Capacity, Applications, and Outlook

Technology Roadmap: TOPCon First Enters Mass Production

with Module Power Now Fully Marching Towards 600W+

TRENDFORCE

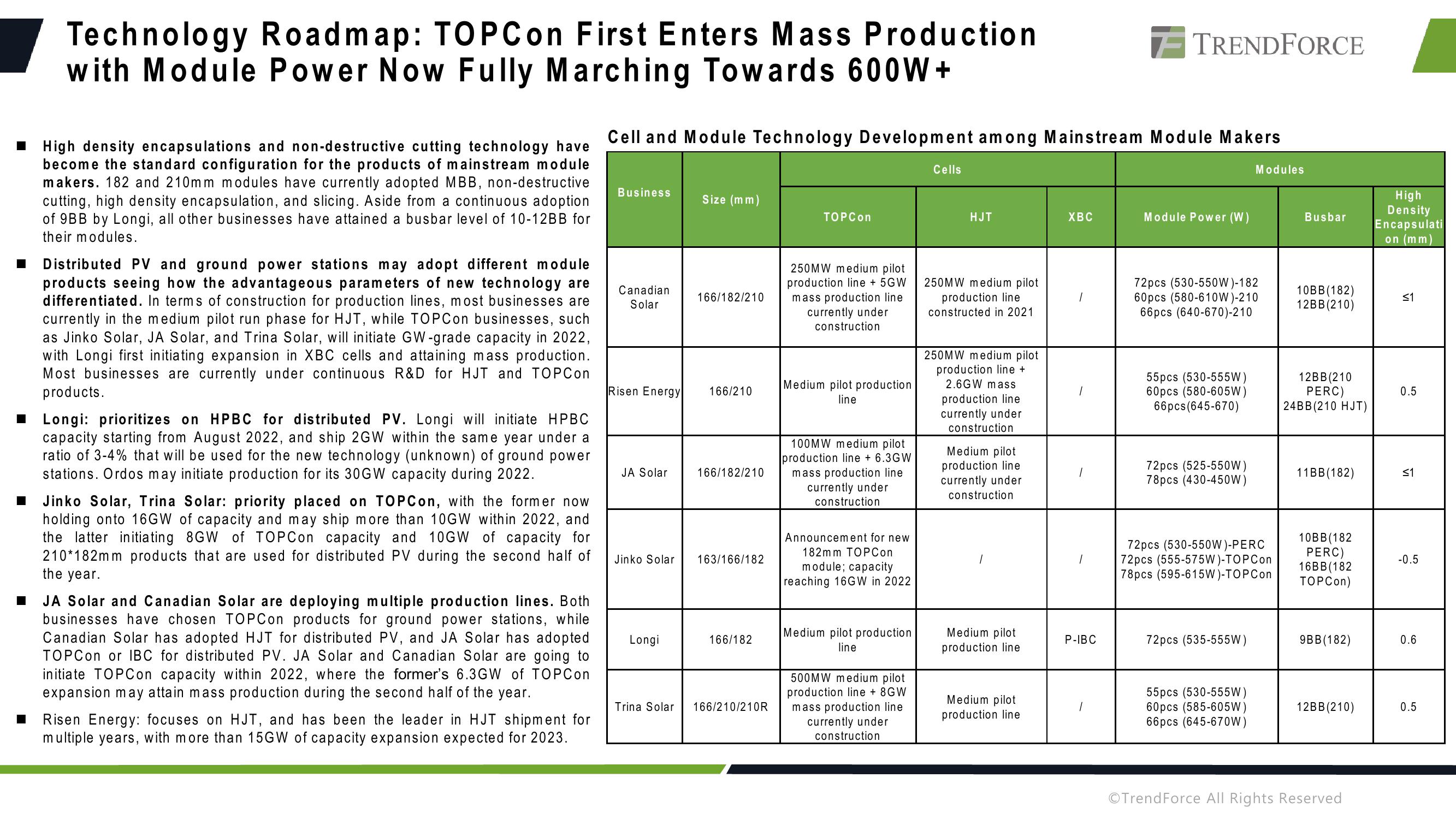

High density encapsulations and non-destructive cutting technology have

become the standard configuration for the products of mainstream module

makers. 182 and 210mm modules have currently adopted MBB, non-destructive

cutting, high density encapsulation, and slicing. Aside from a continuous adoption

of 9BB by Longi, all other businesses have attained a busbar level of 10-12BB for

their modules.

