Porch SPAC Presentation Deck

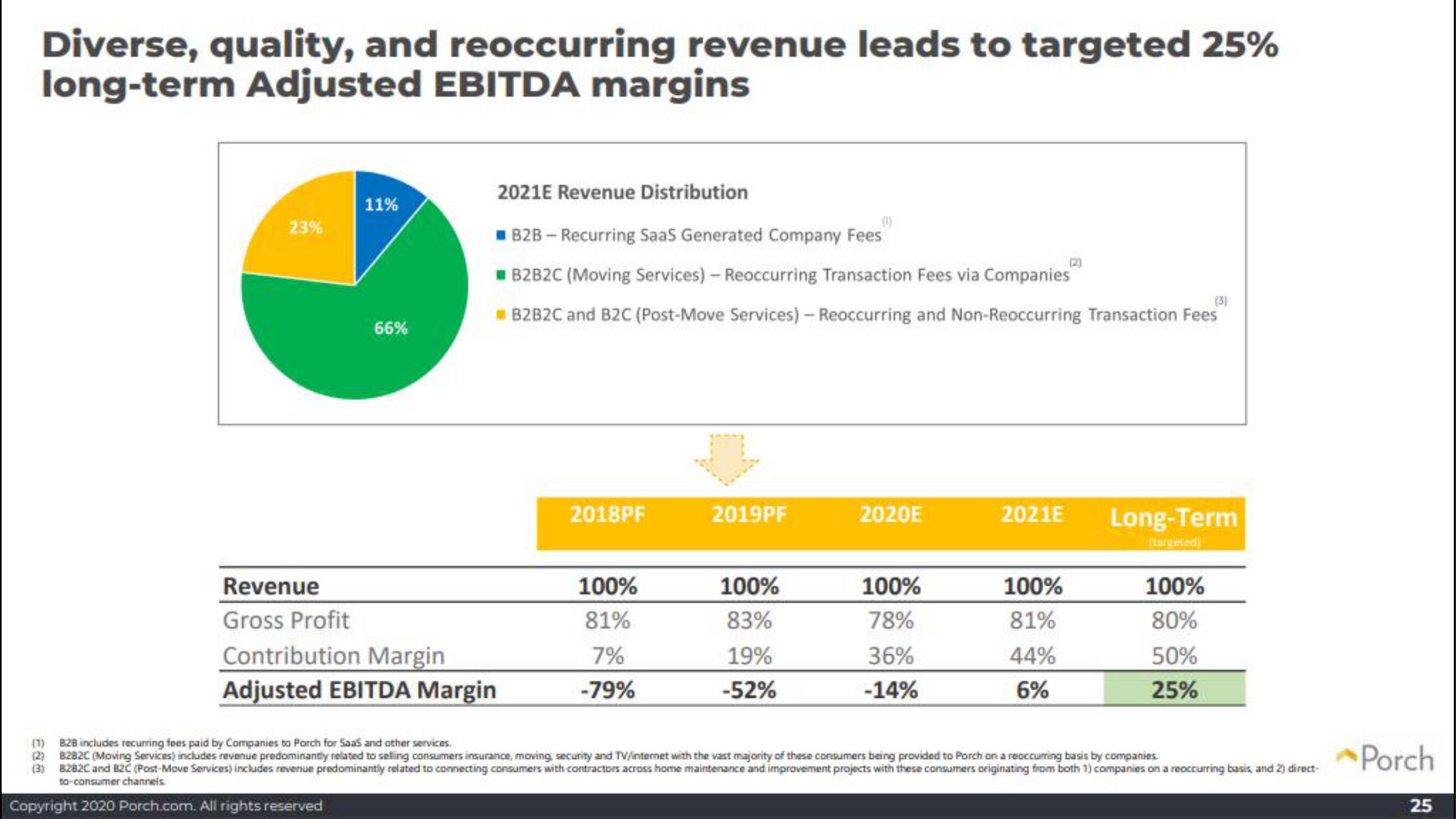

Diverse, quality, and reoccurring revenue leads to targeted 25%

long-term Adjusted EBITDA margins

23%

Revenue

Gross Profit

11%

66%

2021E Revenue Distribution

■ B2B -Recurring SaaS Generated Company Fees

■B2B2C (Moving Services) - Reoccurring Transaction Fees via Companies

B2B2C and B2C (Post-Move Services) -Reoccurring and Non-Reoccurring Transaction Fees

Contribution Margin

Adjusted EBITDA Margin

2018PF

100%

81%

7%

-79%

2019PF

100%

83%

19%

-52%

2020E

100%

78%

36%

-14%

2021E

100%

81%

44%

6%

Long-Term

(targeted

100%

80%

50%

25%

(1) B2B includes recurring fees paid by Companies to Porch for SaaS and other services.

(2) B282C (Moving Services) includes revenue predominantly related to selling consumers insurance, moving, security and TV/internet with the vast majority of these consumers being provided to Porch on a reoccurring basis by companies.

(3) 8282C and B2C (Post-Move Services) includes revenue predominantly related to connecting consumers with contractors across home maintenance and improvement projects with these consumers originating from both 1) companies on a reoccurring basis, and 2) direct-

to-consumer channels.

Copyright 2020 Porch.com. All rights reserved

Porch

25View entire presentation