Investor Deep Dive Corporate Bank

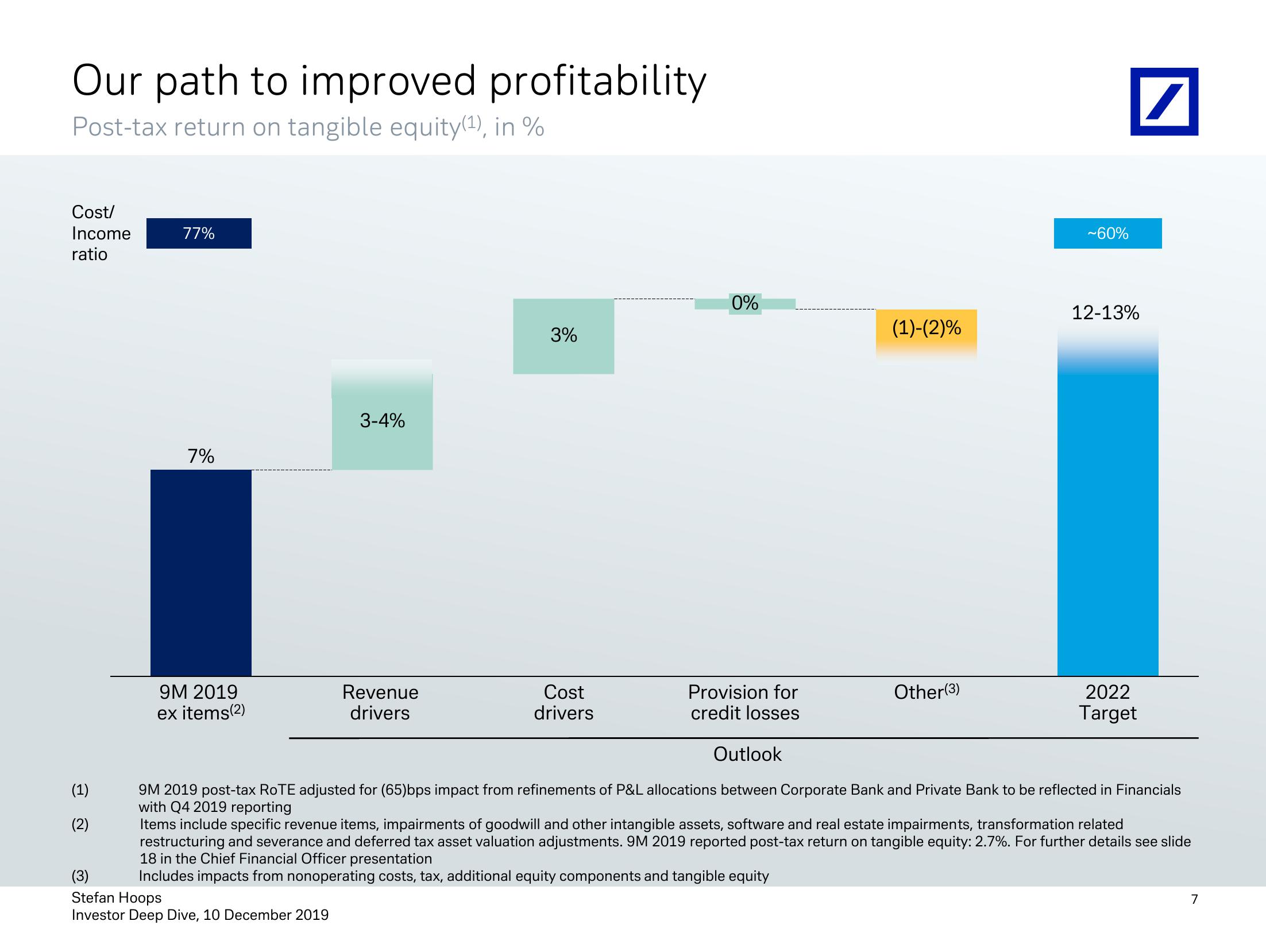

Our path to improved profitability

Post-tax return on tangible equity(1), in %

Cost/

Income

ratio

77%

7%

3-4%

~60%

0%

12-13%

(1)-(2)%

3%

9M 2019

ex items(2)

Revenue

drivers

Cost

drivers

Provision for

credit losses

Other (3)

2022

Target

Outlook

(1)

(2)

(3)

9M 2019 post-tax RoTE adjusted for (65)bps impact from refinements of P&L allocations between Corporate Bank and Private Bank to be reflected in Financials

with Q4 2019 reporting

Items include specific revenue items, impairments of goodwill and other intangible assets, software and real estate impairments, transformation related

restructuring and severance and deferred tax asset valuation adjustments. 9M 2019 reported post-tax return on tangible equity: 2.7%. For further details see slide

18 in the Chief Financial Officer presentation

Includes impacts from nonoperating costs, tax, additional equity components and tangible equity

Stefan Hoops

Investor Deep Dive, 10 December 2019

7View entire presentation