUNDATION

GAMING & ENTERTAINMENT

ROCKY GAP.

CASINO RESORT - GOLF

THE

VENET

RESORT HOTE

GRAND CANAL

3355

CANYONRANCH.

D

CABOT

S&P 500®

2022

First family

entertainment

acquisition of 38

Bowlero properties

International gaming

investments in

Canada

$2,215

Acquired the

remaining 49.9%

stake in MGM Grand

/ Mandalay Bay

PURE

CASINO

MANDALAY BAY

RESORT AND CASINO, LAS VEGAS

LQA

Q3'23

$2,906 (3)

BOWLERO

CORPORATION

ARRASAM

(1) See "Reconciliation from GAAP to Non-GAAP Measures" and "Definitions of Non-GAAP Financial Measures" on pages 24-27 for additional information. (2) Represents (i) $545MM pro forma Adj. EBITDA for the nine

months ended September 30, 2017, and (ii) $145MM Adj. EBITDA for the period from October 6, 2017 to December 31, 2017. (3) Represents annualized Q3'23 Adj. EBITDA of $726MM.

VICI

4View entire presentation