Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

NOTE 3 FINANCIAL RISKS, ETC.

AMOUNTS IN USD MILLION

Except of the below, the financial risks, etc. are not significantly different from those described in note 18 of the

consolidated financial statements for 2014, to which reference is made.

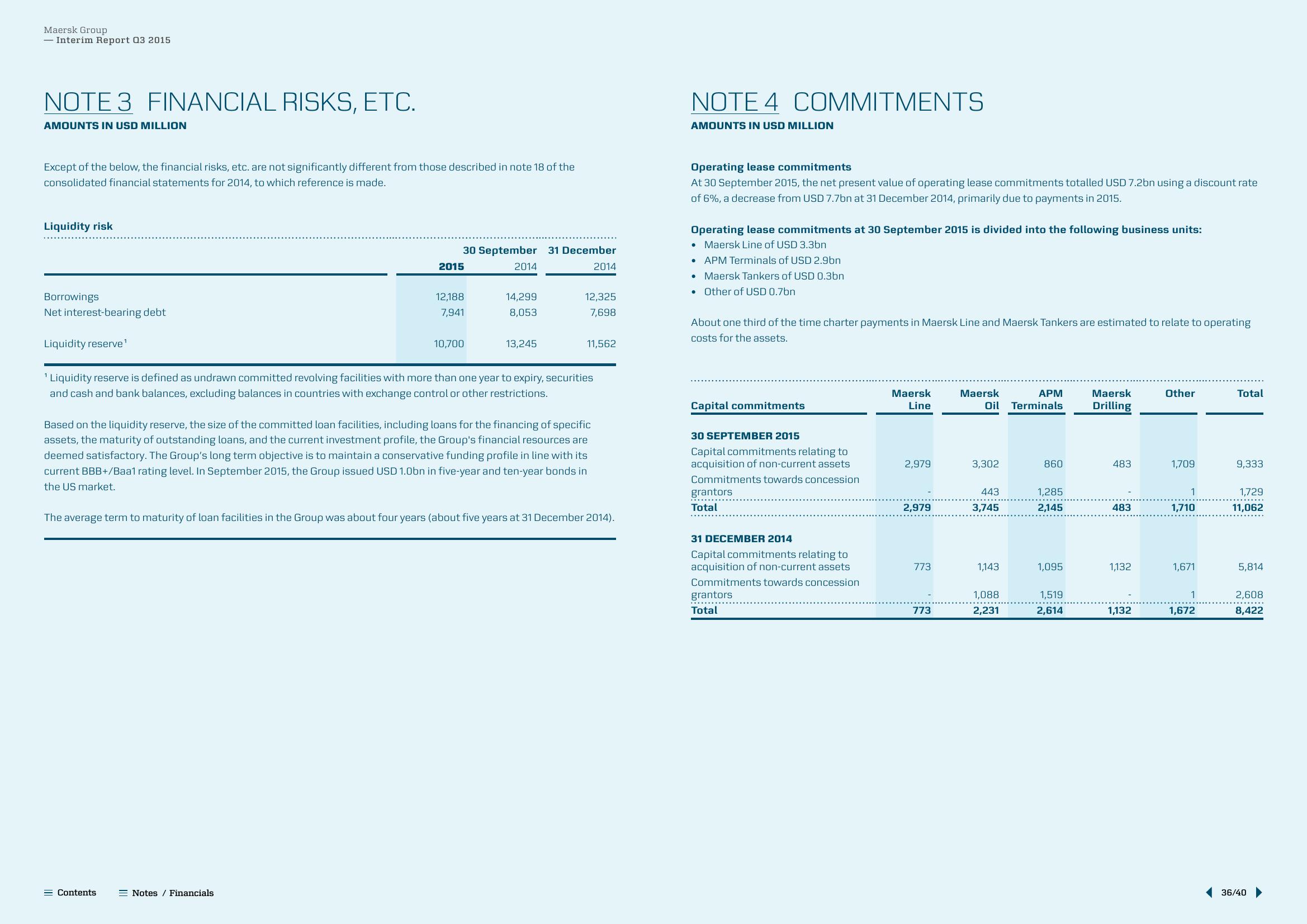

Liquidity risk

Borrowings

Net interest-bearing debt

Liquidity reserve¹

30 September 31 December

2015

= Contents

12,188

7,941

Notes / Financials

10,700

2014

14,299

8,053

13,245

¹ Liquidity reserve is defined as undrawn committed revolving facilities with more than one year to expiry, securities

and cash and bank balances, excluding balances in countries with exchange control or other restrictions.

12,325

7,698

Based on the liquidity reserve, the size of the committed loan facilities, including loans for the financing of specific

assets, the maturity of outstanding loans, and the current investment profile, the Group's financial resources are

deemed satisfactory. The Group's long term objective is to maintain a conservative funding profile in line with its

current BBB+/Baa1 rating level. In September 2015, the Group issued USD 1.0bn in five-year and ten-year bonds in

the US market.

2014

11,562

The average term to maturity of loan facilities in the Group was about four years (about five years at 31 December 2014).

NOTE 4 COMMITMENTS

AMOUNTS IN USD MILLION

Operating lease commitments

At 30 September 2015, the net present value of operating lease commitments totalled USD 7.2bn using a discount rate

of 6%, a decrease from USD 7.7bn at 31 December 2014, primarily due to payments in 2015.

Operating lease commitments at 30 September 2015 is divided into the following business units:

• Maersk Line of USD 3.3bn

APM Terminals of USD 2.9bn

• Maersk Tankers of USD 0.3bn

• Other of USD 0.7bn

About one third of the time charter payments in Maersk Line and Maersk Tankers are estimated to relate to operating

costs for the assets.

Capital commitments

30 SEPTEMBER 2015

Capital commitments relating to

acquisition of non-current assets

Commitments towards concession

grantors

..….....

Total

31 DECEMBER 2014

Capital commitments relating to

acquisition of non-current assets

Commitments towards concession

grantors

Total

Maersk

Line

2,979

2,979

773

773

Maersk

APM

Oil Terminals

3,302

443

3,745

1,143

1,088

2,231

860

1,285

2,145

1,095

1,519

2,614

Maersk

Drilling

483

483

1,132

1,132

Other

1,709

1

1,710

1,671

1

1,672

Total

9,333

1,729

11,062

5,814

2,608

8,422

........

36/40View entire presentation