SoftBank Results Presentation Deck

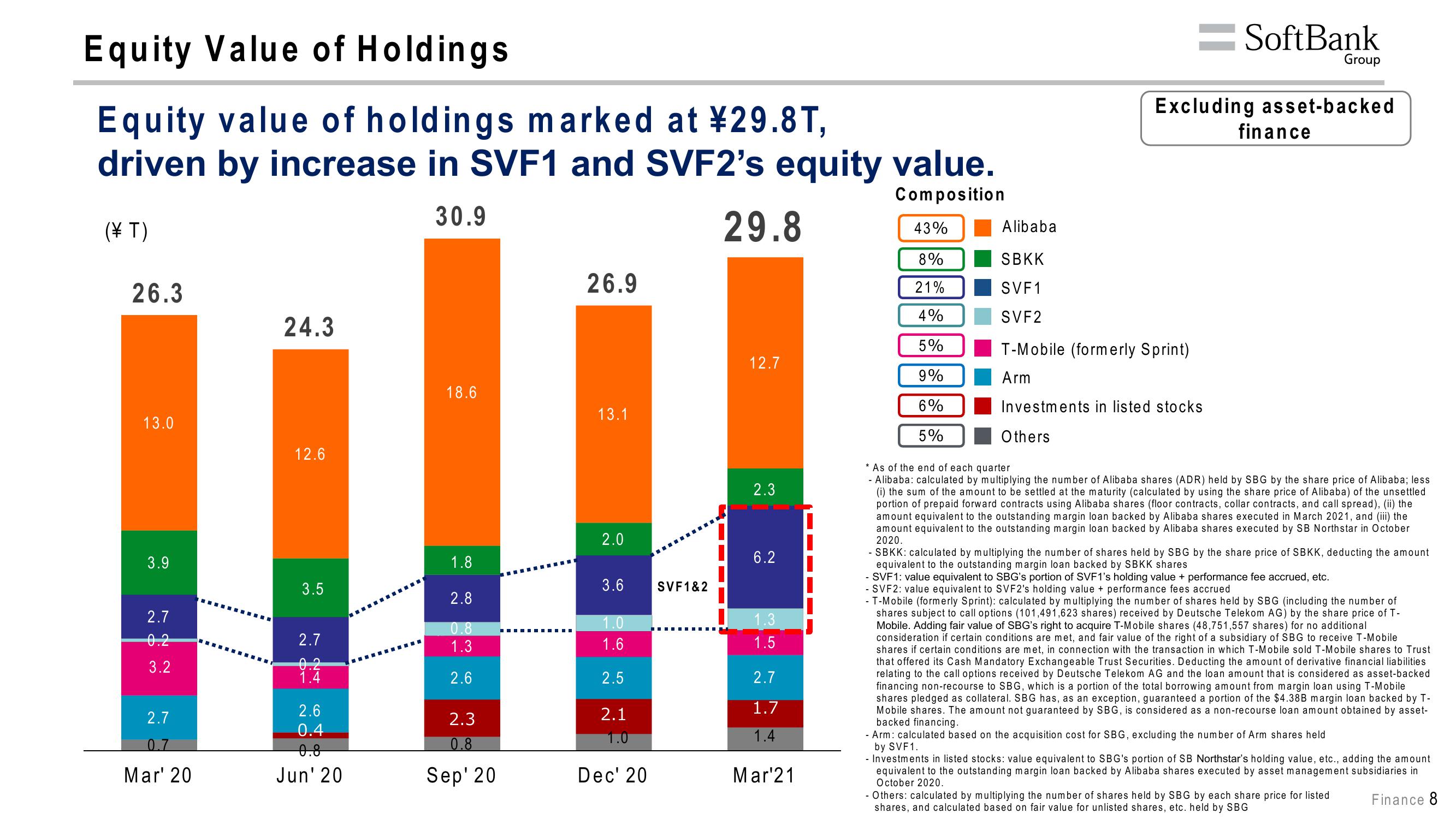

Equity Value of Holdings

Equity value of holdings marked at ¥29.8T,

driven by increase in SVF1 and SVF2's equity value.

Composition

30.9

29.8

(T)

26.3

13.0

3.9

2.7

0.2

3.2

2.7

0.7

Mar' 20

24.3

12.6

3.5

2.7

9.2

2.6

0.4

Jun' 20

18.6

1.8

2.8

0.8

1.3

2.6

2.3

0.8

Sep' 20

‒‒‒‒‒‒‒‒‒‒‒

26.9

13.1

2.0

3.6

1.0

1.6

2.5

2.1

1.0

Dec' 20

SVF1&2

12.7

2.3

6.2

1.3

1.5

2.7

1.7

1.4

Mar'21

43%

8%

21%

4%

5%

9%

6%

5%

Alibaba

SBKK

SVF1

SVF2

T-Mobile (formerly Sprint)

Arm

SoftBank

Excluding asset-backed

Investments in listed stocks

Others

finance

Group

*As of the end of each quarter

- Alibaba: calculated by multiplying the number of Alibaba shares (ADR) held by SBG by the share price of Alibaba; less

(i) the sum of the amount to be settled at the maturity (calculated by using the share price of Alibaba) of the unsettled

portion of prepaid forward contracts using Alibaba shares (floor contracts, collar contracts, and call spread), (ii) the

amount equivalent to the outstanding margin loan backed by Alibaba shares executed in March 2021, and (iii) the

amount equivalent to the outstanding margin loan backed by Alibaba shares executed by SB Northstar in October

2020.

SBKK: calculated by multiplying the number of shares held by SBG by the share price of SBKK, deducting the amount

equivalent to the outstanding margin loan backed by SBKK shares

- SVF1: value equivalent to SBG's portion of SVF1's holding value + performance fee accrued, etc.

SVF2: value equivalent to SVF2's holding value + performance fees accrued

- T-Mobile (formerly Sprint): calculated by multiplying the number of shares held by SBG (including the number of

shares subject to call options (101,491,623 shares) received by Deutsche Telekom AG) by the share price of T-

Mobile. Adding fair value of SBG's right to acquire T-Mobile shares (48,751,557 shares) for no additional

consideration if certain conditions are met, and fair value of the right of a subsidiary of SBG to receive T-Mobile

shares if certain conditions are met, in connection with the transaction in which T-Mobile sold T-Mobile shares to Trust

that offered its Cash Mandatory Exchangeable Trust Securities. Deducting the amount of derivative financial liabilities

relating to the call options received by Deutsche Telekom AG and the loan amount that is considered as asset-backed

financing non-recourse to SBG, which is a portion of the total borrowing amount from margin loan using T-Mobile

shares pledged as collateral. SBG has, as an exception, guaranteed a portion of the $4.38B margin loan backed by T-

Mobile shares. The amount not guaranteed by SBG, is considered as a non-recourse loan amount obtained by asset-

backed financing.

- Arm: calculated based on the acquisition cost for SBG, excluding the number of Arm shares held

by SVF1.

- Investments in listed stocks: value equivalent to SBG's portion of SB Northstar's holding value, etc., adding the amount

equivalent to the outstanding margin loan backed by Alibaba shares executed by asset management subsidiaries in

October 2020.

Finance 8

- Others: calculated by multiplying the number of shares held by SBG by each share price for listed

shares, and calculated based on fair value for unlisted shares, etc. held by SBGView entire presentation