J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

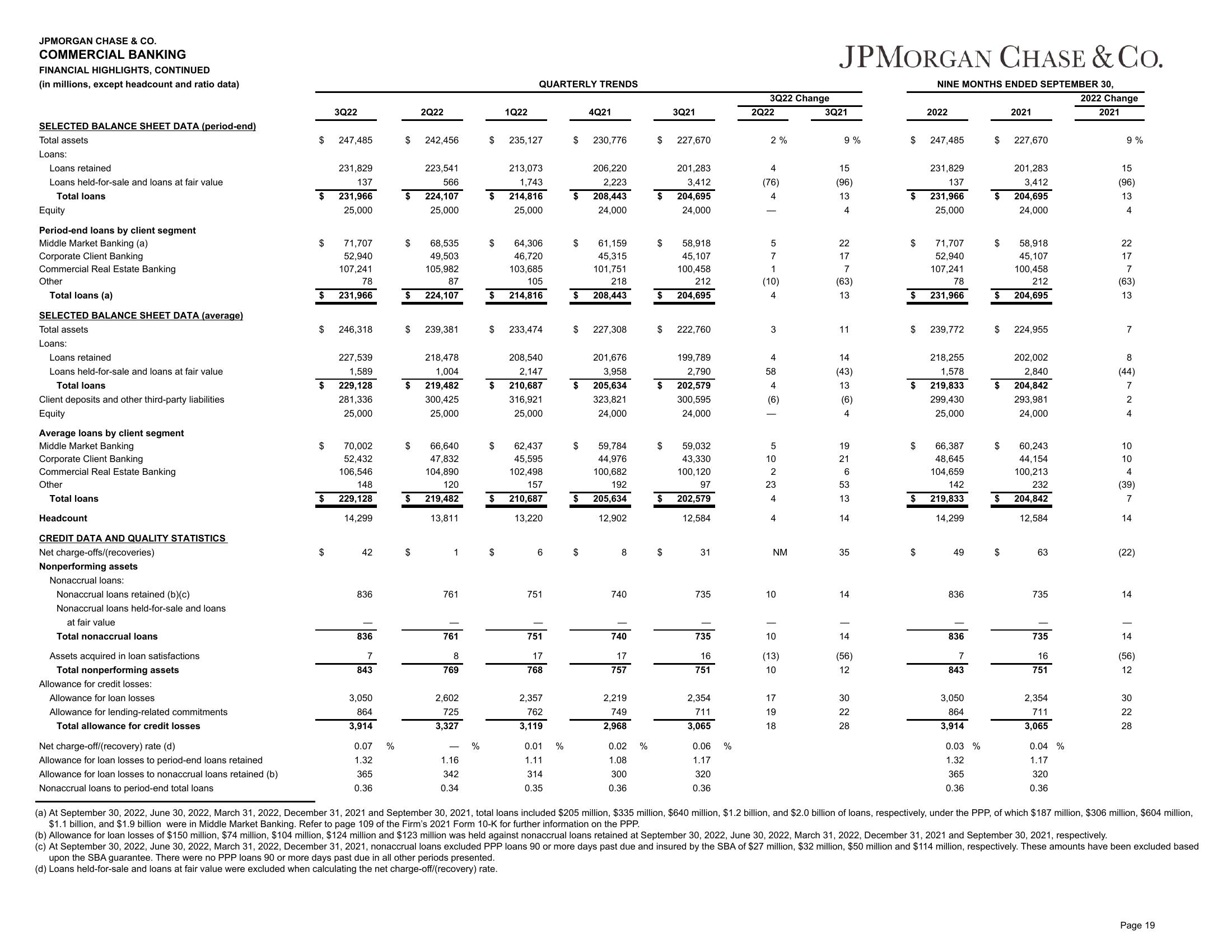

COMMERCIAL BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except headcount and ratio data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Loans retained

Loans held-for-sale and loans at fair value

Total loans

Equity

Period-end loans by client segment

Middle Market Banking (a)

Corporate Client Banking

Commercial Real Estate Banking

Other

Total loans (a)

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans:

Loans retained

Loans held-for-sale and loans at fair value

Total loans

Client deposits and other third-party liabilities

Equity

Average loans by client segment

Middle Market Banking

Corporate Client Banking

Commercial Real Estate Banking

Other

Total loans

Headcount

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonperforming assets

Nonaccrual loans:

