Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

BofA SECURITIES

EVD Capiol Markets

KBW

Morgan Stanley

OPPENHEIMER

RAYMOND

JAMES

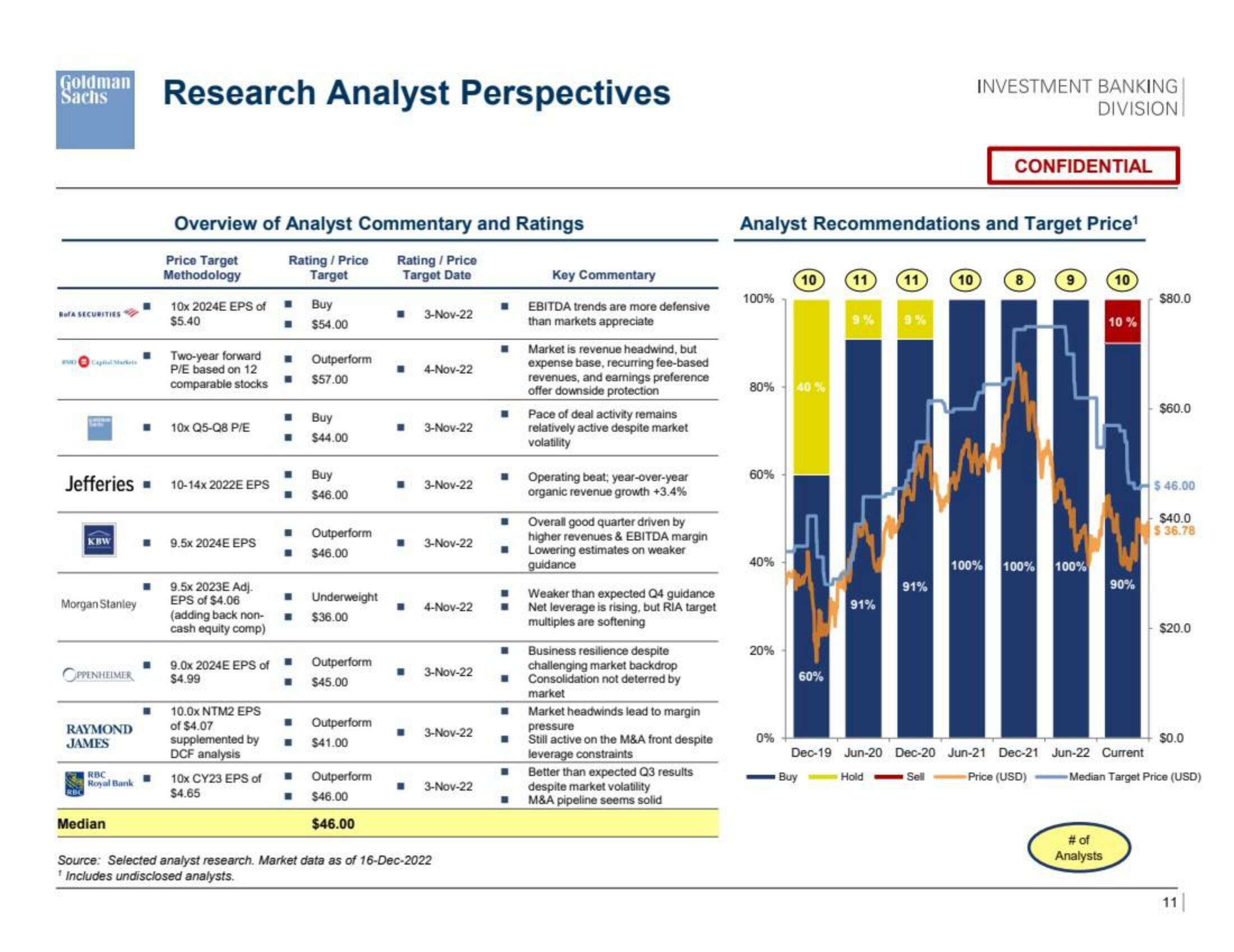

Jefferies 10-14X 2022E EPS

RBC

Royal Bank

Research Analyst Perspectives

Median

Overview of Analyst Commentary and Ratings

Price Target

Methodology

Rating/ Price

Target

Rating / Price

Target Date

10x 2024E EPS of

$5.40

Two-year forward ■

P/E based on 12

.

comparable stocks

10x Q5-Q8 P/E

■ 9.5x 2024E EPS

9.5x 2023E Adj.

EPS of $4.06

(adding back non-

cash equity comp)

9.0x 2024E EPS of

$4.99

10.0x NTM2 EPS

of $4.07

supplemented by

DCF analysis

10x CY23 EPS of

$4.65

■

Buy

I $44.00

■

■

Buy

$54.00

■

Outperform

$57.00

I

Buy

$46.00

Outperform

$46.00

Outperform

I $45.00

Underweight

$36.00

Outperform

$41.00

Outperform

$46.00

$46.00

I 3-Nov-22

4-Nov-22

■ 3-Nov-22

I 3-Nov-22

I

3-Nov-22

■ 4-Nov-22

3-Nov-22

3-Nov-22

3-Nov-22

Source: Selected analyst research. Market data as of 16-Dec-2022

¹ Includes undisclosed analysts.

I

I

■ Operating beat; year-over-year

organic revenue growth +3.4%

■

Key Commentary

EBITDA trends are more defensive

than markets appreciate

Overall good quarter driven by

higher revenues & EBITDA margin

■ Lowering estimates on weaker

guidance

I

Market is revenue headwind, but

expense base, recurring fee-based

revenues, and earnings preference

offer downside protection

I

Pace of deal activity remains

relatively active despite market

volatility

Weaker than expected Q4 guidance

Net leverage is rising, but RIA target

multiples are softening

Business resilience despite

challenging market backdrop

Consolidation not deterred by

market

Market headwinds lead to margin

pressure

Still active on the M&A front despite

leverage constraints

Better than expected Q3 results

despite market volatility

M&A pipeline seems solid

100%

Analyst Recommendations and Target Price¹

80%

60%

40%

20%

0%

10

40%

60%

Buy

11

9%

91%

11

Hold

9%

91%

INVESTMENT BANKING

DIVISION

10

CONFIDENTIAL

8

100% 100% 100%

10

# of

Analysts

10%

90%

$80.0

$60.0

$46.00

$40.0

$36.78

Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Current

Sell

Price (USD) Median Target Price (USD)

$20.0

$0.0

11View entire presentation