Tudor, Pickering, Holt & Co Investment Banking

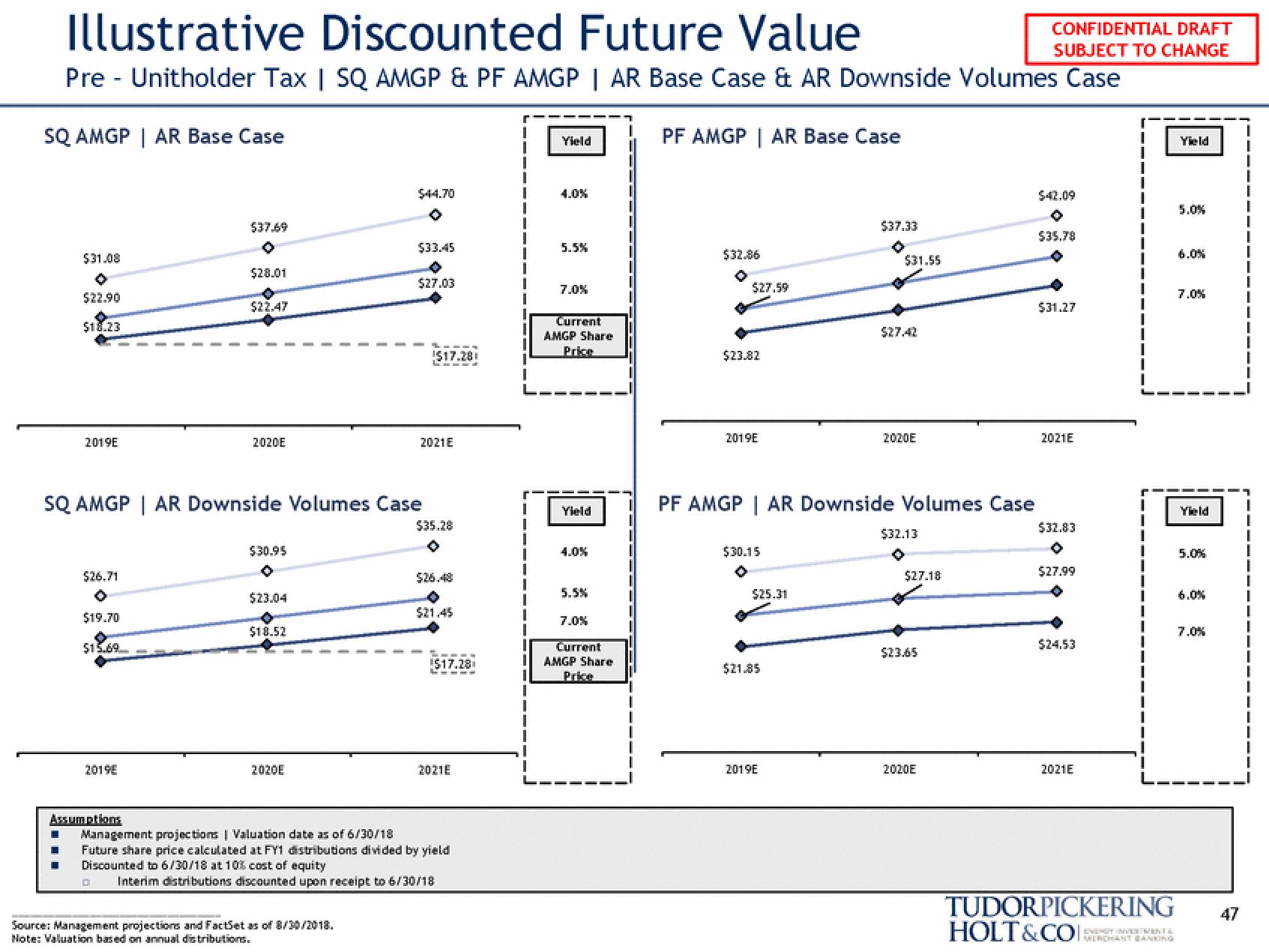

Illustrative Discounted Future Value

Pre - Unitholder Tax | SQ AMGP & PF AMGP | AR Base Case & AR Downside Volumes Case

SQ AMGP | AR Base Case

$31.08

$22.90

$18.23

2019E

$26.71

$19.70

$15.69

2019E

$37.69

Assumptions

$28.01

$22.47

2020E

SQ AMGP | AR Downside Volumes Case

$30.95

$23.04

$18.52

2020E

$44.70

$33.45

Source: Management projections and FactSet as of 8/30/2018.

Note: Valuation based on annual distributions.

$27.03

$17.281

2021E

$35.28

$26.48

$21.45

$17.28

2021E

Management projections | Valuation date as of 6/30/18

Future share price calculated at FY1 distributions divided by yield

Discounted to 6/30/18 at 10% cost of equity

0 Interim distributions discounted upon receipt to 6/30/18

Yield

4.0%

5.5%

7.0%

Current

AMGP Share

Price

Yield

4.0%

5.5%

7.0%

Current

AMGP Share

I

1

I

11

1

I

1

1

PF AMGP | AR Base Case

$32.86

$27.59

$23.82

2019E

$30.15

$25.31

$21.85

537.33

PF AMGP | AR Downside Volumes Case

2019E

$31.55

$27.42

2020E

$32.13

$27.18

$23.65

2020E

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

$42.09

$35.78

$31.27

2021E

$32.83

$27.99

$24.53

2021E

TUDORPICKERING

HOLT&COI:

EVERGY INVESTMENTS

MERCHANT BANKING

Yield

5.0%

6.0%

7.0%

Yield

5.0%

7.0%

47

I

T

I

1

I

I

I

1

I

I

I

IView entire presentation