SoftBank Results Presentation Deck

SPACs Controlled by SBG's Subsidiaries

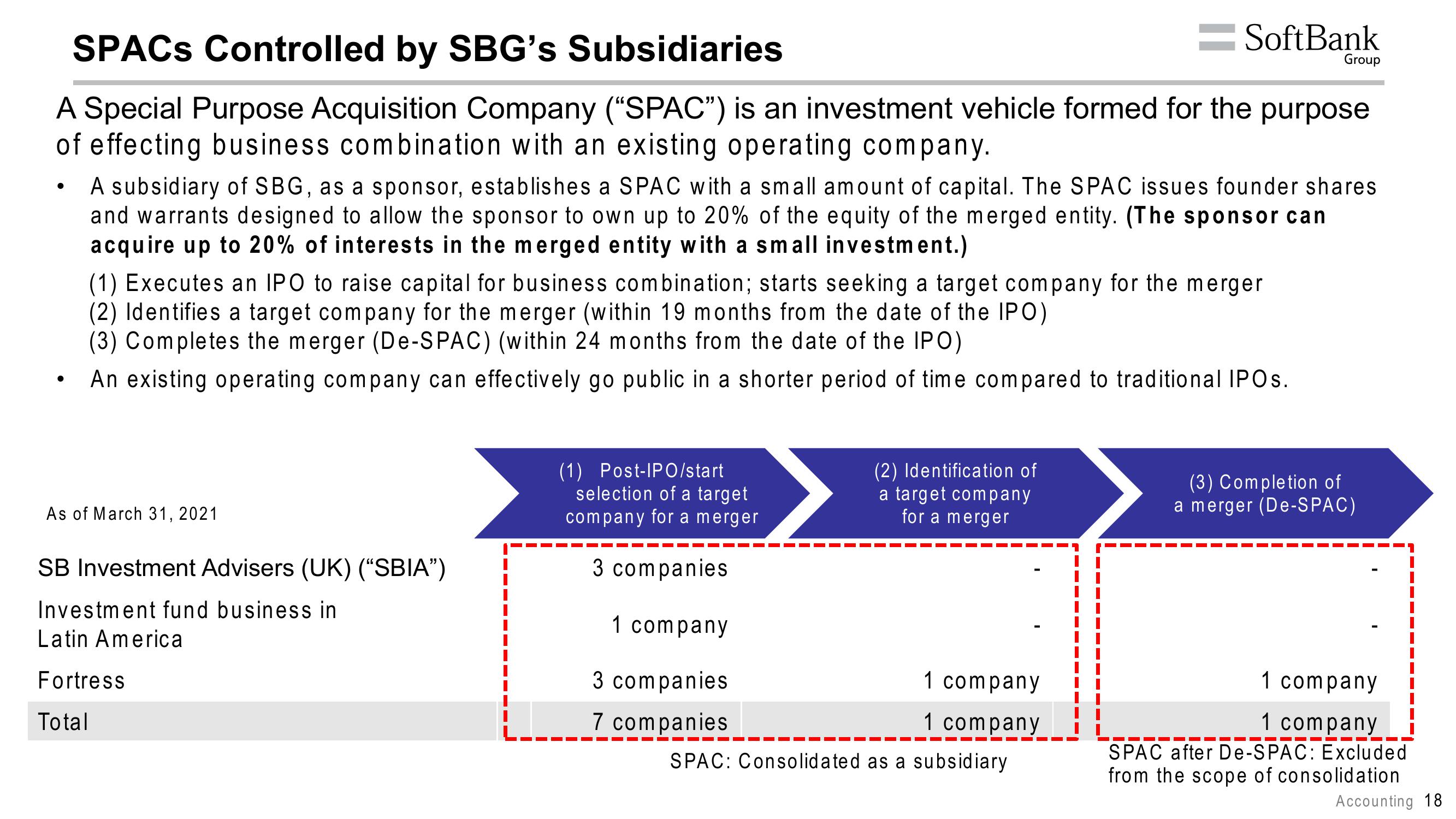

A Special Purpose Acquisition Company ("SPAC") is an investment vehicle formed for the purpose

of effecting business combination with an existing operating company.

●

A subsidiary of SBG, as a sponsor, establishes a SPAC with a small amount of capital. The SPAC issues founder shares

and warrants designed to allow the sponsor to own up to 20% of the equity of the merged entity. (The sponsor can

acquire up to 20% of interests in the merged entity with a small investment.)

(1) Executes an IPO to raise capital for business combination; starts seeking a target company for the merger

(2) Identifies a target company for the merger (within 19 months from the date of the IPO)

(3) Completes the merger (De-SPAC) (within 24 months from the date of the IPO)

An existing operating company can effectively go public in a shorter period of time compared to traditional IPOs.

As of March 31, 2021

SB Investment Advisers (UK) ("SBIA")

Investment fund business in

Latin America

Fortress

Total

(1) Post-IPO/start

selection of a target

company for a merger

3 companies

SoftBank

1 company

3 companies

7 companies

(2) Identification of

a target company

for a merger

1 company

1 company

SPAC: Consolidated as a subsidiary

Group

(3) Completion of

a merger (De-SPAC)

1 company

1 company

SPAC after De-SPAC: Excluded

from the scope of consolidation

Accounting 18View entire presentation