Silicon Valley Bank Results Presentation Deck

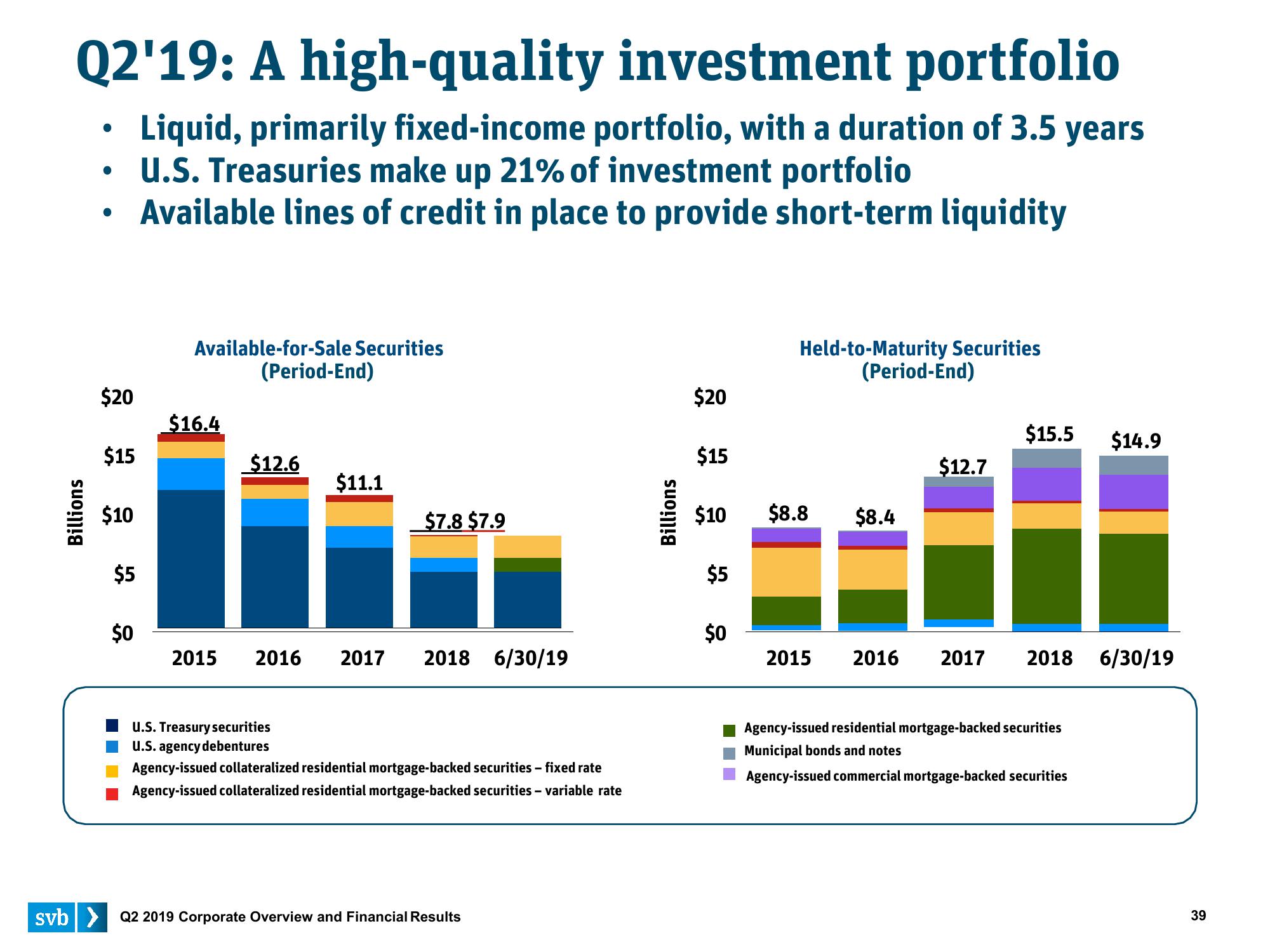

Q2'19: A high-quality investment portfolio

Liquid, primarily fixed-income portfolio, with a duration of 3.5 years

U.S. Treasuries make up 21% of investment portfolio

Available lines of credit in place to provide short-term liquidity

Billions

●

●

$20

$15

$10

$5

$0

Available-for-Sale Securities

(Period-End)

$16.4

2015

$12.6

$11.1

2016 2017

$7.8 $7.9

2018 6/30/19

U.S. Treasury securities

U.S. agency debentures

Agency-issued collateralized residential mortgage-backed securities - fixed rate

Agency-issued collateralized residential mortgage-backed securities - variable rate

svb> Q2 2019 Corporate Overview and Financial Results

Billions

$20

$15

$10

$5

$0

Held-to-Maturity Securities

(Period-End)

$8.8 $8.4

$12.7

$15.5 $14.9

2015 2016 2017 2018 6/30/19

Agency-issued residential mortgage-backed securities

Municipal bonds and notes

Agency-issued commercial mortgage-backed securities

39View entire presentation