Distributed PV and ground power stations may adopt different module

products seeing how the advantageous parameters of new technology are

differentiated. In terms of construction for production lines, most businesses are

currently in the medium pilot run phase for HJT, while TOPC on businesses, such

as Jinko Solar, JA Solar, and Trina Solar, will initiate GW-grade capacity in 2022,

with Longi first initiating expansion in XBC cells and attaining mass production.

Most businesses are currently under continuous R&D for HJT and TOPCon

products.

Longi: prioritizes on HPBC for distributed PV. Longi will initiate HPBC

capacity starting from August 2022, and ship 2GW within the same year under a

ratio of 3-4% that will be used for the new technology (unknown) of ground power

stations. Ordos may initiate production for its 30 GW capacity during 2022.

Jinko Solar, Trina Solar: priority placed on TOPCon, with the former now

holding onto 16GW of capacity and may ship more than 10GW within 2022, and

the latter initiating 8GW of TOPCon capacity and 10GW of capacity for

210*182mm products that are used for distributed PV during the second half of

the year.

JA Solar and Canadian Solar are deploying multiple production lines. Both

businesses have chosen TOPCon products for ground power stations, while

Canadian Solar has adopted HJT for distributed PV, and JA Solar has adopted

TOPCon or IBC for distributed PV. JA Solar and Canadian Solar are going to

initiate TOPCon capacity within 2022, where the former's 6.3GW of TOPCon

expansion may attain mass production during the second half of the year.

Risen Energy: focuses on HJT, and has been the leader in HJT shipment for

multiple years, with more than 15GW of capacity expansion expected for 2023.

Cell and Module Technology Development among Mainstream Module Makers

Cells

Modules

Business

Size (mm)

TOP Con

HJT

XBC

Module Power (W)

Busbar

High

Density

Encapsulati

on (mm)

Canadian

Solar

166/182/210

250MW medium pilot

production line + 5GW

mass production line

currently under

construction

250MW medium pilot

production line

constructed in 2021

72pcs (530-550W)-182

60pcs (580-610W)-210

66pcs (640-670)-210

10BB (182)

12BB (210)

≤1

Risen Energy

166/210

Medium pilot production

line

JA Solar

166/182/210

12BB (210

PERC)

24BB (210 HJT)

0.5

100MW medium pilot

production line + 6.3GW

mass production line

currently under

construction

250MW medium pilot

production line +

2.6GW mass

production line

currently under

construction

Medium pilot

production line

currently under

construction

55pcs (530-555W)

60pcs (580-605W)

66pcs(645-670)

72pcs (525-550W)

78 pcs (430-450W)

11BB (182)

≤1

Jinko Solar

163/166/182

Announcement for new

182mm TOPCon

module; capacity

reaching 16GW in 2022

72pcs (530-550W)-PERC

72pcs (555-575W)-TOPCon

78 pcs (595-615W)-TOP Con

10BB(182

PERC)

-0.5

16BB (182

TOPCon)

Longi

166/182

Medium pilot production

line

Medium pilot

production line

P-IBC

72pcs (535-555W)

9BB (182)

0.6

500MW medium pilot

production line + 8GW

mass production line

currently under

construction

Medium pilot

production line

55pcs (530-555W)

60pcs (585-605W)

66pcs (645-670W)

12BB (210)

0.5

Trina Solar 166/210/210R

OTrend Force All Rights ReservedView entire presentation