FiscalNote SPAC Presentation Deck

53

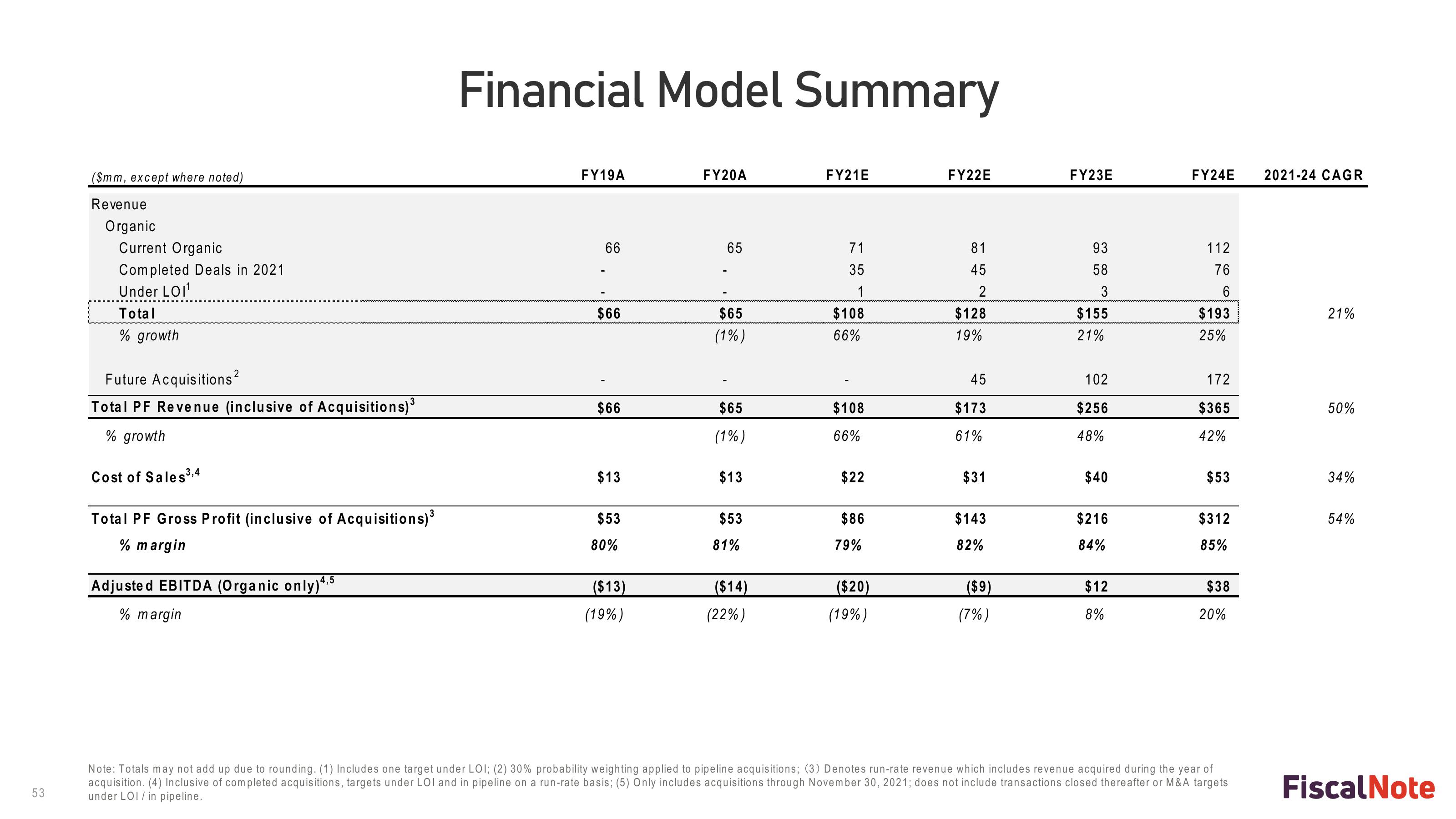

($mm, except where noted)

Revenue

Organic

Current Organic

Completed Deals in 2021

Under LOI¹

Total

% growth

2

Future Acquisitions ²

3

Total PF Revenue (inclusive of Acquisitions) ³

% growth

Cost of Sales ³,4

Total PF Gross Profit (inclusive of Acquisitions)³

% margin

Adjusted EBITDA (Organic only) 4,5

% margin

Financial Model Summary

FY19A

66

$66

$66

$13

$53

80%

($13)

(19%)

FY20A

65

$65

(1%)

$65

(1%)

$13

$53

81%

($14)

(22%)

FY21E

71

35

1

$108

66%

$108

66%

$22

$86

79%

($20)

(19%)

FY22E

81

45

2

$128

19%

45

$173

61%

$31

$143

82%

($9)

(7%)

FY23E

93

58

3

$155

21%

102

$256

48%

$40

$216

84%

$12

8%

FY24E 2021-24 CAGR

112

76

6

$193

25%

172

$365

42%

$53

$312

85%

$38

20%

Note: Totals may not add up due to rounding. (1) Includes one target under LOI; (2) 30% probability weighting applied to pipeline acquisitions; (3) Denotes run-rate revenue which includes revenue acquired during the year of

acquisition. (4) Inclusive of completed acquisitions, targets under LOI and in pipeline on a run-rate basis; (5) Only includes acquisitions through November 30, 2021; does not include transactions closed thereafter or M&A targets

under LOI/ in pipeline.

21%

50%

34%

54%

Fiscal NoteView entire presentation