Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

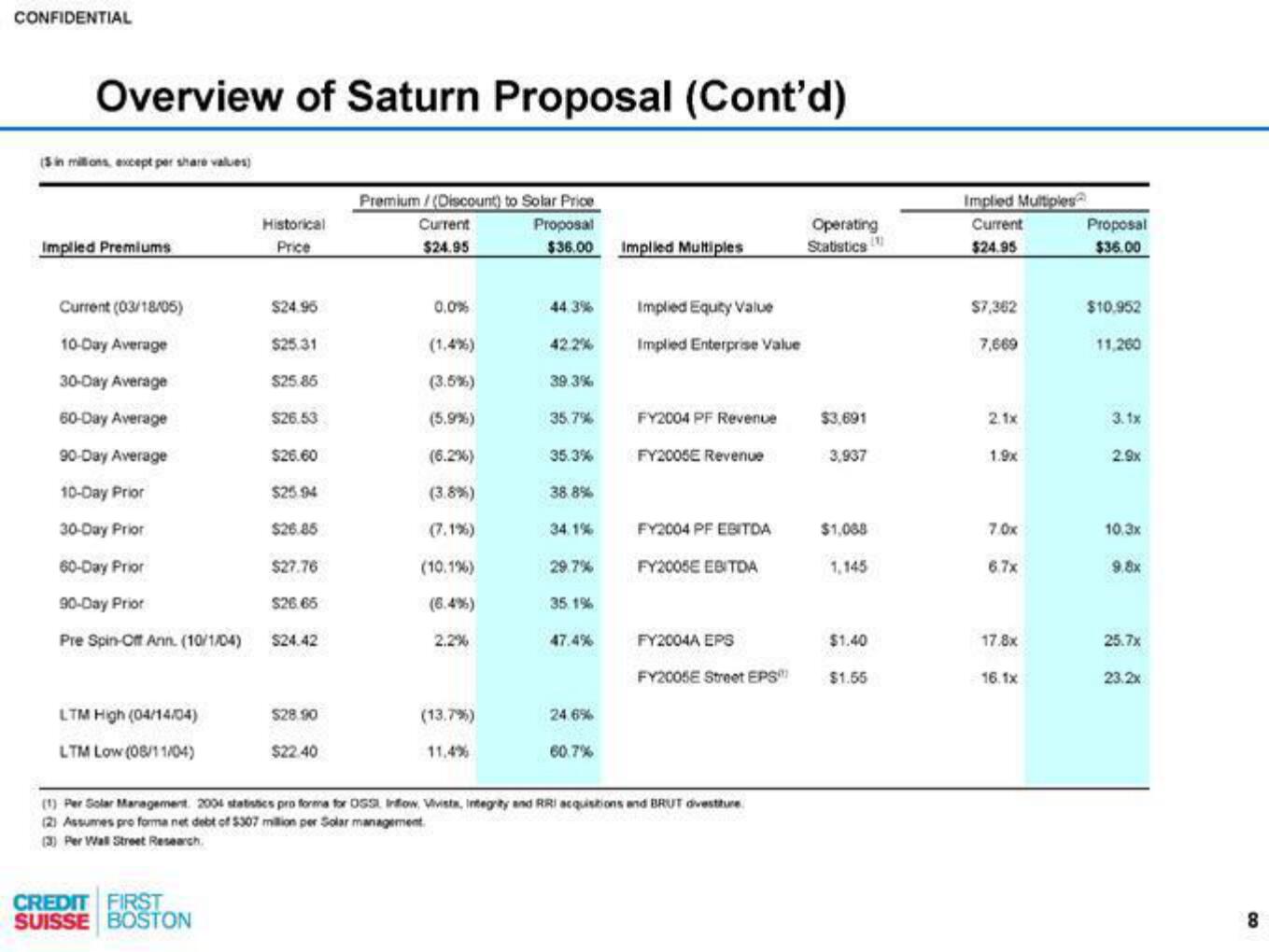

Overview of Saturn Proposal (Cont'd)

(5 in millions, except per share values)

Implied Premiums

Current (03/18/05)

10-Day Average

30-Day Average

60-Day Average

90-Day Average

10-Day Prior

30-Day Prior

60-Day Prior

90-Day Prior

$26.65

Pre Spin-Off Ann. (10/1/04) $24.42

LTM High (04/14/04)

LTM Low (08/11/04)

Historical

Price

CREDIT FIRST

SUISSE BOSTON

$24.96

$25.31

$25.85

$26.53

$26.60

$25.94

$26.85

$27.76

$28.90

$22.40

Premium/(Discount) to Solar Price

Current

Proposal

$24.95

$36.00

0.0%

(3.5%)

(5.9%)

(6.2%)

(3.8%)

(10.1%)

(6.4%)

2.2%

(13.7%)

11,4%

44.3%

42.2%

39.3%

35.7%

35.3%

38.8%

34.1%

29.7%

35.1%

47.4%

24.6%

60.7%

Implied Multiples

Implied Equity Value

Implied Enterprise Value

FY2004 PF Revenue

FY2005E Revenue

FY2004 PF EBITDA

FY2005E EBITDA

FY2004A EPS

FY2005E Street EPS

(1) Per Solar Management. 2006 statistics pro forma for OSS Infow, Vivista, Integrity and RRI acquisitions and BRUT dvesture

(2) Assumes pro forma net debt of $307 million per Solar management

(3) Per Wall Street Research.

Operating

Statistics

$3,691

3,937

$1,068

1,145

$1.40

$1.55

Implied Multiples

Current

$24.95

$7,362

7,669

2.1x

1.9x

7.0x

6.7x

17.8x

16.1x

Proposal

$36.00

$10.952

11,260

3.1x

2.9x

10.3x

9.8x

25.7x

23.2x

8View entire presentation