Nonaccrual loans retained (b)(c)

Nonaccrual loans held-for-sale and loans

at fair value

Total nonaccrual loans

Assets acquired in loan satisfactions

Total nonperforming assets

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate (d)

Allowance for loan losses to period-end loans retained

Allowance for loan losses to nonaccrual loans retained (b)

Nonaccrual loans to period-end total loans

$

$

$

$

$

$

3Q22

$

247,485

231,829

137

231,966

25,000

71,707

52,940

107,241

78

231,966

246,318

227,539

1,589

229,128

281,336

25,000

70,002

52,432

106,546

148

$ 229,128

14,299

42

836

836

7

843

3,050

864

3,914

0.07

1.32

365

0.36

%

$

$

$

$

$

$

$

2Q22

$

242,456

223,541

566

224,107

25,000

68,535

49,503

105,982

87

224,107

239,381

66,640

47,832

104,890

120

$ 219,482

13,811

218,478

1,004

219,482

300,425

25,000

1

761

761

8

769

2,602

725

3,327

1.16

342

0.34

%

$

$

$

$

$

$

1Q22

$

QUARTERLY TRENDS

235,127

$ 233,474

213,073

1,743

214,816

25,000

64,306

46,720

103,685

105

214,816

208,540

2,147

210,687

316,921

25,000

62,437

45,595

102,498

157

210,687

13,220

6

751

751

17

768

2,357

762

3,119

0.01 %

1.11

314

0.35

$

$

$

$

$

$

$

$

$

4Q21

230,776

206,220

2,223

208,443

24,000

61,159

45,315

101,751

218

208,443

227,308

201,676

3,958

205,634

323,821

24,000

59,784

44,976

100,682

192

205,634

12,902

8

740

740

17

757

2,219

749

2,968

0.02 %

1.08

300

0.36

$

$

$

$

$

$

$

$

$

3Q21

227,670

201,283

3,412

204,695

24,000

58,918

45,107

100,458

212

204,695

222,760

199,789

2,790

202,579

300,595

24,000

59,032

43,330

100,120

97

202,579

12,584

31

735

735

16

751

2,354

711

3,065

0.06

1.17

320

0.36

%

3Q22 Change

2Q22

2%

4

(76)

5

7

1

(10)

4

3

4

58

4

(6)

10

2

23

4

4

NM

10

10

(13)

10

17

19

18

JPMORGAN CHASE & Co.

NINE MONTHS ENDED SEPTEMBER 30,

3Q21

9%

15

(96)

13

4

22

17

7

(63)

13

11

14

(43)

13

(6)

4

19

21

6

53

13

14

35

14

14

(56)

12

30

22

28

$

$

$

$

$

$

$

2022

247,485

231,829

137

231,966

25,000

71,707

52,940

107,241

78

231,966

239,772

218,255

1,578

219,833

299,430

25,000

66,387

48,645

104,659

142

219,833

14,299

49

836

836

7

843

3,050

864

3,914

0.03%

1.32

365

0.36

$

$

201,283

3,412

$ 204,695

24,000

$

$

$

2021

$ 224,955

$

227,670

$

58,918

45,107

100,458

212

204,695

202,002

2,840

204,842

293,981

24,000

60,243

44,154

100,213

232

204,842

12,584

63

735

735

16

751

2,354

711

3,065

0.04 %

1.17

320

0.36

2022 Change

2021

9%

15

(96)

13

4

22

17

7

(63)

13

7

O

(44)

10

10

4

(39)

7

14

(22)

14

14

(56)

12

30

22

28

(a) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, total loans included $205 million, $335 million, $640 million, $1.2 billion, and $2.0 billion of loans, respectively, under the PPP, of which $187 million, $306 million, $604 million,

$1.1 billion, and $1.9 billion were in Middle Market Banking. Refer to page 109 of the Firm's 2021 Form 10-K for further information on the PPP.

(b) Allowance for loan losses of $150 million, $74 million, $104 million, $124 million and $123 million was held against nonaccrual loans retained at September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, respectively.

(c) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021, nonaccrual loans excluded PPP loans 90 or more days past due and insured by the SBA of $27 million, $32 million, $50 million and $114 million, respectively. These amounts have been excluded based

upon the SBA guarantee. There were no PPP loans 90 or more days past due in all other periods presented.

(d) Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate.

Page 19View entire presentation