Eutelsat Investor Presentation Deck

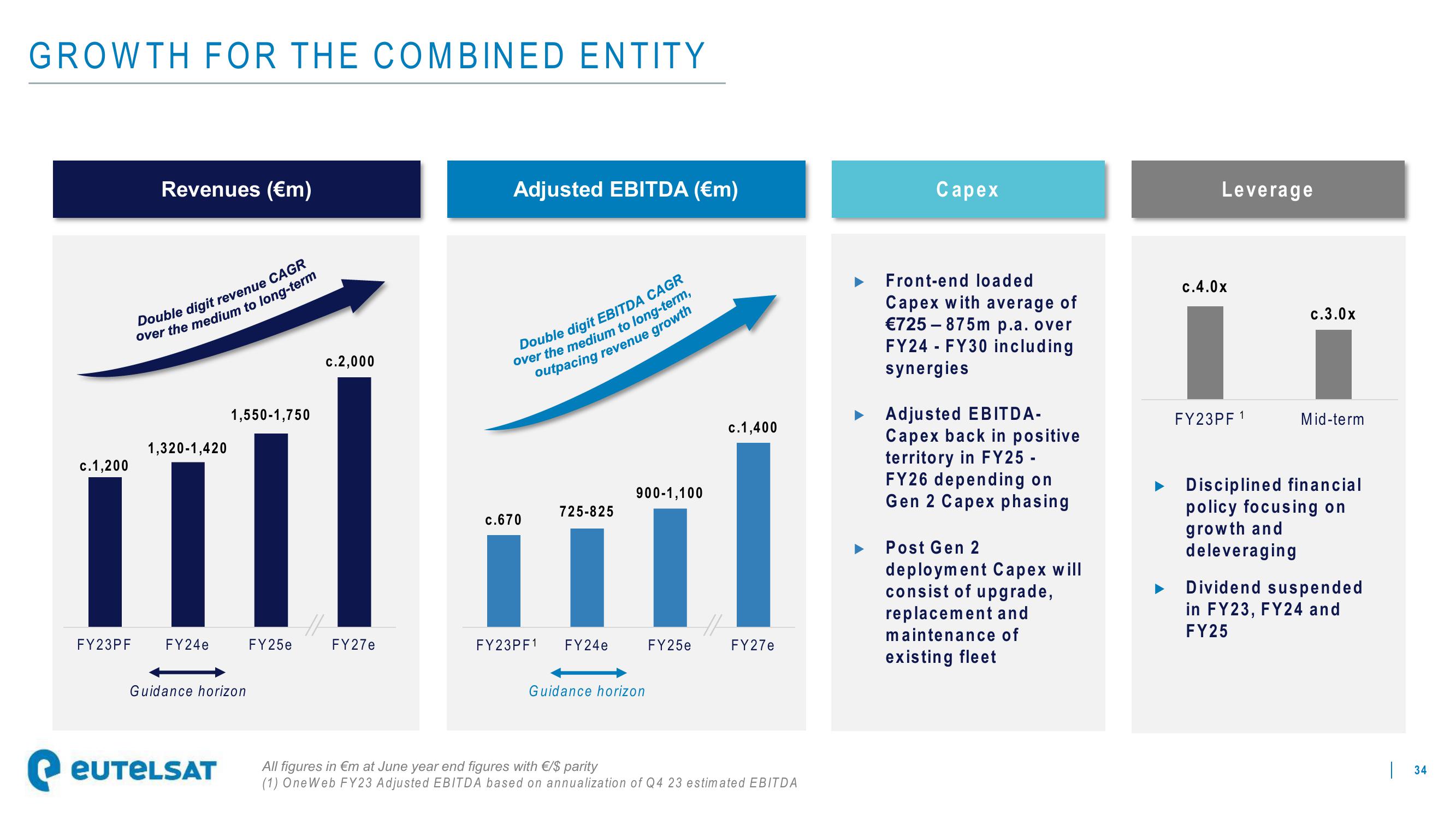

GROWTH FOR THE COMBINED ENTITY

Double digit revenue CAGR

over the medium to long-term

Revenues (€m)

c.1,200

FY23PF

1,320-1,420

ill

FY24e

1,550-1,750

Guidance horizon

EUTELSAT

c.2,000

FY25e

FY27e

Adjusted EBITDA (€m)

Double digit EBITDA CAGR

over the medium to long-term,

outpacing revenue growth

c.670

725-825

FY23PF1 FY24e

900-1,100

Guidance horizon

FY25e

c. 1,400

FY27e

All figures in €m at June year end figures with €/$ parity

(1) OneWeb FY23 Adjusted EBITDA based on annualization of Q4 23 estimated EBITDA

Capex

Front-end loaded

Capex with average of

€725-875m p.a. over

FY24 - FY30 including

synergies

Adjusted EBITDA-

Capex back in positive

territory in FY25 -

FY26 depending on

Gen 2 Capex phasing

Post Gen 2

deployment Capex will

consist of upgrade,

replacement and

maintenance of

existing fleet

Leverage

c.4.0x

FY23PF 1

c.3.0x

Mid-term

Disciplined financial

policy focusing on

growth and

deleveraging

Dividend suspended

in FY23, FY24 and

FY25

|

34View entire presentation