Atalaya Risk Management Overview

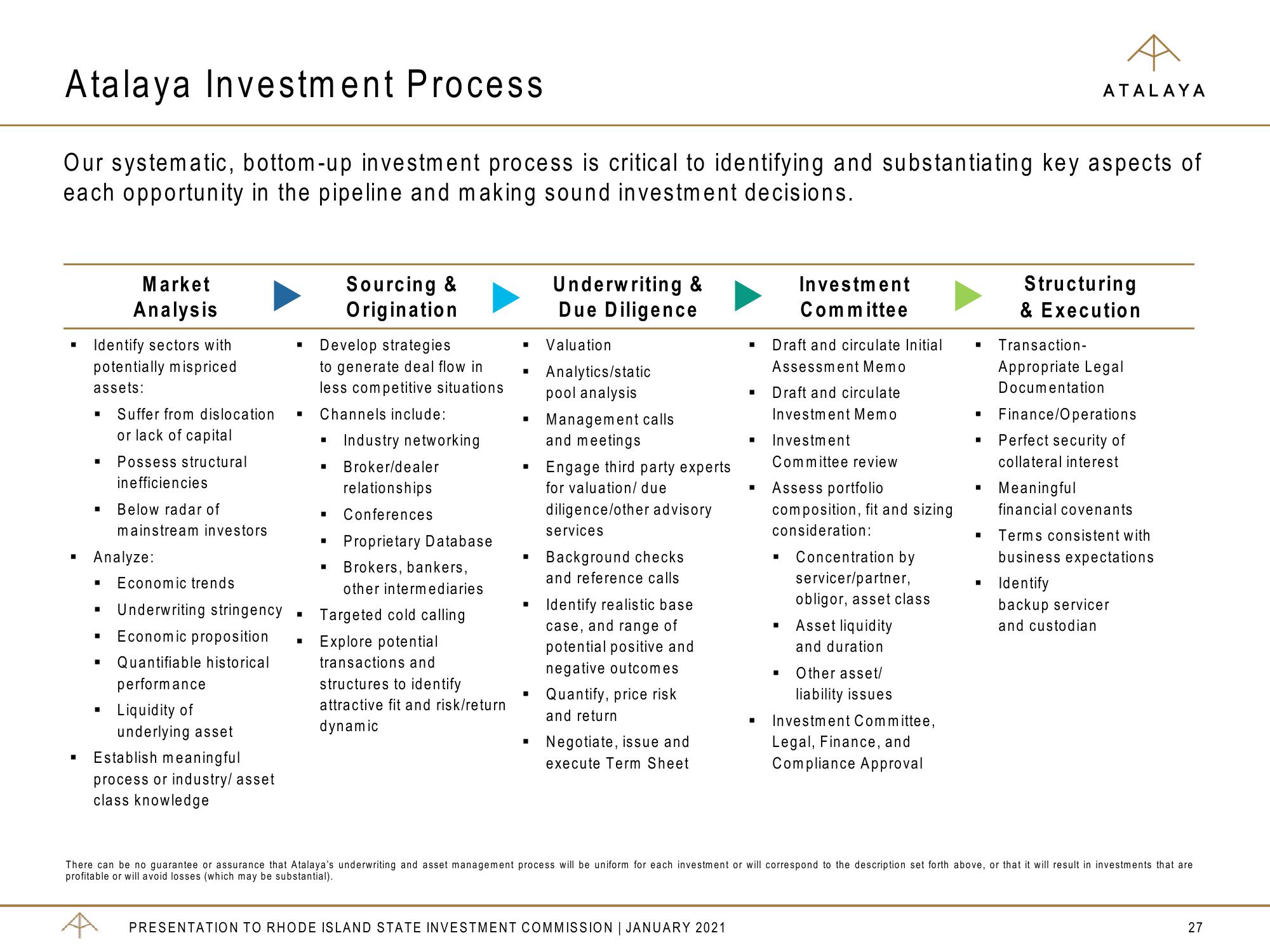

Atalaya Investment Process

Our systematic, bottom-up investment process is critical to identifying and substantiating key aspects of

each opportunity in the pipeline and making sound investment decisions.

■

■

Identify sectors with

potentially mispriced

assets:

■

■

Market

Analysis

I

Analyze:

■

Suffer from dislocation

or lack of capital

Possess structural

inefficiencies

Below radar of

mainstream investors

Economic trends

Underwriting stringency

Economic proposition

Quantifiable historical

performance

Liquidity of

underlying asset

Establish meaningful

process or industry/asset

class knowledge

■

■

Sourcing &

Origination

Develop strategies

to generate deal flow in

less competitive situations

Channels include:

■

Industry networking

Broker/dealer

relationships

Conferences

Proprietary Database

Brokers, bankers,

other intermediaries

Targeted cold calling

Explore potential

transactions and

structures to identify

attractive fit and risk/return

dynamic

■

■

Underwriting &

Due Diligence

Valuation

Analytics/static

pool analysis

Management calls

and meetings

Engage third party experts

for valuation/ due

diligence/other advisory

services

Background checks

and reference calls

Identify realistic base

case, and range of

potential positive and

negative outcomes

Quantify, price risk

and return

Negotiate, issue and

execute Term Sheet

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

■

Investment

Committee

Draft and circulate Initial

Assessment Memo

■ Draft and circulate

Investment Memo

Investment

Committee review

Assess portfolio

composition, fit and sizing

consideration:

■

Concentration by

servicer/partner,

obligor, asset class

Asset liquidity

and duration

Other asset/

liability issues

Investment Committee,

Legal, Finance, and

Compliance Approval

ATALAYA

Structuring

& Execution

Transaction-

Appropriate Legal

Documentation

Finance/Operations

Perfect security of

collateral interest

Meaningful

financial covenants

■ Terms consistent with

business expectations

Identify

backup servicer

and custodian

There can be no guarantee or assurance that Atalaya's underwriting and asset management process will be uniform for each investment or will correspond to the description set forth above, or that it will result in investments that are

profitable or will avoid losses (which may be substantial).

27View entire presentation