Benson Hill Results Presentation Deck

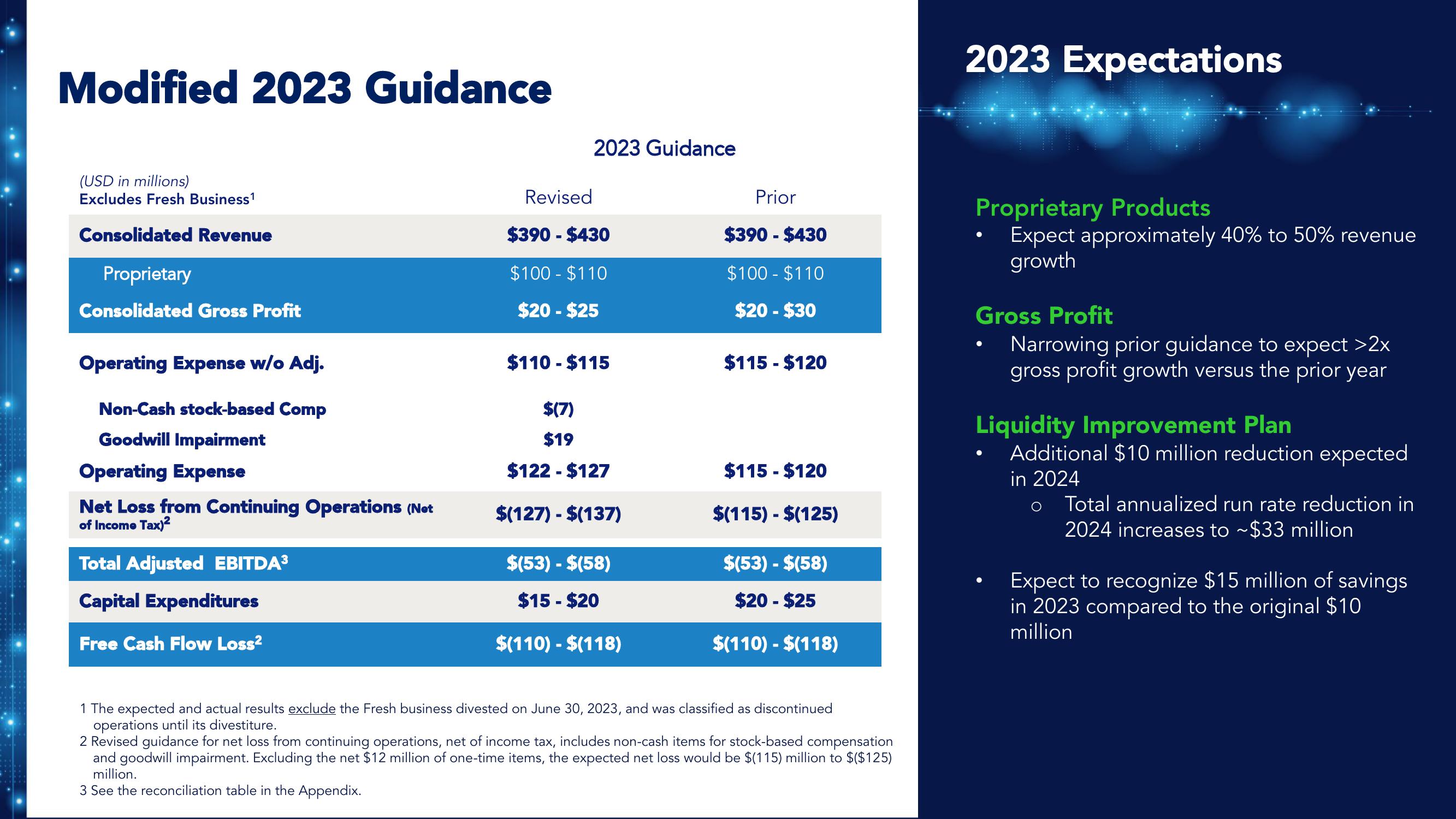

Modified 2023 Guidance

(USD in millions)

Excludes Fresh Business¹

Consolidated Revenue

Proprietary

Consolidated Gross Profit

Operating Expense w/o Adj.

Non-Cash stock-based Comp

Goodwill Impairment

Operating Expense

Net Loss from Continuing Operations (Not

of Income Tax)²

Total Adjusted EBITDA³

Capital Expenditures

Free Cash Flow Loss²

2023 Guidance

Revised

$390 - $430

$100-$110

$20-$25

$110-$115

$(7)

$19

$122 - $127

$(127) - $(137)

$(53) - $(58)

$15 - $20

$(110) - $(118)

Prior

$390-$430

$100-$110

$20-$30

$115 - $120

$115 - $120

$(115) - $(125)

$(53) - $(58)

$20-$25

$(110) - $(118)

1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued

operations until its divestiture.

2 Revised guidance for net loss from continuing operations, net of income tax, includes non-cash items for stock-based compensation

and goodwill impairment. Excluding the net $12 million of one-time items, the expected net loss would be $(115) million to $($125)

million.

3 See the reconciliation table in the Appendix.

2023 Expectations

Proprietary Products

Expect approximately 40% to 50% revenue

growth

Gross Profit

Narrowing prior guidance to expect >2x

gross profit growth versus the prior year

Liquidity Improvement Plan

Additional $10 million reduction expected

in 2024

Total annualized run rate reduction in

2024 increases to ~$33 million

Expect to recognize $15 million of savings

in 2023 compared to the original $10

millionView entire presentation