Pathward Financial Results Presentation Deck

SUMMARY FINANCIAL RESULTS

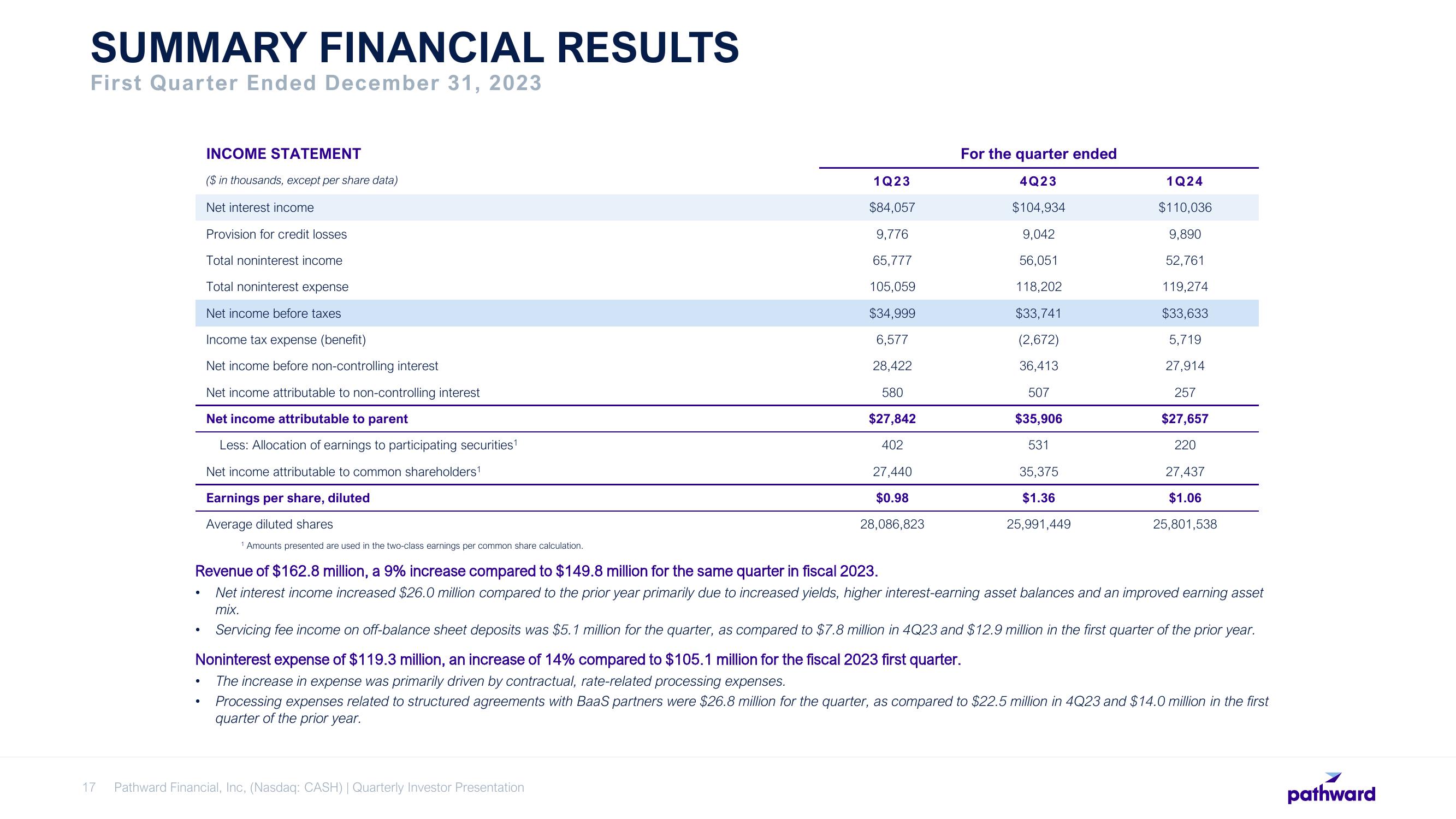

First Quarter Ended December 31, 2023

17

●

●

INCOME STATEMENT

($ in thousands, except per share data)

Net interest income

Provision for credit losses

Total noninterest income

Total noninterest expense

Net income before taxes

Income tax expense (benefit)

Net income before non-controlling interest

●

Net income attributable to non-controlling interest

Net income attributable to parent

Less: Allocation of earnings to participating securities¹

Net income attributable to common shareholders¹

Earnings per share, diluted

Average diluted shares

1 Amounts presented are used in the two-class earnings per common share calculation.

Revenue of $162.8 million, a 9% increase compared to $149.8 million for the same quarter in fiscal 2023.

Net interest income increased $26.0 million compared to the prior year primarily due to increased yields, higher interest-earning asset balances and an improved earning asset

mix.

Servicing fee income on off-balance sheet deposits was $5.1 million for the quarter, as compared to $7.8 million in 4Q23 and $12.9 million in the first quarter of the prior year.

Noninterest expense of $119.3 million, an increase of 14% compared to $105.1 million for the fiscal 2023 first quarter.

The increase in expense was primarily driven by contractual, rate-related processing expenses.

Processing expenses related to structured agreements with BaaS partners were $26.8 million for the quarter, as compared to $22.5 million in 4Q23 and $14.0 million in the first

quarter of the prior year.

1Q23

$84,057

9,776

65,777

105,059

$34,999

6,577

28,422

580

$27,842

402

27,440

$0.98

28,086,823

Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation

For the quarter ended

4Q23

$104,934

9,042

56,051

118,202

$33,741

(2,672)

36,413

507

$35,906

531

35,375

$1.36

25,991,449

1Q24

$110,036

9,890

52,761

119,274

$33,633

5,719

27,914

257

$27,657

220

27,437

$1.06

25,801,538

pathwardView entire presentation