Melrose Results Presentation Deck

Cash management: significant working capital improvements

Melrose

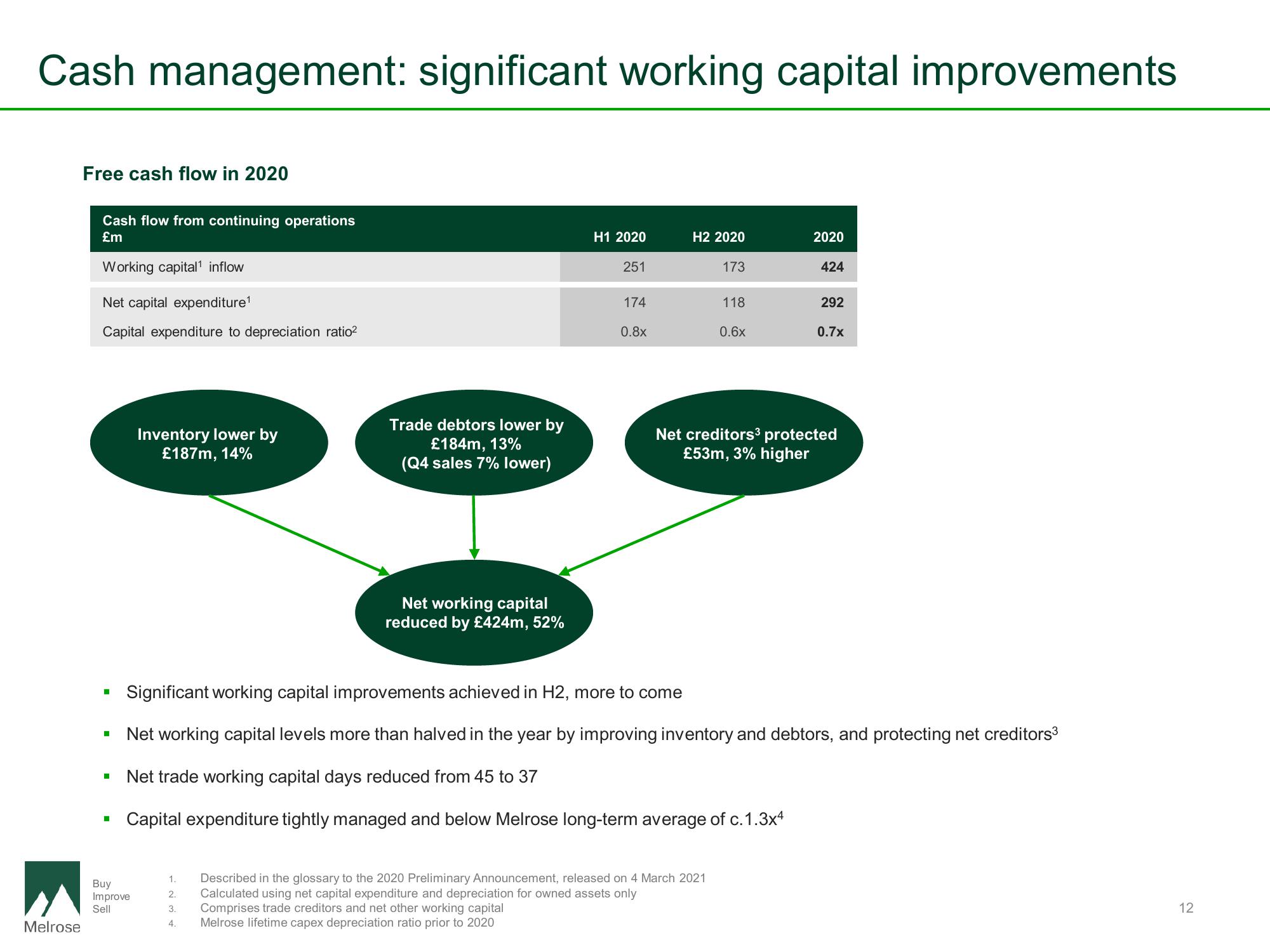

Free cash flow in 2020

Cash flow from continuing operations

£m

Working capital¹ inflow

Net capital expenditure¹

Capital expenditure to depreciation ratio²

I

■

■

Inventory lower by

£187m, 14%

Buy

Improve

Sell

Trade debtors lower by

£184m, 13%

(Q4 sales 7% lower)

Net working capital

reduced by £424m, 52%

H1 2020

251

174

0.8x

1.

2.

3. Comprises trade creditors and net other working capital

4.

Melrose lifetime capex depreciation ratio prior to 2020

H2 2020

173

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Calculated using net capital expenditure and depreciation for owned assets only

118

0.6x

2020

424

Significant working capital improvements achieved in H2, more to come

Net working capital levels more than halved in the year by improving inventory and debtors, and protecting net creditors³

Net trade working capital days reduced from 45 to 37

Capital expenditure tightly managed and below Melrose long-term average of c.1.3x4

292

0.7x

Net creditors³ protected

£53m, 3% higher

12View entire presentation