Evercore Investment Banking Pitch Book

Executive Summary

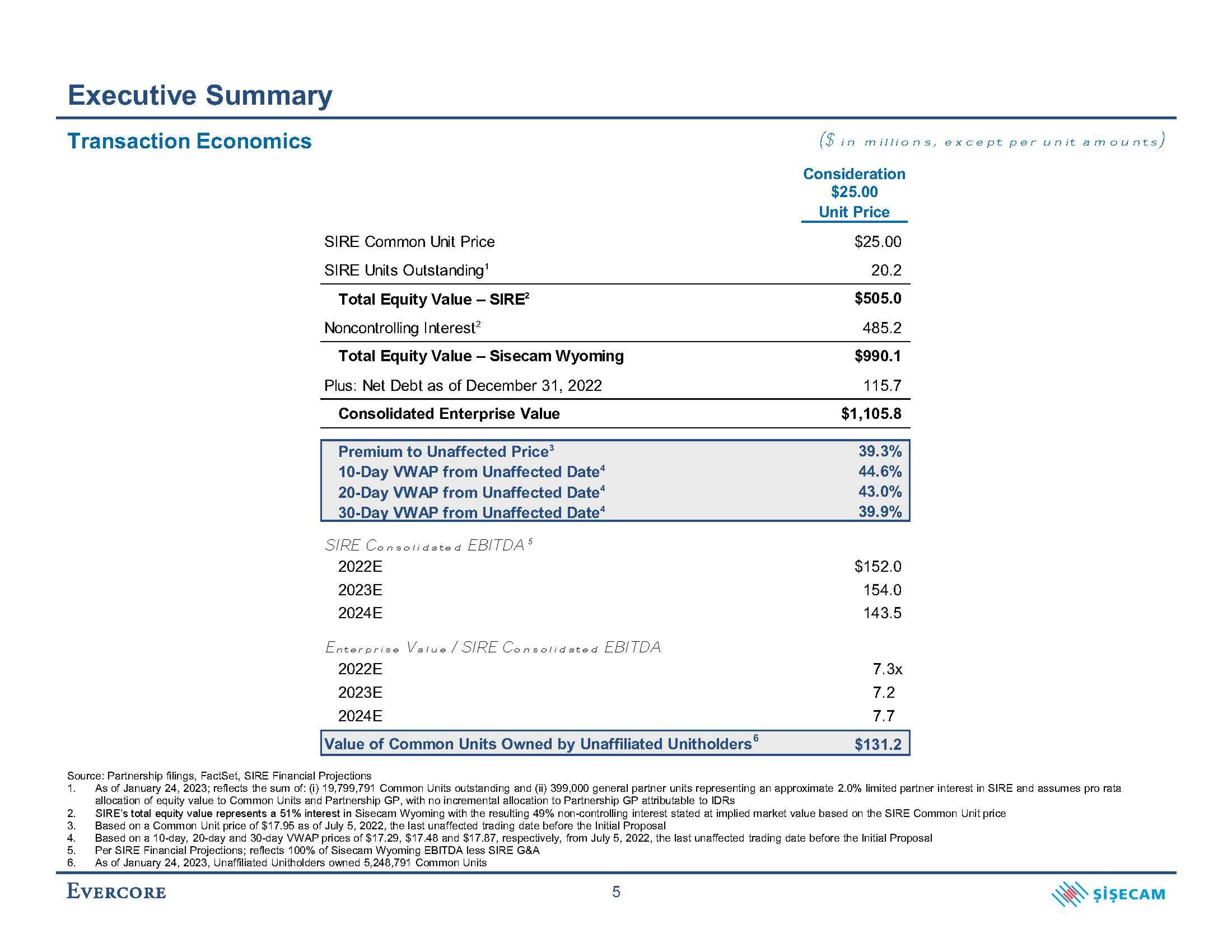

Transaction Economics

2.

3.

SIRE Common Unit Price

SIRE Units Outstanding¹

Total Equity Value - SIRE²

Noncontrolling Interest²

Total Equity Value - Sisecam Wyoming

Plus: Net Debt as of December 31, 2022

Consolidated Enterprise Value

Premium to Unaffected Price³

10-Day VWAP from Unaffected Date4

20-Day VWAP from Unaffected Date4

30-Day VWAP from Unaffected Date¹

4.

5.

6.

SIRE Consolidated EBITDA 5

2022E

2023E

2024E

Enterprise Value /SIRE Consolidated EBITDA

2022E

2023E

2024E

Value of Common Units Owned by Unaffiliated Unitholders

6

($ in millions, except per unit amounts,

Consideration

$25.00

Unit Price

$25.00

20.2

$505.0

485.2

$990.1

115.7

$1,105.8

5

39.3%

44.6%

43.0%

39.9%

Source: Partnership filings, FactSet, SIRE Financial Projections

1.

As of January 24, 2023; reflects the sum of: (i) 19,799,791 Common Units outstanding and (ii) 399,000 general partner units representing an approximate 2.0% limited partner interest in SIRE and assumes pro rata

allocation of equity value to Common Units and Partnership GP, with no incremental allocation to Partnership GP attributable to IDRs

$152.0

154.0

143.5

7.3x

7.2

7.7

$131.2

SIRE's total equity value represents a 51% interest in Sisecam Wyoming with the resulting 49% non-controlling interest stated at implied market value based on the SIRE Common Unit price

Based on a Common Unit price of $17.95 as of July 5, 2022, the last unaffected trading date before the Initial Proposal

Based on a 10-day, 20-day and 30-day VWAP prices of $17.29, $17.48 and $17.87, respectively, from July 5, 2022, the last unaffected trading date before the Initial Proposal

Per SIRE Financial Projections; reflects 100% of Sisecam Wyoming EBITDA less SIRE G&A

As of January 24, 2023, Unaffiliated Unitholders owned 5,248,791 Common Units

EVERCORE

ŞİŞECAMView entire presentation