Bridge Investment Group Results Presentation Deck

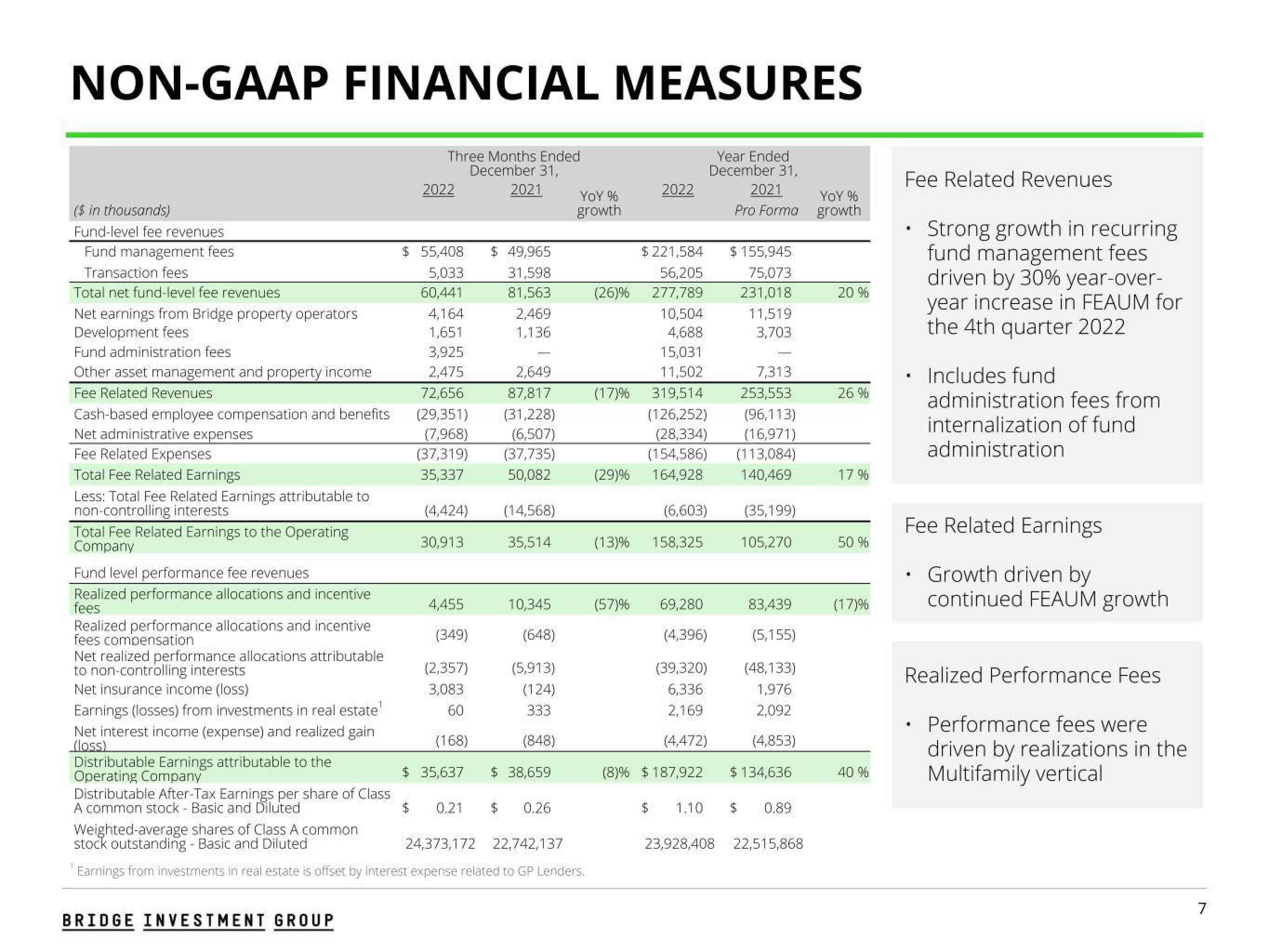

NON-GAAP FINANCIAL MEASURES

Year Ended

December 31,

2021

Pro Forma

($ in thousands)

Fund-level fee revenues

Fund management fees

Transaction fees

Total net fund-level fee revenues

Net earnings from Bridge property operators

Development fees

Fund administration fees

Other asset management and property income

Fee Related Revenues

Cash-based employee compensation and benefits

Net administrative expenses

Fee Related Expenses

Total Fee Related Earnings

Less: Total Fee Related Earnings attributable to

non-controlling interests

Total Fee Related Earnings to the Operating

Company

Fund level performance fee revenues

Realized performance allocations and incentive

fees

Realized performance allocations and incentive

fees compensation

Net realized performance allocations attributable

to non-controlling interests

Net insurance income (loss)

Earnings (losses) from investments in real estate'

Net interest income (expense) and realized gain

(loss)

Distributable Earnings attributable to the

Operating Company

Three Months Ended

December 31,

2021

Distributable After-Tax Earnings per share of Class

A common stock - Basic and Diluted

$

BRIDGE INVESTMENT GROUP

2022

$ 55,408

5,033

60,441

4,164

1,651

3,925

2,475

72,656

(29,351)

(7,968)

(37,319)

35,337

(4,424)

30,913

4,455

(349)

(2,357)

3,083

60

(168)

$ 35,637

0.21

$ 49,965

31,598

81,563

2,469

1,136

2,649

87,817

(31,228)

(6,507)

(37,735)

50,082

(14,568)

35,514

10,345

(648)

(5,913)

(124)

333

(848)

$ 38,659

$ 0.26

YOY %

growth

Weighted-average shares of Class A common

stock outstanding - Basic and Diluted

24,373,172 22,742,137

Earnings from investments in real estate is offset by interest expense related to GP Lenders.

(26

(17)%

(29)%

2022

$221,584

56,205

277,789

10,504

4,688

15,031

11,502

7,313

319,514

253,553

(126,252)

(96,113)

(28,334) (16,971)

(154,586) (113,084)

140,469

164,928

(6,603)

(13)% 158,325

$ 155,945

75,073

231,018

11,519

3,703

(57)% 69,280

(4,396)

(39,320)

6,336

2,169

(4,472)

(8) % $187,922

(35,199)

105,270

83,439

(5,155)

(48,133)

1,976

2,092

(4,853)

$ 134,636

$ 1.10 $ 0.89

23,928,408 22,515,868

YOY %

growth

20%

26%

17%

50 %

(17)%

40 %

Fee Related Revenues

Strong growth in recurring

fund management fees

driven by 30% year-over-

year increase in FEAUM for

the 4th quarter 2022

.

Includes fund

administration fees from

internalization of fund

administration

Fee Related Earnings

Growth driven by

continued FEAUM growth

Realized Performance Fees

Performance fees were

driven by realizations in the

Multifamily vertical

7View entire presentation