Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

15.1%

PERFORMANCE

Dec-21

ASSET QUALITY

c.30bps

14.8%

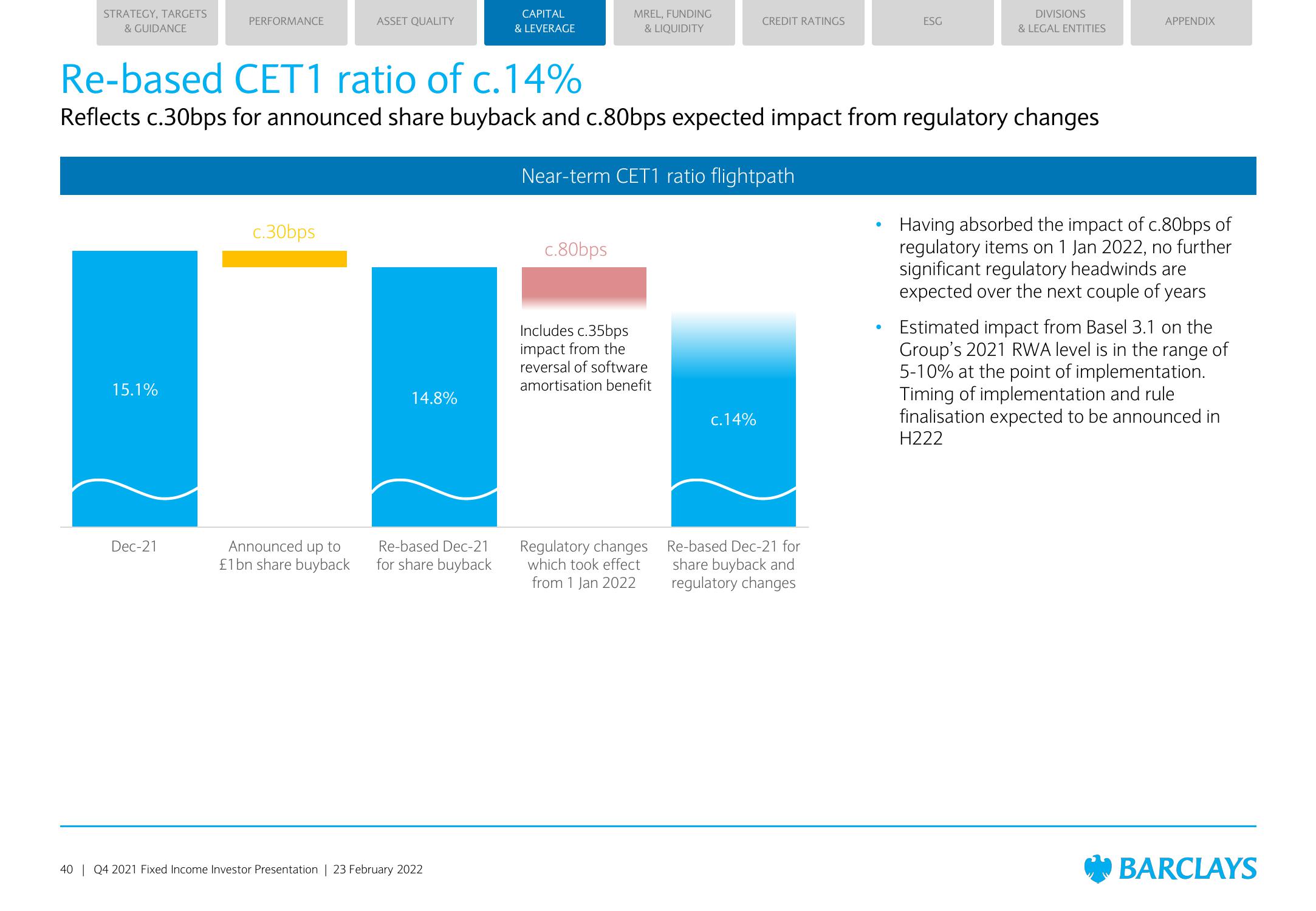

Re-based CET1 ratio of c.14%

Reflects c.30bps for announced share buyback and c.80bps expected impact from regulatory changes

Near-term CET1 ratio flightpath

Announced up to Re-based Dec-21

£1bn share buyback for share buyback

CAPITAL

& LEVERAGE

40 | Q4 2021 Fixed Income Investor Presentation | 23 February 2022

MREL, FUNDING

& LIQUIDITY

c.80bps

Includes c.35bps

impact from the

reversal of software

amortisation benefit

Regulatory changes

which took effect

from 1 Jan 2022

CREDIT RATINGS

c.14%

Re-based Dec-21 for

share buyback and

regulatory changes

ESG

●

DIVISIONS

& LEGAL ENTITIES

APPENDIX

Having absorbed the impact of c.80bps of

regulatory items on 1 Jan 2022, no further

significant regulatory headwinds are

expected over the next couple of years

Estimated impact from Basel 3.1 on the

Group's 2021 RWA level is in the range of

5-10% at the point of implementation.

Timing of implementation and rule

finalisation expected to be announced in

H222

BARCLAYSView entire presentation