Sequoia Capital Educational Presentation Deck

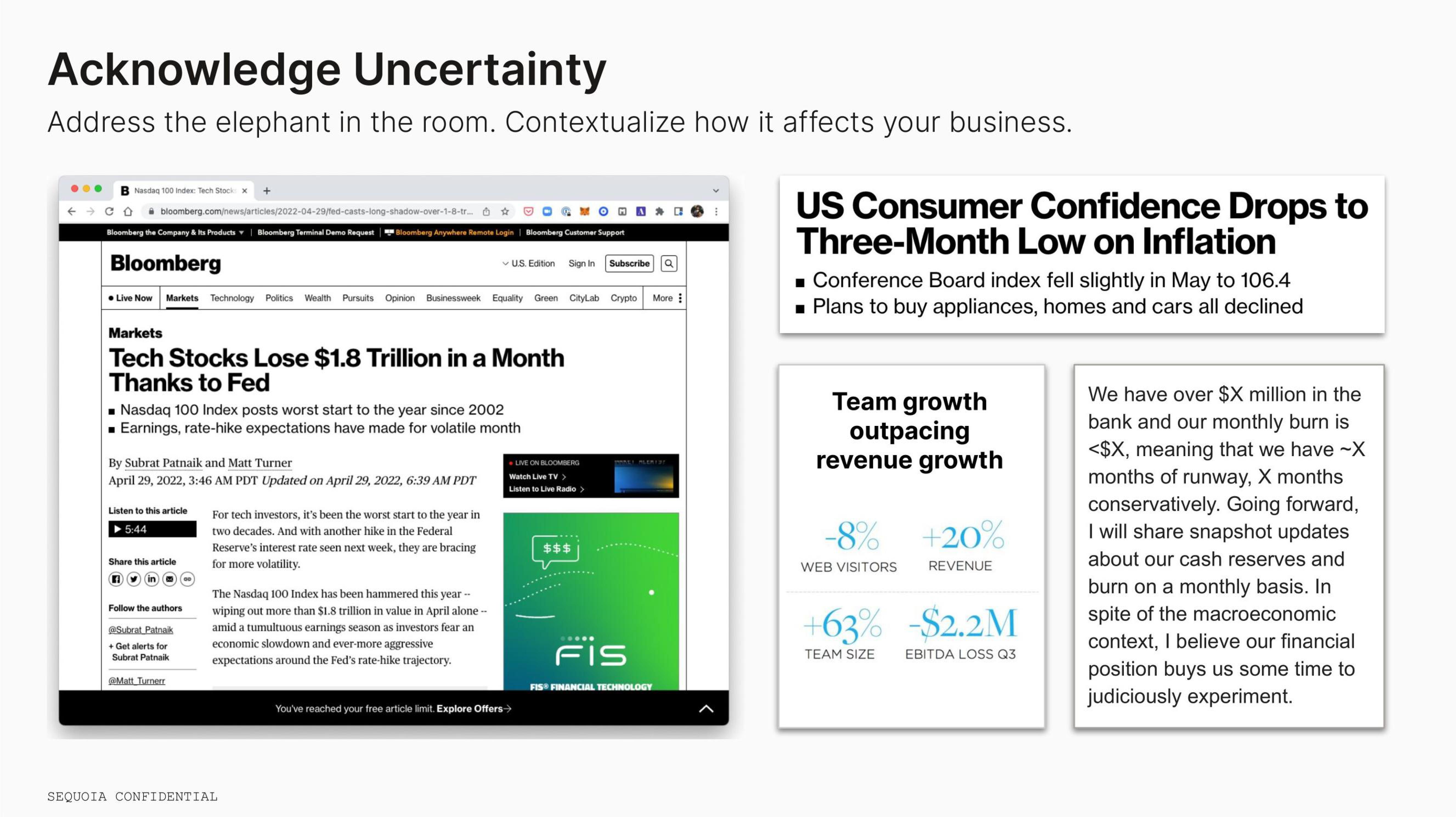

Acknowledge Uncertainty

Address the elephant in the room. Contextualize how it affects your business.

● B Nasdaq 100 Index: Tech Stock x +

C 0

bloomberg.com/news/articles/2022-04-29/fed-casts-long-shadow-over-1-8-tr... O

Bloomberg the Company & Its Products | Bloomberg Terminal Demo Request Bloomberg Anywhere Remote Login | Bloomberg Customer Support

Bloomberg

● Live Now Markets Technology Politics Wealth Pursuits Opinion Businessweek Equality Green CityLab Crypto More

Markets

Tech Stocks Lose $1.8 Trillion in a Month

Thanks to Fed

■ Nasdaq 100 Index posts worst start to the year since 2002

■ Earnings, rate-hike expectations have made for volatile month

By Subrat Patnaik and Matt Turner

April 29, 2022, 3:46 AM PDT Updated on April 29, 2022, 6:39 AM PDT

Listen to this article

▶5:44

Share this article

in

Follow the authors

@Subrat Patnaik

+ Get alerts for

Subrat Patnaik

@Matt Turnerr

For tech investors, it's been the worst start to the year in

two decades. And with another hike in the Federal

Reserve's interest rate seen next week, they are bracing

for more volatility.

✓ U.S. Edition Sign In Subscribe

The Nasdaq 100 Index has been hammered this year --

wiping out more than $1.8 trillion in value in April alone --

amid a tumultuous earnings season as investors fear an

economic slowdown and ever-more aggressive

expectations around the Fed's rate-hike trajectory.

SEQUOIA CONFIDENTIAL

LIVE ON BLOOMBERG

Watch Live TV >

Listen to Live Radio >

M

You've reached your free article limit. Explore Offers →

$$$

MARE ALERTST

FIS

FIS® FINANCIAL TECHNOLOGY

US Consumer Confidence Drops to

Three-Month Low on Inflation

■ Conference Board index fell slightly in May to 106.4

■ Plans to buy appliances, homes and cars all declined

Team growth

outpacing

revenue growth

-8%

WEB VISITORS

+20%

REVENUE

+63% -$2.2M

TEAM SIZE

EBITDA LOSS Q3

We have over $X million in the

bank and our monthly burn is

<$X, meaning that we have ~X

months of runway, X months

conservatively. Going forward,

I will share snapshot updates

about our cash reserves and

burn on a monthly basis. In

spite of the macroeconomic

context, I believe our financial

position buys us some time to

judiciously experiment.View entire presentation