Selina SPAC

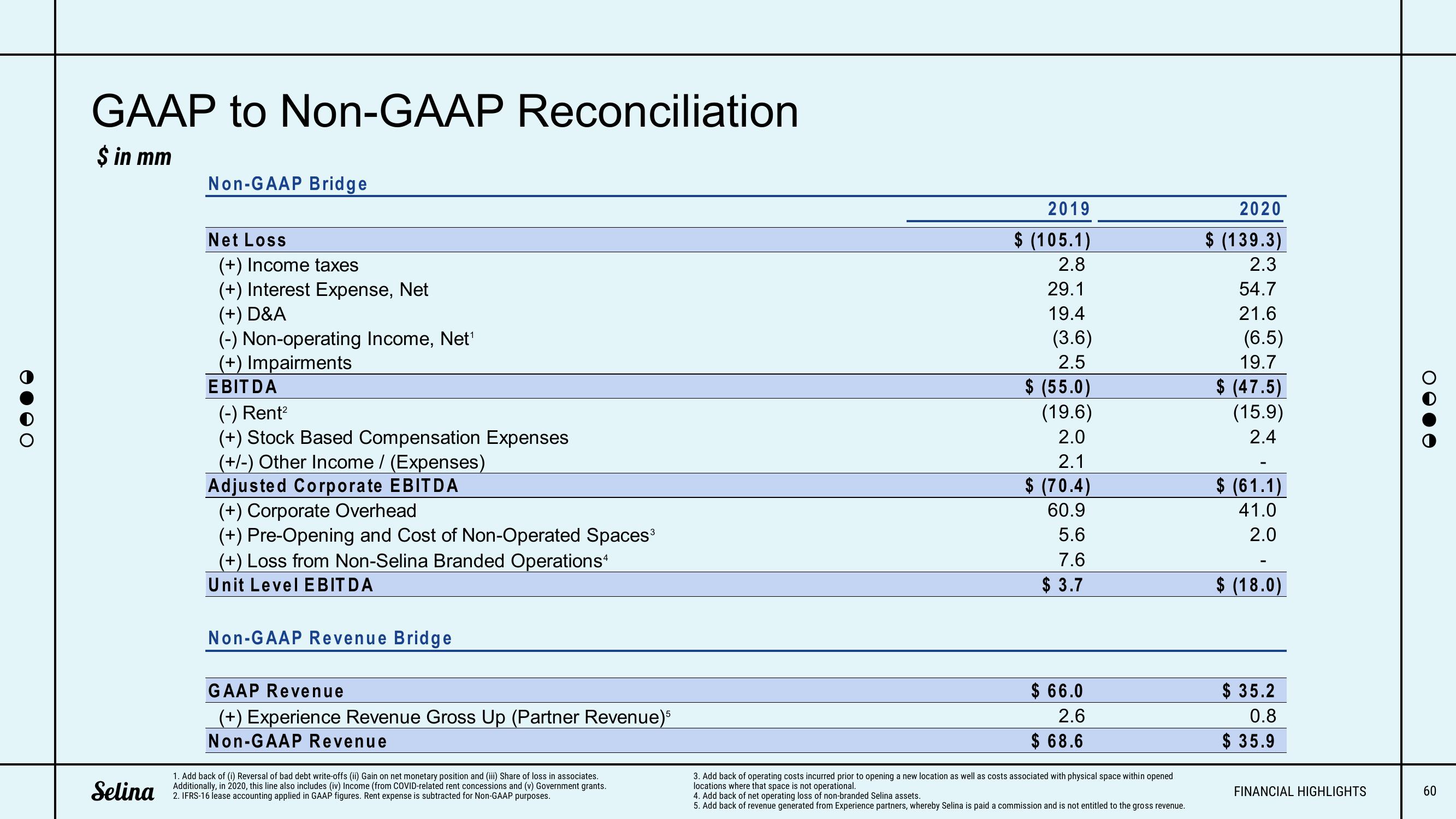

GAAP to Non-GAAP Reconciliation

$ in mm

Non-GAAP Bridge

Net Loss

(+) Income taxes

(+) Interest Expense, Net

(+) D&A

(-) Non-operating Income, Net¹

(+) Impairments

EBITDA

(-) Rent²

(+) Stock Based Compensation Expenses

(+/-) Other Income / (Expenses)

Adjusted Corporate EBITDA

(+) Corporate Overhead

(+) Pre-Opening and Cost of Non-Operated Spaces³

(+) Loss from Non-Selina Branded Operations

Unit Level EBITDA

Non-GAAP Revenue Bridge

GAAP Revenue

(+) Experience Revenue Gross Up (Partner Revenue)5

Non-GAAP Revenue

1. Add back of (i) Reversal of bad debt write-offs (ii) Gain on net monetary position and (iii) Share of loss in associates.

Selina rent concessions and (v) Government grants.

2. IFRS-16 lease accounting applied in GAAP figures. Rent expense is subtracted for Non-GAAP purposes.

2019

$ (105.1)

2.8

29.1

19.4

(3.6)

2.5

$ (55.0)

(19.6)

2.0

2.1

$(70.4)

60.9

5.6

7.6

$ 3.7

$66.0

2.6

$ 68.6

3. Add back of operating costs incurred prior to opening a new location as well as costs associated with physical space within opened

locations where that space is not operational.

4. Add back of net operating loss of non-branded Selina assets.

5. Add back of revenue generated from Experience partners, whereby Selina is paid a commission and is not entitled to the gross revenue.

2020

$ (139.3)

2.3

54.7

21.6

(6.5)

19.7

$ (47.5)

(15.9)

2.4

$ (61.1)

41.0

2.0

$ (18.0)

$ 35.2

0.8

$35.9

FINANCIAL HIGHLIGHTS

60View entire presentation